Maybe one of the best examples of #FinsDontLie in recent memory.

My initial review of these guys came near their peak when they traded close to $1.50, and I subsequently downgraded them in my most recent review back in May to one star when it traded at a buck. It proceeded to drop by 75% over the next several weeks and has settled in at 36.5 cents as of yesterdays close with the financials having seemingly no impact on yesterdays share price. Has there been any progress for this hot garbage disguised as a stock since we last looked?

Balance Sheet:

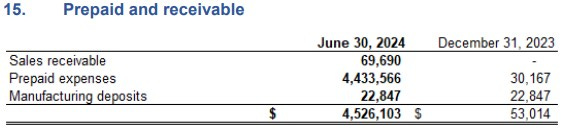

We start with a more than acceptable current ratio of 1.5 that consists of $3.75M in cash, a very interesting $4.5M in prepaids and receivables and $1.5M worth of inventory against $6.4M of current liabilities (excluding deferred revenue). American Aires only has $60k worth of debt dating back to a covid loan.

I find note 15 fascinating. First, it’s a little unusual to have a line in your balance sheet that lumps these two accounts together. Of this line, their receivables only account for 1.5% of the total with prepaid expenses in the amount of over $4.4M and accounting for 98%.

So why would a company that has $4.8M in revenue YTD have prepaid expenses totaling $4.4M since the beginning of the year? Most common examples of expenses you would pre pay are for things like insurance or rent and that is typically done to save money over the course of the year by paying a lump sum up front. Their prepaids went from $0 at the start of the year to $1.4M in Q1 to the $4.4M we see it at today. I think the most obvious answer is for advertising and marketing spend. In Q2 the company announced relationships with personalities like Tiki Barber (former NFL star), John Tavares (Toronto Maple Leaf captain). They also signed a deal with the UFC (that can’t be cheap), as well as time on the right wing platform Rumble with the likes of Russell Brand and Dr. Drew. You can make your own determination of what their target demographic is but I think it is safe to say a Mensa membership is not a prerequisite.

We’ll likely revisit this when we get to the P&L.

Cash Flow:

$5.5M of operational cash burn through their first two quarters compared to only burning $827k during the same time frame a year ago. There are a lot of working capital adjustments in here as well. The $4.4M previously discussed prepaids and a $1.5M investment in growing inventory are negatively impacting their operational cash flow. On the flip side, their accounts payable has increased by almost 6x so they have a lot of bills to still pay. Post financials they signed deals with Canada Basketball, RJ Barrett of the Toronto Raptors and the WWE so it looks like those prepaids are only going to continue to grow.

In the meantime the company raised about $9.2M from private placements, an e-com loan and warrants and options. They pissed away 60% of that during this recent quarter. Even though the company at June 30th is in a much better cash position now then Jan 1 - given their level of marketing spend I would suspect them to be back at the trough to raise more capital soon, likely before they announce Q3 results. Watch for some news flow, then a raise announcement.

Share Capital:

93.3M shares outstanding with 450% dilution over the past year (yes you read that correctly)

35.5M warrants outstanding with 25M ITM at 25 cents expiring in Feb 2026

180k options, 80k ITM

4M RSU's to vest later this year (details conveniently left out of these quarterly FINS

31% insider ownership per Yahoo Finance

Zero participation from insiders on the open market or in the private placements it appears

Fully diluted float in the neighbourhood of 125M shares

Income Statement:

Top line increased in Q2 by 45% to $2.8M and through two quarters up by 41% to $4.8M with QoQ revenue growth of 37%. The company has also seen good margin growth at 60.9% in the quarter, up 200 basis points from last year and halfway through the year 60.6%, up 130 basis points.

The problem is operational spending, and other than $33k in depreciation, it is all cash burning. $3.34M in Q2 and $5.66M YTD. Operational spending grew by 45% quarter over quarter while revenue grew at 45% so some pretty terrible conversion. Their overall net loss improved slightly, at $1.65M in the quarter ($1.94M last year) and through six months a loss of $2.73M ($2.80M last year).

Overall:

For each margin dollar they produce, they spend 125% in marketing and advertising to obtain it. That is not a winning formula. The company has $4.8M in YTD revenue and their break even point is $9.32M, but with the heavy reliance on marketing spend, I’m not sure a break even point is a very reliable metric here given much of this spending is still sitting on the balance sheet as a prepaid expense. It will hit the P&L over the course of their respective contracts. While they only had one month of maybe their biggest marketing endeavor, the UFC, they had much more time with their spending on Rumble and other personalities and so far they haven’t come close to driving the level of business needed to drive anywhere near something that could remotely look profitable.

“$100k a month in for digital marketing services provided by a firm controlled by an officer of the company”. Nice little tid bit I thought I’d throw in.

Personally I think the products they sell are hilarious and I question the sanity of anyone who would buy them. But that alone wouldn’t stop me from investing in WIFI - I don’t have a problem making money of stupid people. I just don’t see them obtaining the level of revenue in order to offset this level of spend on a long term basis. There’s a lot of stupid people out there, just not that many. Maintaining my one star review.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Just wanted to say that I really enjoy your write-ups, not only from an analytical standpoint but from an educational one as well. The hallmark of being knowledgeable on anything is the ability to boil complex concepts and subjects into easily digestible frameworks, and you do exactly that. For example, connecting the dots when saying "For each margin dollar they produce, they spend 125% in marketing and advertising to obtain it." really brings home the full swath of the analysis on their spend.

This is all to say, thanks for the time and effort--keep it coming.