Ever had that one that got away? That's how I feel about Cematrix. Wasn't overly excited about them during my first couple of reviews. Then you take your eye of the ball and nobody requests a review when they turn the corner. Had I reviewed their Q3 of 2023 this is a play that likely would have been a contender for a 2024 selection of the year. I was only able to review their annuals however and it received one of the largest upgrades I've ever given from two stars back in May of 2023 to the 3.75 stars I gave them last month and their run has continued up 26% since then and an incredible 115% since dropping those Q3 fins. Let's see how they started their 2024 year. After a couple days, market was not all that impressed, dropping about 13%.

Balance Sheet:

Very strong start with a current ratio over 3.8 which consists of $7.9M in cash, $4.5M in receivables and $876k worth of inventory against just $3.6M of liabilities due over the next year. Receivables are in very good shape aging wise and they had quite the collections quarter which will also show up in their cash flow. Cematrix has about $2M of debt of which half is due in the next twelve months.

Cash Flow:

Massive turnaround in operational cash flow in Q1 generating $4.8M against burning $238k in the same period last year. But here's the thing, most of that turnaround was in working capital changes. They collected extremely well on receivables and utilized that to pay down a substantial amount of payables as well. Problem is their Q1 revenue was no where near the previous two quarters so don't expect their operational cash flow to trend as good as this. Nothing notable in their investing and financing activities during the quarter so overall their cash position improved by a whopping 140%.

Share Capital:

135.3M shares outstanding with only 1% dilution during this past year

0 warrants left after 24M expired unexercised in 2023

4.7M options outstanding, with about 3M currently ITM. I wish their breakdown in the notes had more clarity

151k RSU's with 1.3M exercised in 2023

Very minimal insider ownership of 3% (per YF)

One director with insider buying late last year and a former member of the mgmt team dumped all of his 1.3M shares back in Dec leaving about 40% of upside on the table. Sucks to be you Patrick

Income Statement:

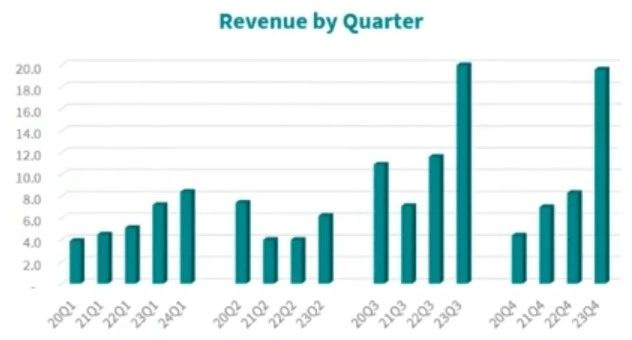

Looking like the story here isn't going to be what Cematrix did compared to Q1 of last year but rather what they did against the previous two quarters. Revenue improved by 17.5% to $8.4M against $7.2 last years Q1. Margins were substantially better from the piddly 10.4% they achieved in Q1 of last year all the way up to 30.2% this quarter, and their SG&A expenses rose slightly less than their rate of revenue increase at 15.7% so they achieved a little bit of conversion there as well. That all amounts to a net income of $350k in the quarter vs a loss of $1.67M a year ago. That is a $2M bottom line improvement on only $8.44M in revenue so if you're just looking at last years Q1, it's pretty impressive. The problem here might be a story of what have you done for me lately.

Overall:

While there is some significant seasonality to consider with Cematrix, revenue was down in Q1 compared to the previous two quarters by over 55%. This is what I imagine the rationale for the big drop in share price in the last two days of last week as well as the slippage of their back log number from $100M to $84M the scope reduction relating to one large project. Does this create a dip opportunity or is the market just factoring in more risk?

Their TTM EV/EBITDA ratio of under 8 and Rev/MC ratio of under 1 all the while improving their margins and bottom line suggest there is still opportunity, but the two strong quarters of Q3 & Q4 are likely making investors a little uneasy. I don't blame themI would expect them to have a strong Q2 with some risk in the back half if they can't beat those two monster quarters, particularly as some of the lost backlog was likely to hit the back half of the year. Minor downgrade to 3.25 stars but I still think there is a lot to like here.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.