A post morning open news release yesterday for their 2024 financials to the masses was an interesting choice. Were they hoping the market wouldn’t notice?

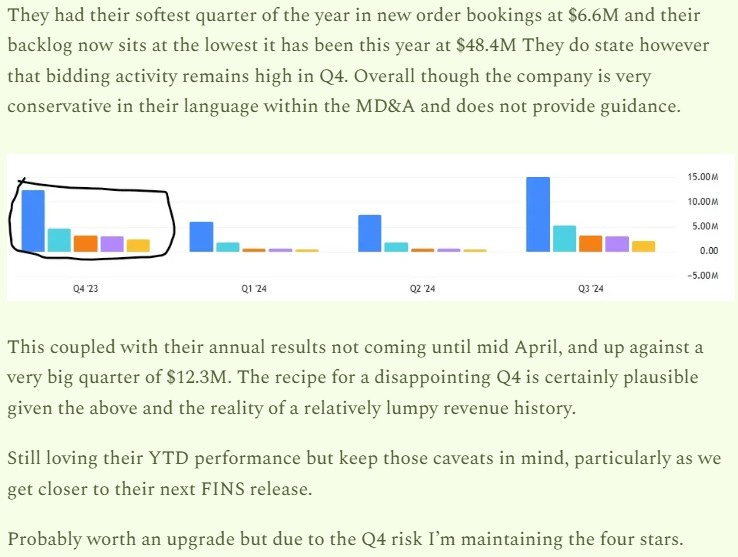

If that was part of the strategy, it certainly didn’t work with the stock falling by over 11% and seeing the highest volume since their much more celebrated Q3 earnings. I am a shareholder in Biorem to get the disclosure out of the way early, but like many I had some concerns coming into this quarter. Here’s a glimpse of what I had to say back in November after their Q3.

After their last quarter, the stock performed as most four star reviews did, going from $2.47 to $3.45. Those were much happier times in the small cap world. Given worries on Q4, add in some tariffs and impending global doom, and the stock has retreated by an incredible 46% since that high achieved in the first week of January. Yikes.

After yesterday’s decline the share price currently sits five cents below where it closed after their 2023 annuals. Were the numbers that came out yesterday really that bad? To be honest, I haven’t fully delved into them yet. Yes, I’ve read the unimpressive highlights, but if you were not aware, I write most of my reviews as I am going through the numbers. Think of my writing as a YouTube unboxing video.

Therefore, let’s unbox Biorem’s Q4.

Balance Sheet:

With deferred revenue removed, Biorem has a slighly improved current ratio over last quarter of 2.8. That is made up of $5.2M in cash, $11.9M worth of A/R, $3M in unbilled revenue, $2.9M worth of inventory and $1.5M in prepaids over top of $8.6M worth of current liabilities due during their 2025 fiscal year.

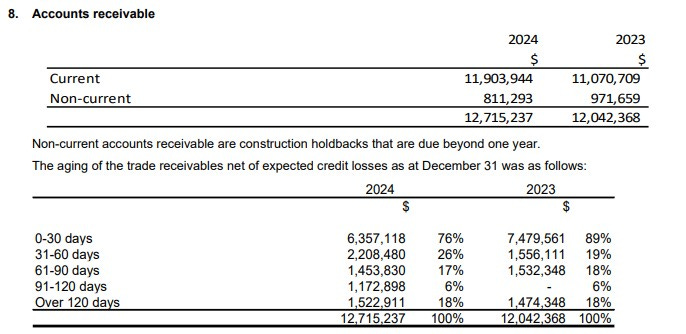

When it comes to their disclosure surrounding their A/R, I’ve not been kind to the company in previous reviews. Therefore I have to give them credit for providing it here in their annual statements.

Now if only I could figure it out. I’m not sure in what world where $1.5M can be over 120 days bucket and yet their total of non-current is only $811k. I also don’t have any idea on what the percentages in the above table represent. Maybe it’s just 6:45 am as I write this but those add up to 143%. On the plus side, the company has only written off a net of $300k in receivables over the past two years.

Biorem has $2.4M of debt maturing in December 2028 at an attractive 4% interest rate.

An overall solid start.

Cash Flow:

The company delivered $3.7M in operational cash flow (OCF) during 2024 which 7.5x more than they achieved during 2023, and that includes carrying more than three times the inventory YoY. Minor activity elsewhere on the cash flow statement including $372k in asset purchases, debt payments of $550k and $156k to the treasury from stock options.

That might be my shortest cash flow section ever. Short usually means good, as is the case here.

Share Capital:

16.1M shares outstanding in a historically well managed float. 2.8% dilution during 2024, all coming via exercised stock options

3.3M options outstanding, all ITM with the exception of 50k awarded this year at $1.96. None expire within the next two years and the company maintains a very retail friendly 5% SBC plan

Only recent insider selling with the board share selling off a quarter million shares in December near $3 after exercising 100k options.

Minimal 2% insider ownership

Income Statement:

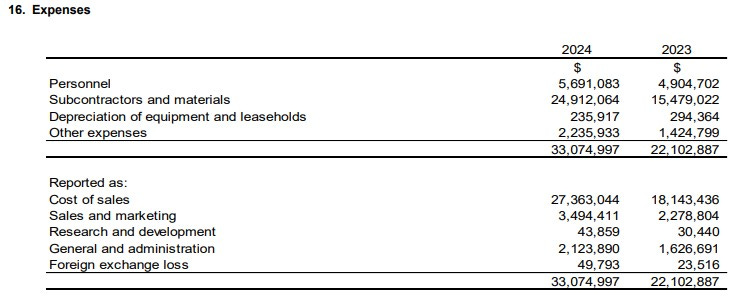

On the top line a very solid year overall with $37.4M generated in revenue, 49% greater than $25.2M in 2023. That extra business came at the expense of 100 basis points in margin erosion however with gross profit at 26.9% vs last years 27.9%, therefore gross profit dollars improved by 43%.

The company has two main cash burning expense buckets, Sales & Marketing and G&A costs. Combined, those grew by 43.8%, right in line with their gross profit growth, therefore they didn’t capitalize or convert any additional profitability below that margin line. Earnings from operations while still impressive at 41.8% growth is therefore less than their rate of increase in revenue and growth profit. Biorem also experienced an 81% increase in their tax burden so their Net income of $3.04M was 39.6% better than what they achieved in 2023.

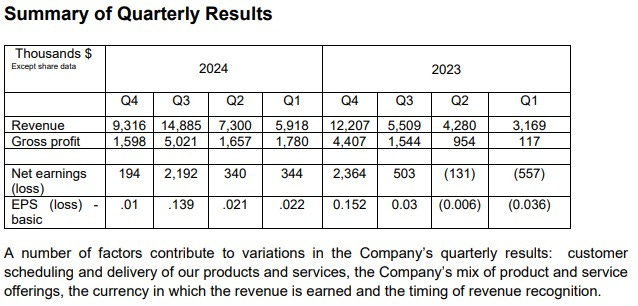

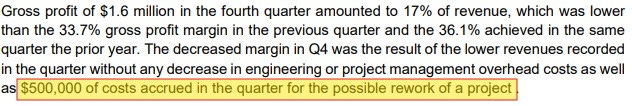

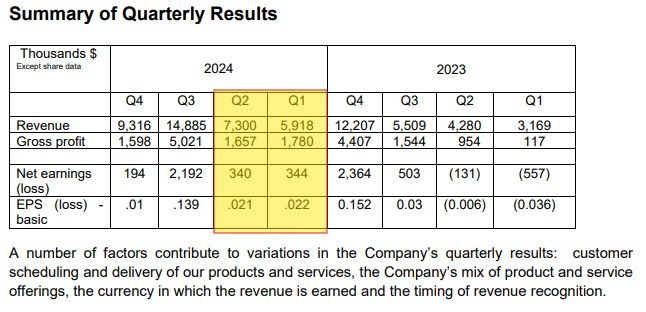

The company’s fourth quarter on its own is much less attractive. The company achieved $9.3M in revenue, 23.7% less than the $12.2M in the comparable quarter. Margin was disastrous in Q4 with only 17% compared to 36%. After being ahead YTD after Q3 by over 500 basis points, this margin hit in the quarter erased those 2024 gains.

For me this might be the most concerning line within the financials, being the accrued costs for possible rework of a project. Even with this half million added back into their margin numbers it would still come in at a rather pedestrian 22.5%. It also begs the question of why they may need to rework a project in the first place at such a significant cost and how likely is something like this going to happen again?

The bottom line results is net income of $200k vs $2.2M in Q4 vs last year.

Overall:

As mentioned off the top from my Q3 review, the recipe was there for a disappointing Q4 and that certainly played out - not only on the top line but on the margin line as well. If there is some good news within their Q4 is they seem to be a little more nimble within their controllable cash burning expenses than I may have thought. With revenue down on a QoQ basis by 37%, marketing and G&A costs were 35% lower, and that is a good sign for a company with lumpy revenue expectations.

While the comparison to 2023 Q4 and QoQ look poor, I think it is important for investors to remember this recent quarter was their third best top line of the last eight. This isn’t a SaaS business or one with recurring revenue, so if you’re long on Biorem, you need a have a strong stomach and think in longer timeframes. Did the company have a soft quarter? Yes. Have they shown the ability to grow the business over longer comparable time frames? Also yes and a significant one at that with 49% growth year over year.

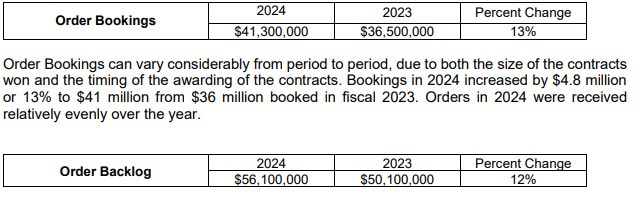

Does it appear they can duplicate that in 2025? Well, yes as an increase in bookings during the year including a record Q4 and another backlog record of $56.1M suggest they can have another solid year. The company announced on February 11th $8M more in contracts and a new backlog number of over $60.5M. If you reverse engineer those numbers it works out to recognizing $3.6M worth of revenue in their first month or so of the year.

Looking ahead the company is up against quite soft numbers in their next two quarters, including just $5.9M in Q1 that they will report by the end of May, potentially less than six weeks away. So as much as Q4 looked to have some danger baked in, Q1 looks like it has some opportunity for a decent beat.

With that said I’m still going to measure Biorem’s progress generally on TTM basis, and not a quarter over quarter one. Easier said than done of course.

Back to my original question from the start of the review. Does it make sense that the stock is five cents cheaper today than it was a year ago? Given revenue increased by 49%, profitability by 40% and the P/E went from 14 to 9, I’m going to say it’s a much better buy today than it was a year ago.

That is not to say the company is without any warts, and we are also in challenging times given global trade and potential recession uncertainty. I am still long on the company and comfortable as a shareholder but with this Q4 margin number I have no choice but to give them a downgrade.

3.75 stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf! I've been holding for a while and will continue to hold. Not sure if I'll add along the way before the next financials, given all the uncertainty. Love your "unboxing" review.

The a/r over 120 days is long term receivable and short term receivable not paid within 120 days.