The last review of ADF Group came inSeptember with a solid 3.75 star rating. The stock certainly hasn’t performed to that rating, down 27% since they released their Q2 results, but has performed much better over the past twelve months, up 40%. Within that the share price has also been quite volatile, from concerns over backlog numbers, YoY revenue performance, election results and tariff threats which brought the stock down to an eight month low of $8 per share two weeks ago.

Let’s drill into their Q3 numbers. I’ll also listen into their commentary from the conference call to see if and how that influences my outlook. Full disclosure - I do own DRX group stock including adding at that $8 dip in late November.

Balance Sheet:

A very strong current ratio and improved from Q1 at 2.22. That consists of $65.5M in cash, $78.8M in receivables and $47M in other short term assets against $86M of liabilities due in the next twelve months. Liquidity is strong with their current cash position covering payables and current portion of their debt. Long term debt sits at $39.2M with $17M in additional deferred tax liabilities.

Cash Flow:

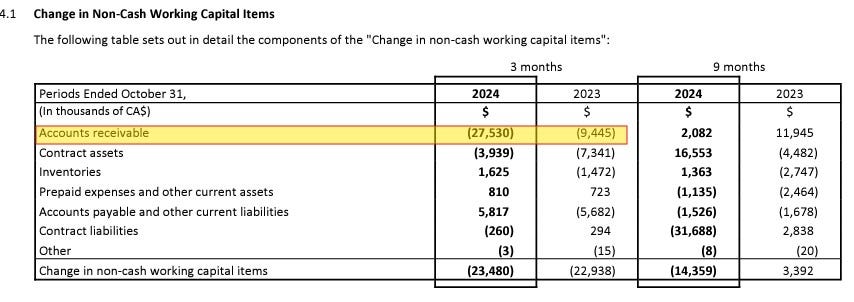

Operational cash flow YTD sits at $53.3M, up 17% from a year ago. OCF was down by $6.7M in the quarter due to an additional $3.5M in taxes paid in the quarter and heavy working capital adjustments from receivables which can easily be excused for timing adjustments.

During the year ADF Group has utilized $7.3M for asset purchases, bought back a staggering $48.4M of stock and paid down their debt by $2.3M. Overall their cash position has depleted by 9.5% from the beginning of the year but still remains in a very healthy position.

Share Capital:

29.9M shares outstanding, an 8.5% reduction in share count through an aggressive use of their NCIB

NCIB was renewed in conjunction with the release of these financials which would allow them to reduce by 1.7M of subordinate shares if fully utilized. Given the share price and what they did last year, I would expect them to remain aggressive

Approximately 900k of RSU/DSU/PSU’s outstanding. These numbers are not updated in their quarterly statements but there doesn’t appear to be much activity within their SEDI filings that would alter the last count significantly.

Insider ownership is skewed due to the multiple voting share/subordinate share breakdown. I’m certainly not a fan of this type of upper class/peasant share structure

DRX pays a .42% forward yielding dividend. SMH.

Income Statement:

Revenue in the quarter came in 2.7% softer than the comparable quarter last year at $80M vs $82.1M, but everything below that is extremely positive. Gross margin dollars improved by 21% producing $4.3M more margin dollars on $2M less revenue which was achieved by improving their margin rate by 600 basis points to 30.4%. Expenses in the quarter were down by a mind blowing 63% which includes a $2.1M birdie in foreign exchange and a 50% reduction in Selling and Admin. Even with paying 157% more in taxes, and seeing revenue slide by 2% in the quarter they were able to drive 47% more profitability to the Net Income line. Due to the reduction in share count this had an even greater impact on EPS which grew by 62% to 55 cents a share.

YTD looks much better on the top line with $262.2M in revenue, up 8.1%. Once again on just $20M in additional revenue drove nearly $32M in additional gross margin dollars thanks to an improvement of over 1000 basis points to 31.4%. Total expenses are also down 6.2%. Once again despite paying an additional $12.5M in taxes so far YTD, they drove an additional $20.5M in profitability and improved EPS by 84% over last year.

Overall:

Once again I expect there to be a lot of discussion, concern or even some panic on the overall backlog numbers. Investors typically overreact to backlog numbers whether they are on the rise or decline. In this case backlog numbers are significantly down from over a half billion dollars to $330M from the start of their fiscal year 9 months ago. But by the same token the backlog number is basically flat on a YoY basis.

Uncertainty with the new administration in the USA, along with tariff threats are also a factor to consider here. With ADF Group’s plant south of the border they can likely mitigate some of those impacts, but the one thing that isn’t going to change is the massive need for infrastructure improvements on both sides of the border that this company can provide.

Since the company deals in very large, multi-million dollar contracts there are also some bullish factors moving into 2025 provided that tariffs turn out to be a nothing burger. These large contracts are heavily financed by their customer base and interest rates are coming down which should lead to more infrastructure investment. The Canadian dollar, while bad news for many, could be favourable for ADF Group as witnessed in these Q3 financials.

Conference Call notes:

“First of all, let’s not panic about the backlog”. This is the tone that I want to hear from management.

“3x EBITDA is a joke” LOL, I love this guy.

The first portion of the call talking to the results were surprisingly dry, but the Q&A IMO is outstanding.

There is a bullish feeling about growing backlog and landing new contracts and the impressive margins are expected to continue for the next couple of quarters.

From a valuation perspective, it appears likely that the company will achieve $2 or greater in EPS. At a $9.50 share price that’s a P/E of 4.75 and for much of the year the stock was trading between a 7 and 9 P/E ratio. As I type this the 10% initial increase in share price at open has now come back to slightly red. The market is getting this wrong.

There is some reason to be tentative and manage your positions wisely here, but if this year has taught us anything, is that ADF Group is a very well managed organization that can withstand a little turmoil from time to time - unlike their investors and share price. I’m staying the course with 3.75 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks Wolf. Back in again at $8.75

Now trading 15 cents below yesterday's close, the market definitely doesn't agree which, given the run-up just off the results this morning, is a bit weird in light of how aggressively positive the Q&A were