First time review of Avicanna via a request from Milo from Substack. One year chart looks like a fun one for swing traders, longs not so much. Don’t look left as it gets worse. Let’s get into it.

Balance Sheet:

We start with a pretty weak current ratio of .83 that is made up of $812k in cash, $2.8M in receivables, $3.9M worth of inventory and about $600k in other short term assets against $9.7M of liability commitments due within the next twelve months.

Not only is the current ratio weak but so is liquidity with cash only making up 10% of current assets.

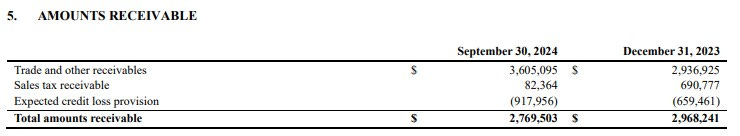

There are also identifiable issues within their receivables as well with an expectation to write off over $900k in bad debt, and given their revenue volume is not a good number - 4% of TTM sales. The fact that their receivables appear this unreliable just makes the fact that they do not provide an aging report that much more irresponsible for shareholders.

It’s notable that the company has added $7M in revenue with less inventory so their turnover has significantly improved. They also hold no long term debt or no long term liabilities.

Cash Flow:

$2.3M of operational cash burn for their first three quarters or about a quarter million burn rate per month, which is actually about 4x worse than what their burn rate was at the same time last year although much of last years impact was working capital changes. YTD they have raised over $4.15M already via a PP and warrants and paid off $1.6M in debt. After all of that activity they have increased their cash position by 85% from the beginning of the year, but with $250k of monthly cash burn and $9.7M of outgoing financial commitments in the next twelve months, this review is looking pretty rough so far.

For those following the company it could not have been a surprise to many that they raised $800k about a week and a half ago at 30 cents. Unfortunately this is just a drop in the bucket of their apparent needs and investors need to wonder how soon they will be at the financing trough again.

Share Capital:

106.9M shares outstanding as of Sept 30, 22% dilution over the past year

25.2M warrants outstanding, 10.4M expiring in less than 6 months but none currently ITM

1.33M warrants issued post financials at 40 cents

8.1M options outstanding, none currently ITM

1.7M RSU’s outstanding with 8.8M already vested over the past two years under their 10% Omnibus plan. I never like to see free unit awards for company’s who still burn cash

23% insider ownership (per Yahoo Finance) which I believe includes holding of IDK and personal holdings of Sheldon Inwentash.

IDK and Mr. Inwentash have been buying the up and down swings all year and participating in PP’s. Note: this does not endear me towards liking this stock

Income Statement:

Revenue was basically flat in the quarter, $6.27M vs $6.25 with a noticeable shift in segments with service revenue at $694k vs basically nothing and product sales, the bulk of their business declining by nearly 11%. This shift and other factors had a significant positive impact on margin which saw over 100 basis points of improvement coming in at a tasty 57.9%. To gain $700k on the margin line on virtually flat sales is super impressive due to the addition of the MyMedi platform.

Cash burning expenses were up 12% on that flat revenue however so those margin gains were not enough and the net loss for the quarter was $786k, but that is a 45% improvement over the loss experienced in the same quarter last year.

The revenue story on the YTD side is much more impressive with $18.8M achieved through nine months, 75% better than 2023. The nice margin story continues for the full year at 50.1%, 400 basis points better than last year. Cash burning expenses are up 35% on the year so they are getting some conversion on those extra sales, but ultimately it was not enough experiencing YTD net losses of $3.75M. Nearly a $2M improvement but a lot more needs to be done before some of that return goes back to shareholders in the form of EPS. Tack on an unfortunate $2M bogey on foreign exchange and all of that hard work above the margin line disappears with their net comprehensive loss $50k worse than 2023.

Overall:

Some impressive metrics in here but the negatives or concerns are outweighing those positives for me and things look like they could get tougher. Revenue has stagnated. While they have shown great growth over last year, they are now coming up against tougher quarters. This quarter was their first test and were only able to saw off last year, and that was with the addition of a new business line. Organic growth was off by 11% and as you can see in the table below, the numbers will be just as tough for the next three quarters.

25M of TTM revenue with $6M in net losses is not going to ever get a great review. In addition, they have serious balance sheet and cash flow issues and this latest $800k raise appears to be just a temporary drop in the bucket to fulfill their 2025 needs. Expect additional raises, more dilution, and Wolf to stay on the sidelines. $28M MC doesn’t feel exceptionally offside, but it’s not attracting me here. Two stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.