Note: Originally published Dec 15 so share prices and returns stated will vary from the public release date of Jan 1, 2025.

It’s hard to fathom how many stocks were considered, reviewed, tossed out and in some cases brought back in for a second look and then tossed again. Needless to say it was a lot. Many took only seconds to dismiss, and others including some personal favourites just had to take a back seat. But we’re here.

Before we get into the new ones, I obviously have to touch on the previous two years.

In 2023, my selections were Happy Belly Food Group (HBFG.C), Atlas Engineered Products (AEP.V), KITS Eyecare (KITS.TO), NowVertical (NOW.V), and Simply Better Brands (SBBC.V).

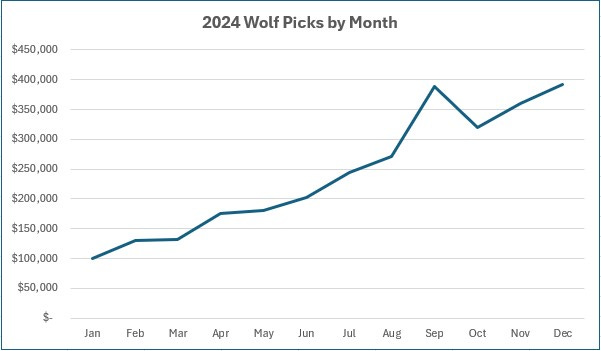

2023 was a decent year with these five stocks gaining by a total of 59%, but it has really been the past six months of this year where returns have really taken off driven in large part by HBFG, which is also my largest micro cap holding. As of time of writing, these five picks are up 354%. $20k invested on Jan 1, 2023 in each of those stocks would be worth $454,800 currently.

2024 has seen more immediate returns. Those five stocks, announced between the dates of December 12th and 21st of 2023 were Thermal Energy Int. (TMG.V), Enterprise Group (E.TO), Kraken Robotics (PNG.V), Gatekeeper Systems (GSI.V), along with a longshot pick, NTG Clarity Networks (NCI.V).

Those five have combined for a return of 292% or $391,600 if $20k was invested across each pick.

When you combine the ten over two years they have produced (at peak):

Two 13 baggers (HBFG & NCI)

Three 4 baggers (PNG, KITS & SBBC)

One 3 bagger (E.TO)

Two doubles (GSI & AEP)

Two currently in the red (TMG -5% and NOW -41%)

The above returns do not reflect my holdings or returns and used for illustration purposes. I personally did not invest in them equally at the time of the selections. Of the ten, I only hold the same level or more shares in four of them (in bold above). I’m completely out of GSI & NOW (dead to me), hold about half positions in TMG and AEP, and I have just a minor position left in KITS. I had been out of SBBC for sometime but re-entered after their most recent quarter and I’m quite bullish on them once again.

Simply Solventless Concentrates $HASH.V

Announced as an early 2025 pick back in September at 51 cents. An unusual move for me both on the timing and in a sector that I have been very critical of for many years. Over the next week the stock moved as high as 75 cents for a 47% jump, but has settled back down, closing at 56 cents on Friday. Full disclosure: I have built up a position since announcing it as a 2025 pick.

HASH will be a significant 2025 growth story and we will see the first indications of that when they report their Q4 earnings in late April. In their last twelve months, HASH has produced $11.5M in revenues and $1.15M in Net Income. Their guidance for just Q4 is to produce $11.8M in revenues and $2.9M of net income, largely due to a pair of great acquisitions. In one quarter they will basically deliver a similar top line number from the previous four quarters with nearly triple the profitability. On the comparable quarter from Q4 of last year that represents over 6x in revenues and 23x of profitability. This should garner some pretty outstanding headlines. Simply Solventless is also projecting annualized revenues of $47.2M and net income of $11.6M. As of today that puts their current valuation at just under 4x forward earnings. That forward calculation is based on a share count of 78M, and we know this is going to grow due to warrant accelerations. One would have to assume all warrants will be exercised giving an implied share count of around 105M shares for an implied market cap of around 58M. Given those metrics it would still trade around a forward multiple of 5x earnings and a 1.25x revenue multiple. Given that I see a very good potential of a 2025 double in valuation from today in the $1 - $1.10 range. This doesn’t include any other potential acquisitions, organic growth or operational improvements.

Risks:

It is in the highly volatile cannabis sector

Liquidity and cash flow concerns in large part due to significantly bloated inventory numbers. They really need to maintain current inventory levels to achieve their 2025 revenue figures or about a 3x turnover ratio annualized. It would really be a shame to have to raise capital in 2025 while driving near 20% net income to sales

Leadership seem like the maverick type. Like I said in my last review that can produce spectacular results, but it can also make your financials at times to look like a monkey fucking a football

You can read my latest review from their Q3 financials below.

Zoomd Technologies $ZOMD.V

Another great performing stock from 2024 which I believe has a great chance to build on that success in 2025. It 11 bagged so far this year going from 6.5 cents to 75 cents on Friday, even reaching as high as $1.

About ten days out from their Q3 financials, I highlighted an expected significant beat in their earnings which at the very least appeared to be a great swing opportunity. I highlighted a swing zone in the 48-50 cent range which was a nice consolidation and support area for a nice move. That turned out to be one of my best calls in recent memory which drove a quick double. Full disclosure: In about eight days I traded the stock from 49 cents, selling at 99 cents and then have been adding back in the 75 cent area, so I do hold a position moving into 2025.

Those Q3 financials were awarded four stars, and that latest review can be read below.

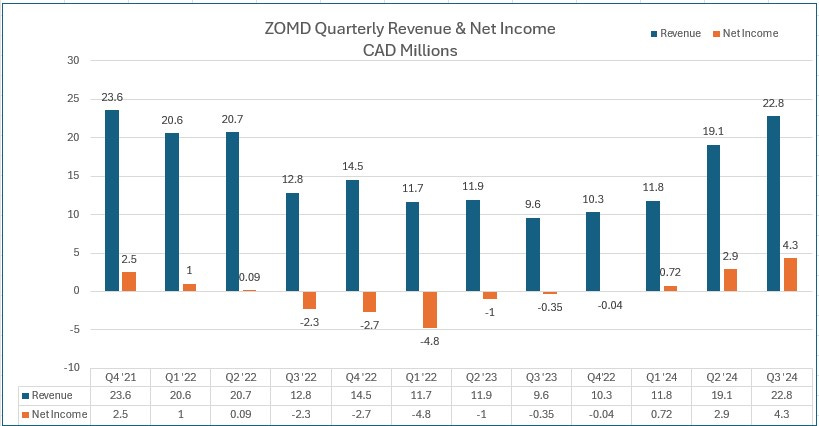

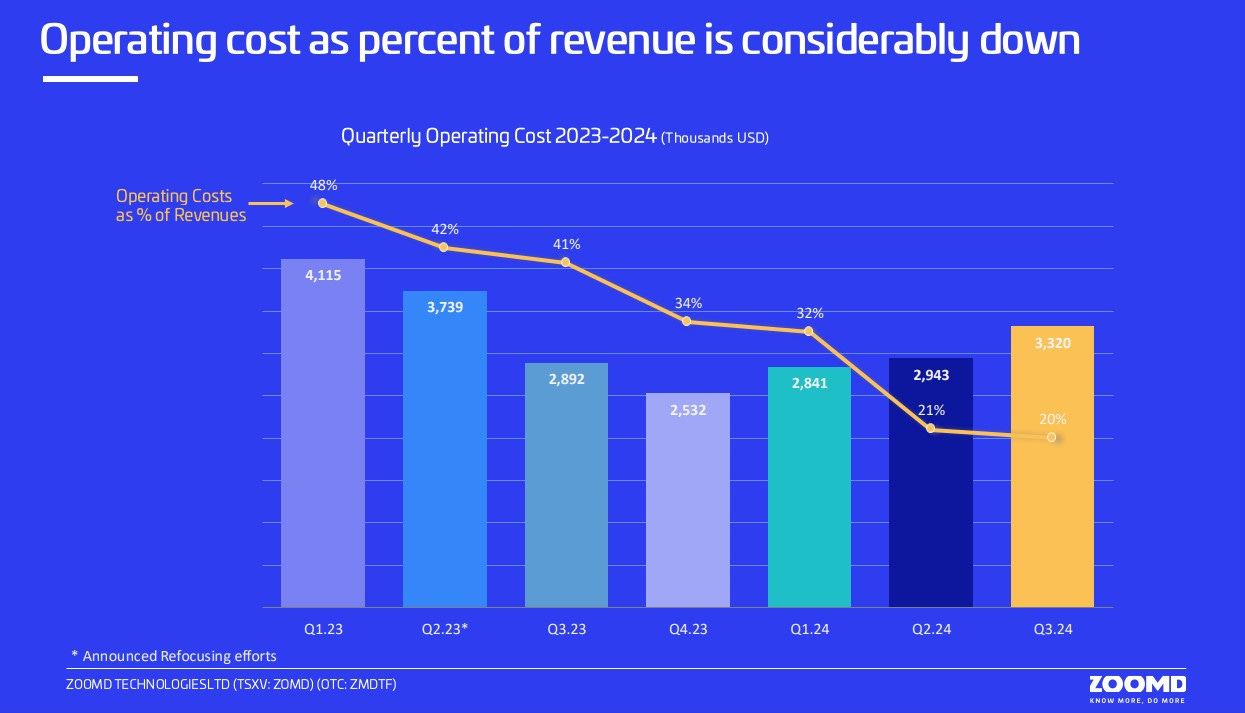

ZOMD’s transformation began in the middle of 2023 with a strategic shift to focus on specific profit producing revenue lines and getting more efficient within their operations.

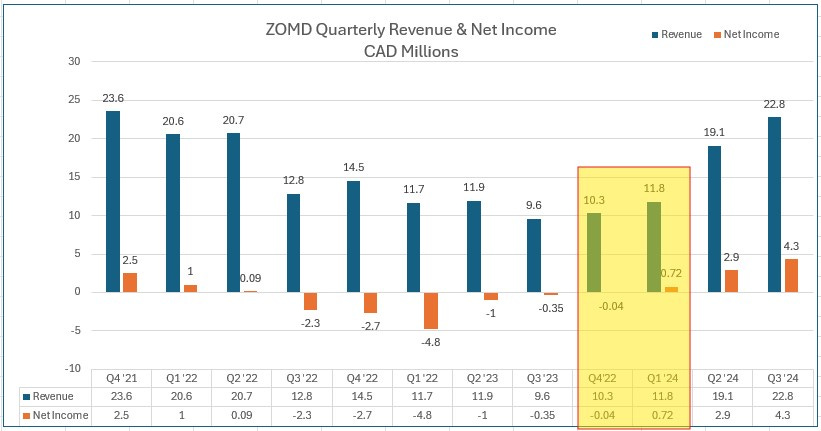

This came after three very ugly quarters of sales declines with very ugly bottom lines. By the end of last year there were signs that the transformation was working and the last two quarters achieved record profitability with the latest producing $4.3M of net income, nearly 19% of their $22.8M revenue.

You tend to see a lot of nano and microcaps go through these strategic changes, but rarely do you see a company come out the other side like Zoomd. This includes lessening their operational costs as a percentage of revenue by more than half, stabilizing in the low 20% range. Margins have also stabilized and have been pretty consistent in the 38-39% area and that combines for a significant increase in net income.

The company has received several accolades and awards for their work who service a very diverse and loyal customer base across numerous sectors.

Current TTM valuations are at a sub 10 Price to Earnings, 1.25 Price to Sales and under 6 EV/EBITDA. Now let’s look at that revenue and net income chart again and highlight the next two quarters they are up against.

If we trend out their last two quarters, by the end of Q1 of 2025 (reported end of May), they would deliver $84M of revenues and $14.4M of net income and that doesn’t account for any organic growth or QoQ top line growth. Those metrics would bring valuations of a 5.1 P/E, a P/S of under .9, an EBITDA multiple of about three and 5x Free Cash Flow. Should they be able to accomplish the above which does not seem like a stretch in the slightest, a $1.50 valuation by the middle of next year appears very achievable. Do I have your attention yet?

Risks:

My biggest pet peeve with Zoomd is how they report their financials. Their interim Q3 financial statements were ten pages long which includes the header and table of contents. By contrast, as the requirements are different, their annual financials last year were 40 pages long. The risk here is something could show up in the annual reports that someone like myself who analyzes financials thoroughly would not have been able to see due to lack of disclosure. While I feel that risk is very small, it’s there.

Loss of their largest customer representing about 1/3rd of their 2023 volume

Simply Better Brands ($SBBC.V)

My first repeat pick - this one from back in 2023. The last few months I have considered bringing back a previous pick but if you were to ask me in the summer if SBBC had a chance, it would have been a firm no.

After selecting them back in Dec of 2022, it’s little secret I grew frustrated with the business, and that frustration grew over time. More specifically the cannabis silo of their business, PureKana. Their marketing spend required to drive business was extreme to put it mildly. As great as I thought TruBar could do on their own, I felt they were never going to become a viable business as long as they were holding on to the anchor of PureKana. I exited my position sometime in February of this year. As luck (bad luck) would have it, they announced a strategic review of the brand a few weeks later, and then a month after that SBBC announced suspending operations of PureKana and the brand would be entering bankruptcy proceedings.

The stock grew substantially in the months afterwards from the low 40’s, reaching as high as 95 cents in early July, then falling back and consolidating between 60 and 75 cents prior to their Q3 financials. Those sets of financials I feel will be viewed as a big inflection point down the road. My upgraded 3.25 star review of those financials can be viewed below.

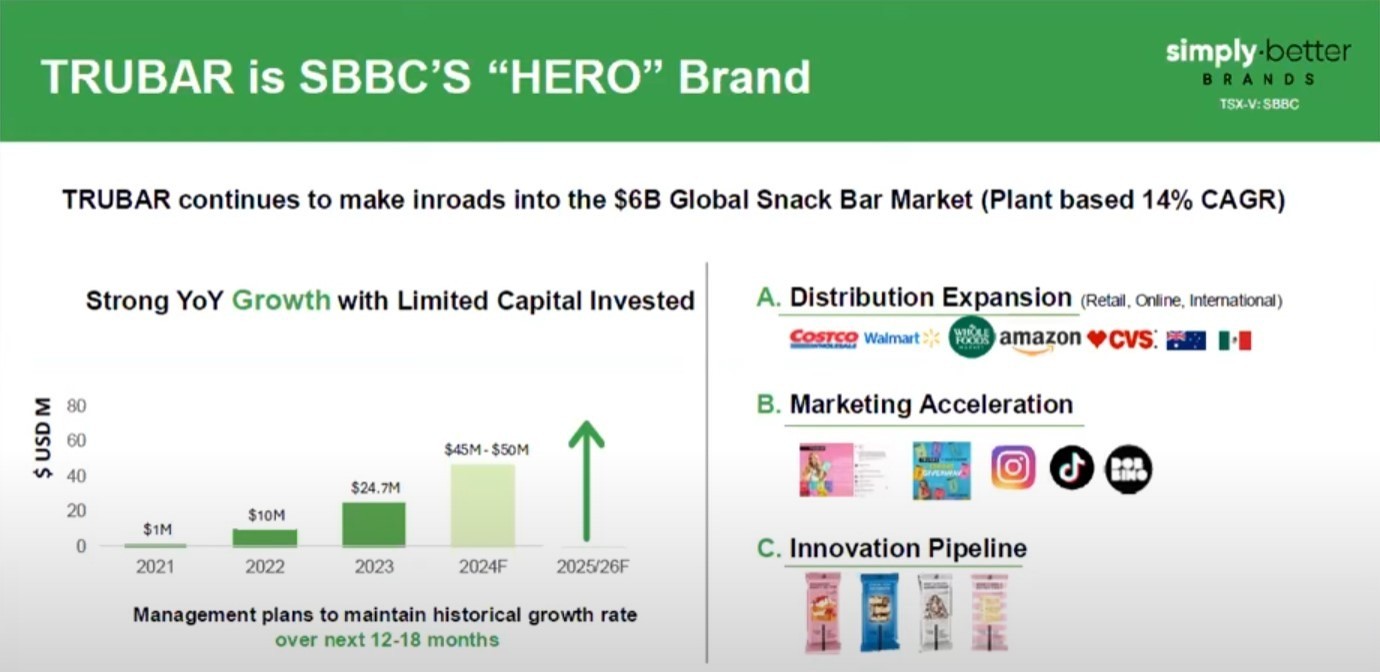

To briefly summarize, SBBC has significantly improved the look of their balance sheet and is now producing operational cash flow. The float is still relatively attractive at under 100M shares with insider skin in the game including fairly recent insider buys on the open market. Their recent quarter grew by 126% with a 500 basis point improvement in margin resulting in a breakeven quarter.

The company has done an incredible job thus far in expanding their North American retail footprint to 15,000 stores including some very strong regional chains. Growth in DTC (direct to customer) via Amazon grew by 250% in their latest quarter, and 1000% from where they started at the beginning of the year.

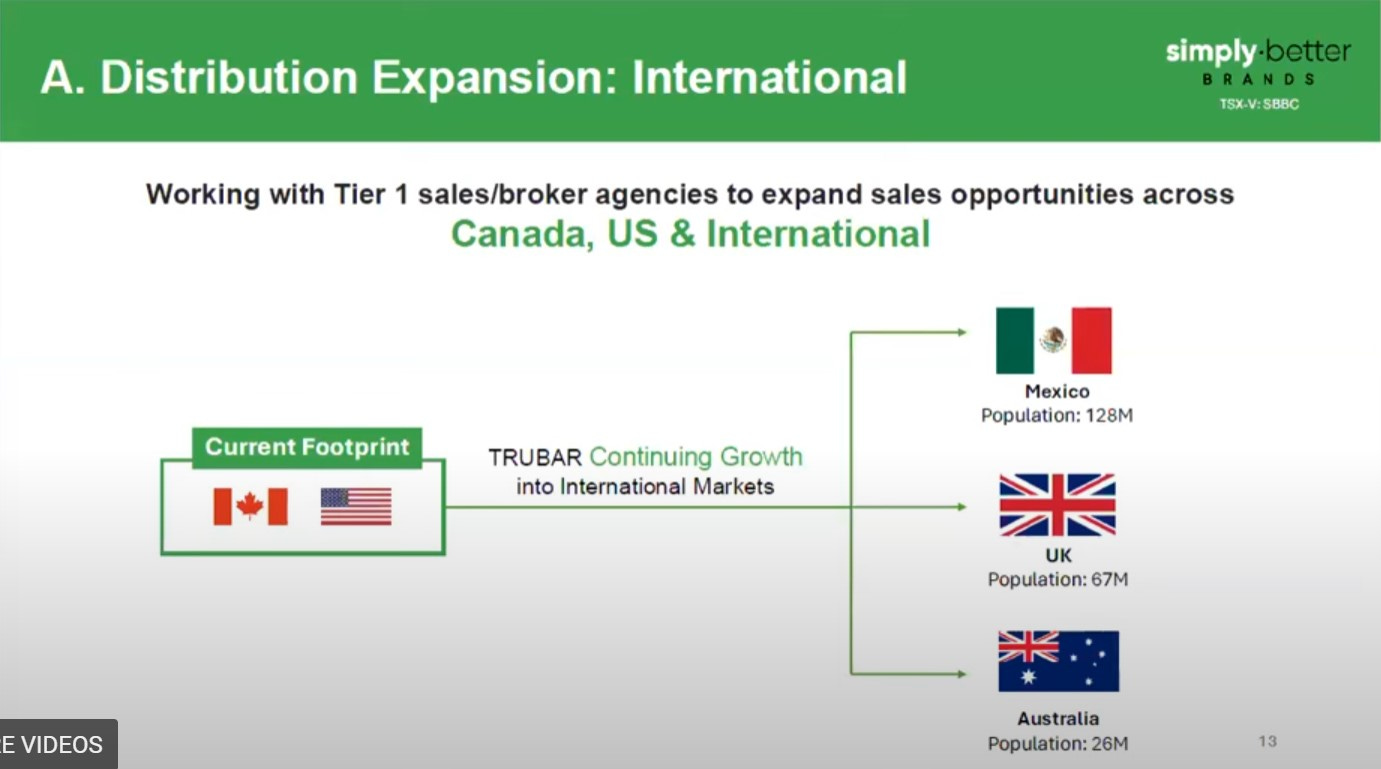

There are a couple of upcoming catalysts to watch out for in 2025 which should help to send the stock price higher. The first is the anticipated international expansion of TruBar, most likely to come via Costco and other retailers.

The next would be a very important milestone of hitting a $100M run rate, and that is in USD. Their latest quarter put them at a $48M run rate and that is without many of those 15,000 locations fully in play. It would not be surprising to see them hit that within their first couple of quarters of 2025, therefore doubling their top line RR from where they sit today.

This isn’t a company where I expect to award four star financials in the future, but in this instance that is ok. It’s no secret that the end game here is to grow TruBar to the point where it becomes attractive for a buyout. I therefore expect that their marketing expense will remain higher than I would typically like to see in order to drive that top line to make the brand more attractive to potential suitors.

Speaking of their marketing expense, I did get some PureKana flashbacks when I initially saw their Q3 marketing spend. I felt much better about it when I watched their Q3 earnings call however. I urge any potential investor to review their earnings call if they are new to the SBBC story, as it is also a great DD primer.

In terms of current valuations, SBBC sits at a $93M (CAD) market cap, roughly trading at around a 1.5x revenue multiple based on their TTM. We know that TTM revenue number will be left in the dust shortly so that same 1.5x multiple on a $100M USD run rate, works out to roughly $2/share based on current exchange rates, making it more than a double from here. Add in international expansion, and my expectation that the profitability and cash flow metrics will improve as well and those multiples could improve further. Longer term, you can hypothesize on your own on what a potential valuation could be obtained in a buyout from a major CPG player. Full disclosure: I’m big again on SBBC and do hold a position. The longer this stays in the 95 cent to $1 range increases the likelihood that I will add more.

Risks:

There is always the risk of one of these larger retail chains deciding to discontinue the relationship or the international expansion plans don’t materialize. I would suggest these risks are low but they are not zero

I’d like to tell you that I fully trust leadership, but I can’t. When insiders are fully aligned with shareholders and loan the company funds, it is usually done at or near market rates. When you see a mob like VIG of 15 points, not so much. I’m not hating on their capitalism, I might do the same in that scenario. But if a potential buyout came and there was a way to squeeze out more of the benefit giving less to retail shareholders in the deal structure, I wouldn’t put it past them.

ADF Group Inc. ($DRX.TO)

After my review just a few days ago, I don’t think I have to go into a lengthy story here as much as the other picks. For that, I’ve included the link below.

To best illustrate how stupid this stock has been trading the past little while, above is the five minute chart encompassing the last two days of trading since their financials were released. In the first half hour of trading the stock went up over 10% to the $10.60 range, and over the next hour and a half dropped 20% to as low as $8.50, only to end up recovering and finishing exactly where it was at the start of the day.

I was using their Q3 financials and the market reaction as a barometer on whether or not it would be chosen as a 2025 pick. The other piece I was waiting for was how leadership was going to handle the earnings call. While the results portion of the call was typically dry, I think they knocked it out of the park on the Q&A portion. Backlog can be a tool for investors to consider when making a determination on a stock but in my opinion it is typically an overvalued and over relied on one. The CEO said as much in response to an analyst question in a very passionate and dismissive tone. Couple with his other quote (“3x EBITDA is a joke”) in a snotty French Canadian accent solidified their spot in this list.

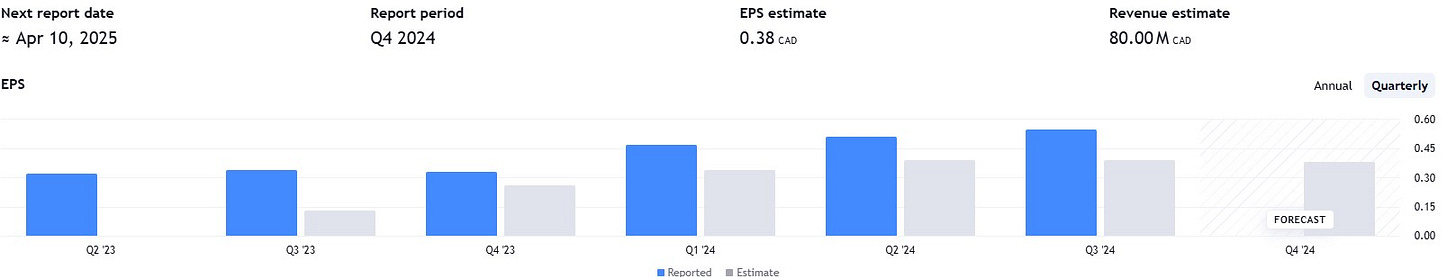

Take a peek at the above EPS growth history which has blown away estimates on every occasion over the past six quarters and then try and reconcile that with the fact that the stock price is down by over 50% in the past six months.

Risks:

While I think the reaction to the backlog has been overblown, it can’t be ignored, so investors will have to keep abreast of how that progresses

Tariff impacts and while they do some mitigants in place a lengthy tariff war would certainly have impacts on results and the stock

This pick likely doesn’t have as much multiple potential as the others while it trades near $10 and a $300M market cap, but at a 3x EBITDA, .8 price to sales, 5.1 P/E and 3.5x operational cash flow, it is very deserving of being on this list.

Full disclosure: I do hold a position here as well, adding on the dips between $8 - $11.

2025 Wolf Long Shot:

MTL Cannabis Corp ($MTLC.C)

What? Another weed play from the Wolf, has he been hacked?

Perhaps, and even I am questioning my own sanity a little bit here, but this little $22M market cap may be one to watch out for in 2025. The stock has been beaten up this year, down 60% YTD, and 72% dating back to last December.

The current valuation metrics are as follows - a 0.3 P/S ratio, an EV/EBITDA ratio of 3.9, and since they are profitable (yes profitable) a 5.4 P/E with a 2.5x multiple on free cash flow.

They current sit with $75M TTM in revenue with guidance of over $80M to round out 2024 and potentially a $100M annual run rate after Q1 of 2025.

Since this stock entered my radar screen late in the year, I have not published a formal review of their financials as of yet.

So what’s the catch and why are they trading so cheap given the earlier valuation ratios? It’s pretty simple and a very similar story to last years long shot pick, NTG Clarity - DEBT and a less than ideal balance sheet.

Their current ratio sits at .69 with $28M in current assets against $40.8M in current liabilities, which includes $14.3M in notes payable, $6M of convertible debentures, and $2.45M in a mortgage and unsecured loan.

Given they are currently on pace to produce $16M in operational cash flow this fiscal year, they will have the ability to service the debt, and I expect that much of the notes payable due next June will once again be pushed back into 2026. Through six months of 2024 (year end is March 30, 2025), the company has reduced their debt burden by about $2.4M.

Aside from their debt, they have $15.5M of payables due within the next year and their cash plus receivables only amount to $12.3M. Therefore an additional raise of capital cannot be ruled out.

The float is quite reasonable with 117M shares out with 8M warrants and 6.6M options outstanding, along with the convertible debentures outstanding which will add to dilutive measures in both shares and warrants given the debenture structure.

There is not a lot of social chatter about this one that I can find and I secretly love that a little bit. For an DD introduction, I’ve attached the investor deck below.

I do not currently hold a position here, but I could be tempted if it got into this buy zone. This could 5x or burn out in a blaze of glory. A true risk/reward longshot.

2025 Wolf Long Shot #2:

Northstar Clean Technologies ($ROOF.V)

My first ever pre-revenue pick, which certainly does make me uncomfortable, but at least it’s not a miner or biopharma degenerate play. I have been following their story for much of this year as the company does an excellent job of regularly updating investors, and potential ones.

It would take me longer to type out what they do and how their business model works than this three minute YouTube describes. So start there.

The model is pretty simple, and when a company doesn’t have to pay for their raw materials, but instead gets paid to take them AND gets them delivered to their literal back door, that’s a good start. In fact, more than one third of their 2026 projected revenue will be from tipping fees from shingles that would otherwise be dropped into a landfill. They already have two supply agreements in place and it’s hard to imagine it is going to be difficult to secure additional ones for new facilities - proximity to contractors will be key.

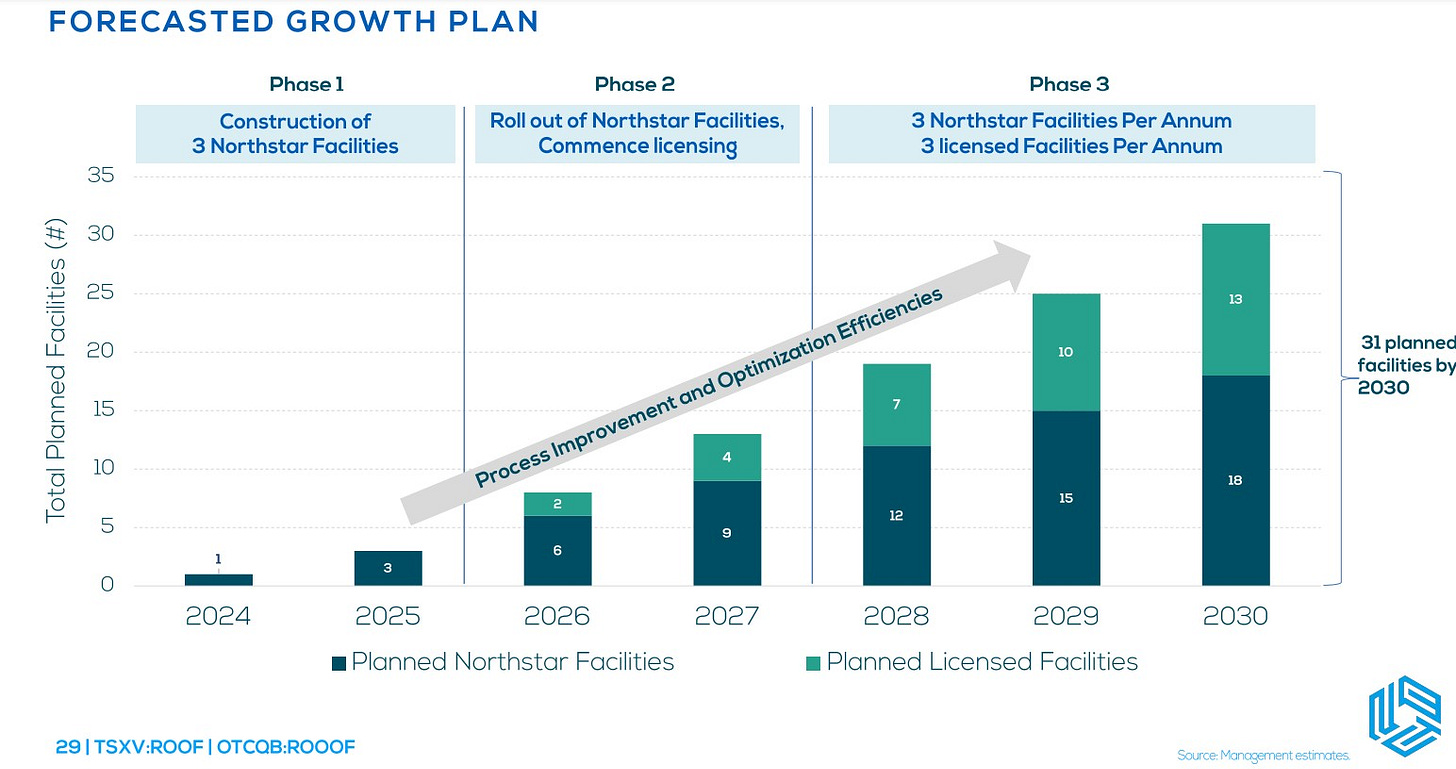

The company has a pilot facility in Vancouver with a scaled up Calgary facility under construction which should be operational in 2025. They have also recently signed an LOI to build out another in Hamilton. In 2026 the expansion plans are to include licensing out new facilities.

By the year 2030, they project they could have as many as 31 facilities open. And if you are wondering about unit economics, each would produce about $10M of revenue, delivering 55% EBITDA. The next announced facility will likely be announced in the USA, as there is already an MOU signed for four facilities and I imagine the first will be located near their strategic partner in Maryland.

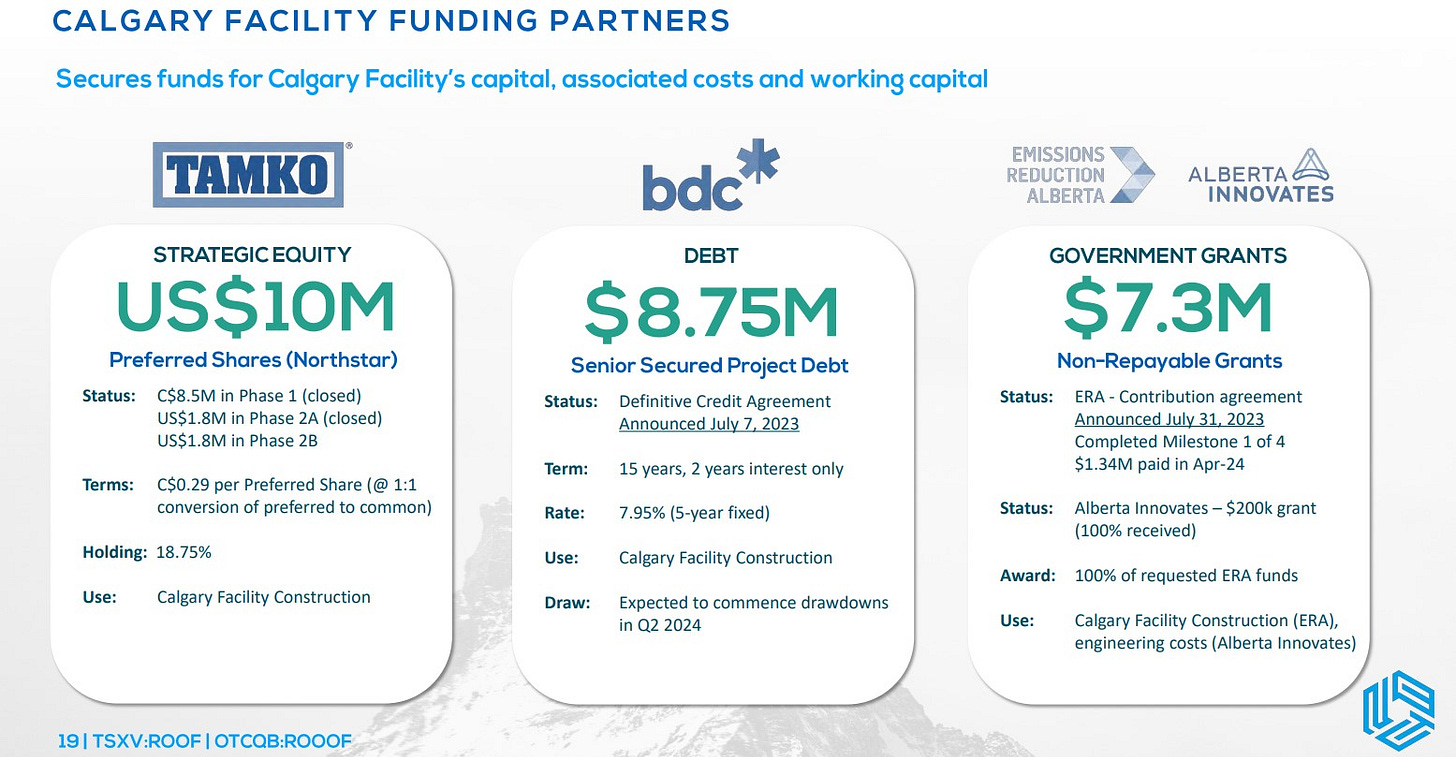

In terms of financing to date, it has come through multiple sources, government grants, debt secured at reasonable market rates via the BDC and via a strategic partner who also happens to be a shingle manufacturer in the US, and is in at an investment around the current share price.

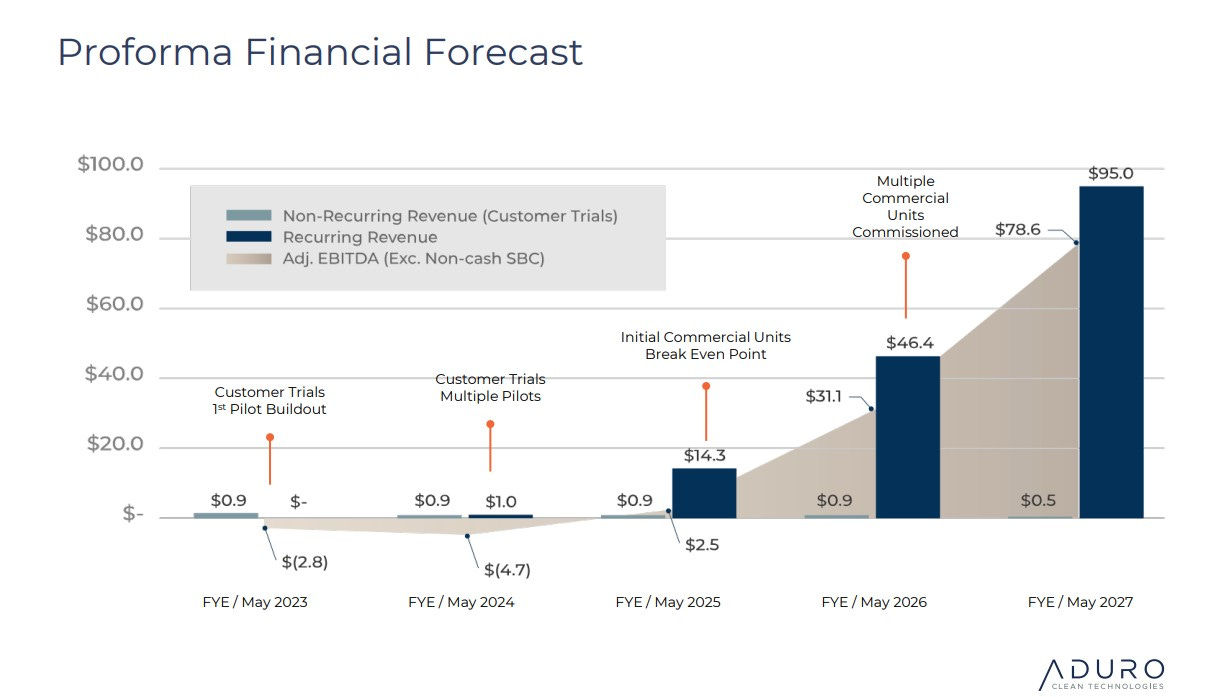

In summary I’d like to make a comparison here to Aduro Clean Technologies. ROOF currently sits at a $40M market cap, while ACT or whatever the fuck ticker they are going by these days is sitting at $230M. If you have invested or traded Aduro in the past, congratulations. I have too and did very well. But Aduro’s focus over the past six months has been on raising capital, spending money on promo, pimping themselves at investor roadshows, and a reverse split in order to uplist to Nasdaq, while visions of revenue from operations grow further into the future.

I had problems with the above slide during my many Aduro reviews in the past and now they are not even including it in their current investor deck. What I thought was weak sauce two years ago has been further pushed out into the future. And it was only $95M in 2027 to begin with.

Not to mention you have this sour MF going after legitimate small cap influencers, while he gets paid handsomely to promote one star performing shitco’s.

I do not yet hold a position in ROOF. (updated - I’m in at .34)

I’m horribly sorry to end my picks on that, but there you have it, my 2025 Wolf Picks.

As a bonus, here are a few more I like in 2025 for various reasons:

NCI.V

Even after going from 15 cents (post reverse split) from my 2024 pick to $1.51 today, this is STILL showing up on my value screeners. If they hit their 2024 targets with 14% net income, $2 and beyond is easily achievable next year.

EMO.V

This pre-revenue play has had its share of big winners and big bagholders over the past few years. They could finally have resolution to their long awaited court battle and if successful this could be one of the big runners in 2025.

TMG.V

I really love their products and the value prop it creates for their customers. 2024’s worst performing Wolf pick could very well take off in 2025 if their investments on the sales and marketing side finally pay off.

NPTH.V

I covered them very recently in a review (look for it - I’ve posted enough links). They have a low MC to sales on a basically break even cash flow generating business. If I could see them shaving 200 basis points out of operating expenses or another path to $100M in revenue and $5M in net income it would have made the cut - but I just don’t see it. Minor profitability improvements will still re-rate them in 2025.

BRM.V

Love this stock and I own it, and was probably next in line if I were going to make another pick. Could outproduce everything above and I wouldn’t be surprised.

Happy holidays and even happier investing outcomes in the new year.

Wolf

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Only one way to find out if you are right.... doing some buying

Excellent write-up as usual.