BeWhere has been reviewed on two previous occassions, a three star review in April, and most recently an upgraded 3.25 star for their Q2 released back in August.

It’s 10:30 am as I write this on the morning of the release, and the market appears to hate it, down 13% in the first hour of trading.

The stock has been on a heater, up 273% YTD and about a double since my first review. I wanted to get in on the action but had already felt it was trading ahead of itself back in August and it only continued to run. Is the market finally getting around to re-pricing this? Let’s see.

Balance Sheet:

One thing I’ve come to expect now is a solid balance sheet out of BeWhere and it is still quite solid with a current ratio of 3.1 (deferred revenue removed). That is made up of $4.8M in cash, $5M of receivables, $1.4M worth of inventory, and $200k of other short term assets against $3.7M of short term liability commitments. The ratio is down slightly from the last look but I don’t believe that is cause for concern.

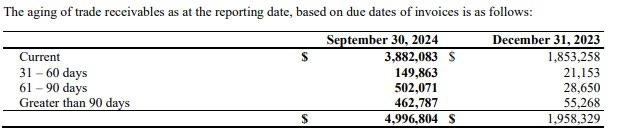

Receivables could look better with 22% of them overdue and nearly $1M past two months late. Time to kick some customers in the ass Mr. or Mrs. Credit Manager.

BEW has a minor $415k government loan as their only debt.

Cash Flow:

Operational cash flow looking like a bit of an issue here with $462k of OCF generated through their first nine months, which is 47% less than what they achieved at the same stage last year. The weakness here due to a higher investment in inventory and the big increase in accounts receivables. This was highlighted last quarter and expected it might correct itself here but it has not - mainly due to their aging reports getting much worse over the last three months. Beginning to wonder if they have overly generous payment terms also. One good collections quarter could clean this up, so something to monitor when their annuals are reported.

Not much else happening in the rest of the cash flow statement but they have bought back $115k worth of shares YTD. Overall their cash position by a minor 4%

Share Capital:

Not a whole lot has changed in this section since last quarter so you can read what I wrote then by clicking the review below.

Income Statement:

Expecting more positive things to say here. Revenue was solid once again with $5.03M achieved in the quarter, 64% better than Q3 last year. It’s also an impressive 16% over their previous quarter. On the year so far they have achieved revenues of $12.85M, a 45% increase over 2023.

Gross profit rate absolutely tanked in Q3 however coming in at 28.2%, more than 1200 basis points less than last year. So only 14% more gross profit dollars on 64% more revenue is quite the kick to the gonads. At the midway point of the year in my last review, margin was only off by 190 basis points, so this is quite the eye opener and not in a good way. That YTD gap is now 580 bps, with their GP rate at 32.5% compared to 38.3% in 2023. That’s a $750k missed opportunity on their top line.

Expenses thus far have been pretty well controlled and in Q3 cash burning expenses are about flat to last year, in part due to reductions in R&D spending, which oddly had a small credit in the quarter.

After an unfortunate $120k bogey to last year in foreign exchange, net income for the quarter was $334k, a 17% improvement to last year. YTD looks better with $932k in comprehensive profit, 84% better than 2023.

Overall:

Exciting top line, but the gross profit erosion took the air out of the tires here. The discussion within the MD&A blames higher freight and a new product launch, but doesn’t discuss mitigants or whether they expect that to trend or improve. Combine that with reduced operational cash flow to last year and I’m much less impressed than I was hoping to see. Certainly takes them out of the running for a potential 2025 pick - so I can cross them off that list.

Stock is currently up a few cents from it’s morning low. At a $77M market cap we’re looking at approximate valuation ratios of 4.8 MC/Sales and a 53 P/E on a TTM basis. No thank you, not right here - particularly with a long long wait until we see their Q4.

Generously maintaining my 3.25 star rating.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review Wolf