I’m not one to tell you I told you so (who’s kidding who, of course I am), but the writing was indeed on the wall after my last two reviews with the share price down by 83% from my initial review near the peak less than eight months ago.

I’m feeling a little rusty with my last review about a month ago just before my Icelandic adventure, and since then I’ve been working on my golf game while the weather still allowed. Let’s check out WIFI’s Q3 and see if I still know how to do this.

Balance Sheet:

American Aires current ratio overall looks pretty decent at 1.7 (deferred revenue removed) which consists of $1.8M in cash, $4.5M of prepaids/receivables and $2.2M worth of inventory against $4.9M of liabilities due over the next twelve months. Liquidity on the other hand is terrible with cash only making up 21% of their current assets and covering only 40% of their short term liabilities. More than half of their current assets are within the unusual line of Prepaids & Receivables, and only a tenth of that $4.5M are actual receivables with over $4M in prepaids. I speculated during my previous review that these are likely prepaid marketing costs from their signings of NHL and UFC stars, as well as controversial social media figures.

Outside of a small $60k government loan, WIFI has no other debt or long term liabilities.

Cash Flow:

The company is still hemorrhaging cash at a rate of over $900k per month with $8.3M of operational cash burn through their first 9 months of 2024. They are not trending in the right direction either with $2.8M burned in Q3 alone.

Nothing of note has occurred on the investing section of their cash flow statement but they have raised $10.1M within the financing section with $7.2M raised via two private placements and $2.8M raised through warrants and options exercised.

With their relatively consistent burn rate of $900k a month and $4.9M worth of liabilities due in the next twelve months, I don’t see how American Aires can finish the calendar year without raising additional capital, so watch for a raise imminently as these financials are now a month old.

Share Capital:

100.5M shares outstanding as of Sept 30th, a staggering 267% rate of dilution in one year

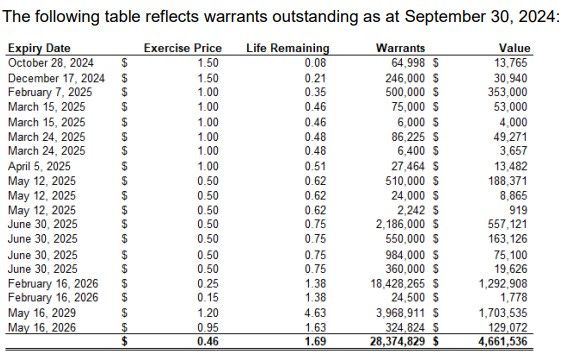

28.4M warrants outstanding, but only 25k currently ITM with 18.4M right on yesterdays closing share price

1.17M options outstanding, with only 80k ITM

4M RSU’s to vest later this year (not disclosed in these financials)

No participation in the open market from insiders this year

Income Statement:

Impressive top line in the quarter with $4.6M in Q3, a 120% increase above the $2.09M they achieved last year and now on a YTD basis, $9.42M of revenue against $5.5M last year, 71% better through nine months. Those revenues come with excellent margin as well at 63.2% in the quarter (down 350 basis points to LY) and 61.9% YTD (down 30 basis points).

Unfortunately their major problems reside below this line, particularly within their Advertising and Marketing spend and consulting fees. For each dollar in gross profit the company earns, they spend $1.58 in those three buckets combined YTD, and Q3 wasn’t much better at $1.44. And that doesn’t include their other expenses like Office and General, Salaries and Benefits, and Interest Expense. To be fair, those buckets look quite lean, but as long as they need to spend this amount of money on marketing and advertising costs to bring in sales revenue, it’s no where close to a viable business model.

Net losses in the quarter came in at $1.9M, compared to $172k last year and through three quarters a net loss of $4.6M, compared to $2.9M

Overall:

When your losses are 10x compared to last year, it really doesn’t matter that your top line more than doubled, it’s just a bad formula. Couple that with their atrocious looking cash flow statement, a very immediate need for some influx of capital, and this stock is just untouchable right here, even given the stock is trading at about 1.4x MC/Sales.

If they could ever drive revenue with more reasonable marketing spend, then maybe there would be something here but it doesn’t look like they will be able to get off of that marketing drug anytime soon.

Another downgrade to .75 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to review requests. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Eagerly awaiting TMG's review. I wonder how many times they've disappointed you.

Good lesson that a company trading on a impressive top line and revenue growth doesn't matter when said company is lighting cash on fire. A good ol 0.75/5 stars. 😭