Sadly I got in on this one a little later than I would have liked, but better late then never on a winner and I made my entry shortly after my four star review of after their Q2 back at the end of August.

The stock is now up 185% on the year, 26% up after that last review.

There have only been a couple of handfuls of initial reviews that have received four or greater stars on my first review. Can they match off or even improve upon the success of Q2? The highlights in their news release yesterday morning certainly suggest it was “Bat Flip” worthy and the market liked it too. But, will I?

Balance Sheet:

With unearned revenue removed we start with a very good current ratio of 2.75 consisting of $7.3M in cash, $7.7M in accounts receivables, $2.2 in unbilled revenue, $3M worth of inventory and $1.8M in prepaids against $8M in liabilities due over the course of the next twelve months.

In my last review, I gave them a bit of shit for their disclosure surrounding their A/R. My plea to see aging reports outside of their annual filings has been ignored apparently. When you include statements such as the one below in your MD&A, I only want to see an aging report that much more.

While the current ratio is slightly less than it was last quarter, the overall balance sheet looks a little stronger liquidity wise. Their cash position has improved and receivables make up a much less percentage of their current assets then last quarter. Inventory has tripled but given their top line performance I think they can be forgiven for that. Biorem currently has $2.56M of debt.

Cash Flow:

Through three quarters, BRM has produced $5.4M in operational cash flow which is 12x greater than they achieved last year. $3.1M was generated in Q3 alone mainly due to a very good quarter on A/R collections.

They purchased $367k in assets and made $408k in loan payments YTD, so their overall cash position has improved by 217% or nearly $5M from the beginning of the year.

Solid.

Share Capital:

Very tight outstanding float with 15.8M shares outstanding with very small dilutive measures of 200k options exercised in the past 18 months

3.6M options outstanding. All are in the money but expiry dates are between three and nine years

Biorem has a very conservative and retail friendly 5% SBC plan and the world would be a better place if more small cap stocks followed their lead

Insider activity is virtually non existent sadly

Income Statement:

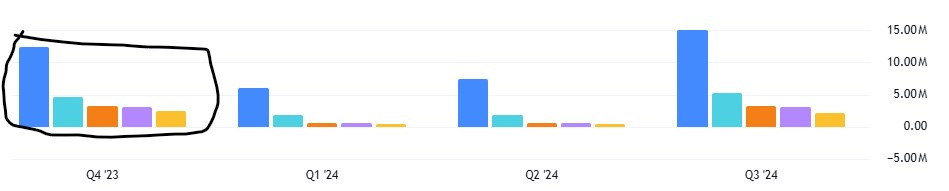

Fabulous top line with $14.9M in the quarter (a new record for the company), 170% better than a year ago, bringing their YTD total to $28.1M, 117% better than the same stage in 2023. Equally as impressive is their performance in gross profit, up by 510 basis points to 33.1% in Q3 and now sits at 30.1% on the year which is up 1000 basis points from last year through three quarters. That equates to 223% more gross profit dollars year over year on 117% more business.

Operating expenses have grown by a greater rate than revenue at 167%, but due to their great margin performance still converted on GP dollars. Therefore Net Earnings rose by over 4x in the quarter to $2.2M and now sits at $2.9M YTD against a $147k loss for a greater than $3M turnaround on the bottom line.

Overall:

From top to bottom these are simply outstanding financials.

On a trailing twelve month view, Biorem has generated $40.3M in revenue, $5.2M in net income, and $7.7M in EBITDA. Therefore they are trading at just a 1.1 revenue multiple, an EV/EBITDA multiple of 5.3 with a P/E ratio of 8.3. With their growth rate this year that suggests there is still some very good value in the current stock price.

There are some other factors to consider however.

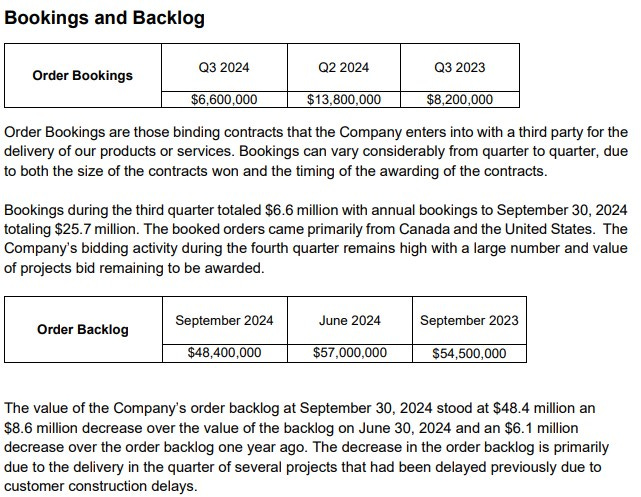

They had their softest quarter of the year in new order bookings at $6.6M and their backlog now sits at the lowest it has been this year at $48.4M They do state however that bidding activity remains high in Q4. Overall though the company is very conservative in their language within the MD&A and does not provide guidance.

This coupled with their annual results not coming until mid April, and up against a very big quarter of $12.3M. The recipe for a disappointing Q4 is certainly plausible given the above and the reality of a relatively lumpy revenue history.

Still loving their YTD performance but keep those caveats in mind, particularly as we get closer to their next FINS release.

Probably worth an upgrade but due to the Q4 risk I’m maintaining the four stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.