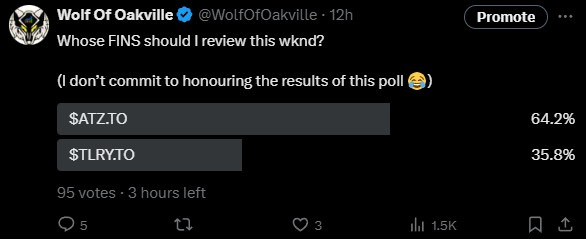

It’s a lean time of year for financial reviews, at least if you prefer to look at companies with recent results. Two companies released results this past week that seemed worthy of taking a look at - Tilray and Aritzia. Last night I offered up the following poll, and even with a few hours left, there is pretty clear general consensus. Both stocks released financials yesterday and the market reaction could not have been more opposite.

I have reviewed Aritzia once before, back in May of 2023. It was a relatively neutral review with many positives cited but also some pretty valid concerns around the state of their balance sheet and inventory levels and the risks those posed on future quarters. The stock performed terribly over the next three quarters losing more than 50% of their valuation, dropping down almost as low as $20.

If you bought that dip and held through yesterday you achieved a three bagger in about fourteen months with the stock soaring by an insane 19% in yesterday’s trading, on a day which saw way more losers than winners.

As someone who spent the first twenty years of their career in the sector, I’m pretty sour on it for a lot of reasons, so it is rarely one I look to when investing. Over that timeframe I led teams in operations, marketing, merchandising, and sales support so I think I know a thing or two about a thing or to. Aritzia has done an incredible job in a very challenging sector where most who participate fail or at best tread water. Bricks and mortar retail is tough and that isn’t about to change any time soon. I also don’t love reviewing $8B market caps and I’m also opening myself up to some jabroni comment due to my DD not being as strong as theirs. So just know as you continue reading that my heart may not be in this one, as I’d much rather be shitting on a failure of a cannabis company.

Balance Sheet:

Aritzia’s current ratio of 1.7 (deferred revenue removed) is solid and consists of $207M in cash, $21M in receivables and a hefty $462M worth of inventory along with about $60M of other short term assets against $445M in short term liabilities. Very notable is the company is debt free but does have about $350M in credit through multiple facilities available.

If there is one thing that jumps out on their balance sheet it is inventory levels which is up by a significant 36% from the start of the year and 16% more at the same time a year ago. That will have some impact within their operational cash flow but that will also be offset by the 67% growth in their A/P, so this has all the indications of a recent ramp up.

Cash Flow:

Aritzia is a cash flow producing juggernaut with $297M of operational cash flow generated through their first three quarters, bettering what they achieved a year ago by 15%. The bulk of that came in Q3 with $215M, off of the $241M produced in Q3 of last year.

YTD they have spent about $73M in net lease costs, received $22M from stock options exercised and bought back $5.9M in stock, all of that occurring in the most recent quarter. They have also utilized almost $200M in asset purchases. Overall they have improved their cash position by 27% from the start of their fiscal year. Very impressive.

Share Capital:

At quarter end, the company had 20.4M multiple voting shares and 92.4M subordinate voting shares in what I like to call a caste system share structure. I’m not a fan.

Approx 2% dilution (SVS) over the past year when you net buybacks (134k shares) against SBC (1.85M)

7.6M options outstanding with 860k granted at $47 and 1.22M exercised at $16 for a very nice insider payday

Approx 900k in other outstanding SBC plans consisting of DSU/RSU/PSU’s

Insider equity ownership is in the neighbourhood of 19% but voting interests of around 69%

Most insider activity on the open market in the past year have been exercising the $16 options and selling them back in the open market.

Income Statement:

Solid double digit revenue performance in both the third quarter of 11.1% and on a YTD basis of 11.6%. Perhaps even more impressive is what they have done on the margin line with a 430 basis point improvement in the quarter to 45.8% of gross profit, and 480 bps YTD increasing from 38.6% to 43.4%. That’s 25.5% more in gross profit dollars on 11% more business which is an extremely sexy performance in an sector.

They didn’t convert as well within their SG&A expenses which rose by 15% in the quarter and 16% YTD so we can’t award them with the elusive ‘Wolf Trifecta’, but it is pretty damn good conversion on GP dollars to it’s as close as one is going to get.

Even with a 50% increase in income taxes they delivered over $74M in net income and 66 cents of EPS, and improvement of 72% in Q3. On a YTD basis they have doubled net income to $108M.

Back in my retail days, achieving 10% EBITDA was a hell of an accomplishment. But these guys just pulled off a better than 10% Net Income quarter. Incredible.

Overall:

These are four star worthy financials.

Aritzia did open up 11 new locations in the past twelve months but even their comp store growth was up 6.6% in the quarter and 5.3% YTD. Their e-com segment is also growing by double digits. If there’s a negative in these financials is that the entire Q3 performance and very significant amount of their YTD growth was driven out of the United States which were up by over 20% in the quarter and YTD basis while their Canadian operations were slightly down in the quarter and slightly up YTD. Those are going to be some frightening US numbers to match off next year.

When you get into the valuations they are currently trading at 20x EBITDA and 50x earnings which seems unfathomable to me but they have been in this area all year. If you like their mid-long term prospects maybe those metrics don’t frighten you. Four star financials but a three star valuation works out to 3.5 stars overall.

I would have had more fun with Tilray. LOL

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3200+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Aritzia seems to have found its product/market fit, is now expanding across the US and will next go to Europe and Asia. I see it as a Lululemon ten years ago or so (obviously going after a different segment of the clothing market, but you get the idea).

So, it is a great company.

Does that justify its current share price and earnings multiple? No it does not, especially after a 17% jump in one day. Aritzia is priced for perfection. When it inevitably falls a bit short, Mr. Market will give opportunities to buy in at lower prices.

Note: I listened to the earnings call and what I think what triggered the price jump was Aritzia management saying that Q4 was coming in quite a bit better than they had thought. That got the analysis all excited. You could practically hear the bored analysts perk up and start updating numbers in their spreadsheets.

Management also waxed eloquent about the synergy between retail locations and eCommerce and how that will be amped by the Aritzia app which they will soon launch. They believe the app will significantly increase customer stickiness (and purchases) with its capability to let customers imagine all sorts of new looks via the various Aritzia designer brands.

Fantastic wolf thanks. Nice your looking at larger companies not just micro caps. I appreciate your willingness to look outside of micro caps and provide facts and numbers