A classic “tweener”. A company that I’ve liked enough to keep on the watchlist for sometime, but never liked enough to actually pull the trigger. My last review turned out to be a decent time to pull that trigger as the stock has just about doubled since that three star review. Interesting market reaction to these financials last week with the initial movement quite positive, but ended up closing in the red and has slid about 10% from the day before their financials were released. Let’s get into it.

Balance Sheet:

Solid current ratio of 2.8 (and up from 1.5 last quarter) but fairly miniscule numbers with $555k in cash, $329k in receivables and a handful of other short term assets against only $341k in liabilities due over the next year. Not only does Avricore have no long term debt, they have no long term liabilities. Not much else to say here.

Cash Flow:

Operational cash flow of $417k through six months against $227k at the same mid way point last year, growing by 83%. Utilized $125k in asset purchases and paid off $30k in debt. Overall they have doubled their cash position from the start of the year. This is going to be a short review.

Share Capital:

99.9M shares outstanding with very minimal dilution over the past 18 months via option exercises (645k)

10M options outstanding, all well ITM. 1.45M will be exercised before mid Oct but not much help to the treasury at a nickel a piece

10% insider ownership and they appear to be allergic to buying in the open market, even at all time lows

The company has a 20% SBC plan, and you probably know how I feel about that. They are not retail friendly and I avoid investing in companies who have them. In fairness, over the past three years the company has only awarded 8.3M options. But in June of last year made the change from a 10% plan to a 20% plan. So just because someone who has the ability to fuck me hasn’t fucked me yet, isn’t comforting. Making that change last year gives me the impression that they eventually plan to, ya know, fuck me. And it appears retail investors were asleep at the wheel letting this change go through without raising their voice. Post financials, they did award 3.36M options which is fairly reasonable, but they could drop 16M more at any time under the new plan which they changed, last summer. I digress.

Income Statement:

$1.05M of revenue in Q2 a 91% increase over the comparable quarter. At the halfway point of the year, 84% better at the same stage in 2023. Impressive on the surface on the top line but we have a pretty mixed bag on the margin line. Margins came in over 600 basis points lighter than Q2 last year at 35.4%, compared to 41.7%, so that 91% revenue growth only delivered 62% more gross profit dollars. YTD numbers are going the other way with a 200 basis point improvement over last year, from 37.4%, to 39.4%. For what should be a relatively simple business model, I find the lumpy margin rate a little surprising to see an 800 basis point swing from quarter to quarter.

Total operating expenses are down 30% YTD, but actual cash burning expenses are down 7%, which is still impressive conversion on that top line growth. The bulk of the difference in opex was share based compensation which they have basically shifted from Q1 to Q3 this year so investors will see the impact of that when they release their next quarterly in November.

Bottom line is much improved, going from a loss to a profit in both the quarter and YTD. Due to the margin variances however, Q2 profitability was only about a third of what they did in Q1.

Overall:

I feel like the review started to go a little sideways after the cash flow section.

Compared to last year, the financials are overall pretty good, but once you start to get into some of the intangibles, I have questions. The company has one segment with all of their business coming from Shoppers right now. The Rexall pilot has been slow moving but that seems like it could be poised to escalate soon as well as UK partner expansion. The TAM is definitely there if the company can execute, and the simplicity of the model should be one that’s easily scalable. But I don’t think I’m on board quite yet.

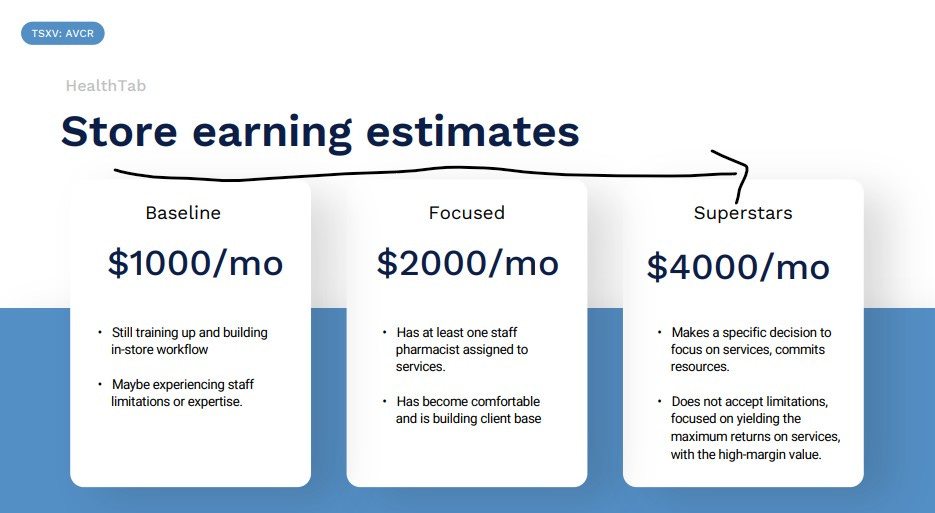

I’d also like to hear more about what the company is doing to move stores from the left side of this slide to the right. The two QoQ revenue declines suggest that more can be done here which would help smooth out some of the testing seasonality.

The fact that 50% of the company’s cash burning expenses go back to insiders and my comments on the SBC plan are not endearing qualities.

In terms of valuation, we’re at a $28M MC, about 7x MC/Sales multiple and we’re a little too early to attach profitability metrics to it. I’m going to give it the Goldilocks award and suggest where it is trading now is just right.

Three stars again.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

One thing of note is the testing volumes carry a lower gross margin so revenue growth without installs keeping pace is definitely going to do that to gross profit. I don't like their compensation scheme either seems shortsighted.

Thanks Wolf for the review

Initially I was intrigued by their business but after viewing the interview by small so discoveries I felt the CEO was deflecting the question by Paul Andreola of 'how should judge progress at Avricore going forward?'. So I put them into the penalty box of mine for the time being https://youtu.be/_wQB1MJMlx0