So many requests for this one over the past few months. It’s been a long time since their Q3 was released and normally I shy away from reviewing financials this old, but it’s also one that I’ve wanted to take a look at for some time, so why not?

Longs have to be ecstatic as you could have had this in the $5.50 range at the beginning of the year and currently sits 165% above that. It is also off by about five bucks from it’s 52 week high back in August. What do the financials tell us?

Balance Sheet:

A solid current ratio of 2.0 that consists of $9.5M in cash, $13.2M in receivables, $5.3M worth of inventory and $1.05M of prepaids against $14.5M in current liabilities due within the next year.

The variances to last year jump off the page as their current ratio stood at 8.75 a year ago, cash depleted by over $30M, receivables up by over 2.5x on 32% more revenues, and have added $40M in new debt. Clearly it has been a very eventful previous twelve months.

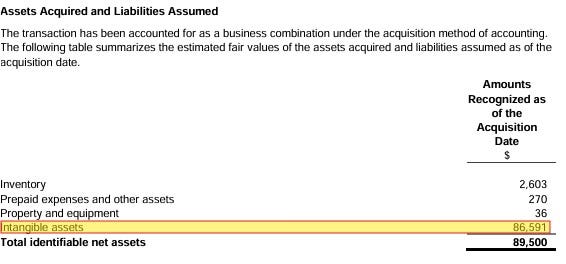

The rationale for much of this was of course the massive acquisition of ParaPRO LLC, giving them global product rights for a lice and scabies treatment in Natroba. This sent the stock soaring. The total purchase price was nearly $90M USD which at the time was well over half the company’s market cap. They achieved this through $40M in cash and $40M in debt through a newly established $65M credit facility through the National Bank of Canada. That debt carried an interest rate of 6.6% and will fluctuate based on SOFR and the company’s leverage ratio measured quarterly.

A couple of concerns do stand out here. The first is their accounts receivables which stood at $13.2M. That A/R growth was $9.4M in the quarter while total revenue in the same quarter was $10.4M. I can’t ever recall seeing receivables growth of 90% of quarterly revenue. It might very well be nothing but timing differences but without an aging report or any mention of it within their MD&A or financials notes, it’s not something to be overlooked.

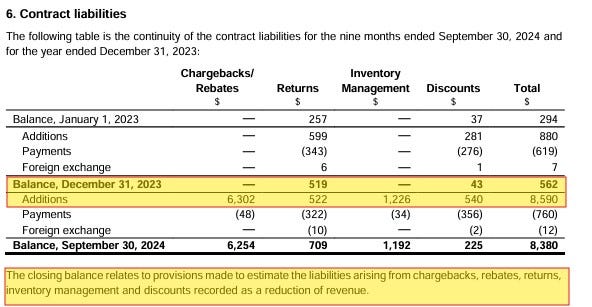

Next is the growth of their contract liabilities which grew by $5.8M in Q3 and once again a very significant portion of their Q3 revenue. Chargebacks to pharma companies via their wholesalers are arguably the largest risk to their financials statements, and quite frankly this number freaks me out and I wonder about the negative impact this could have on future financials. It could explain the large variance in their accounts receivables as well.

Cash Flow:

Cipher has generated $10.7M of operational cash flow through their first three quarters which is down 21.5%, or $2.9M lower than the same stage last year. This stems largely from the lower net income to last year and also includes some significant variances within adjustments to working capital already discussed. They added $80M worth of assets with the ParaPro acquisition via $40M in cash and $40M of debt. Overall Cipher’s cash position has depleted by 75% from where they began the year.

Share Capital:

Tight float with 25.3M shares outstanding with about 7% dilution occurring this fiscal year, mainly through the shares issues as part of their acquisition

Bought back $26k of shares this year, but none since March and they did not enter into a new NCIB when it expired in mid November

Cipher has an ESPP allowing employees to purchase shares at a 15% discount. 4800 shares were bought so far YTD compared to 11,400 last year

1.3M options, all ITM but none expiring for 2.5 years or more along with 233k RSU’s

Insider ownership of 42% with 1.5% institutional (per YF) with minimum share ownership requirements for insiders and directors

CEO takes no base salary currently other than fees as board chair. Receives 100% of his comp via SBC

No insider purchases in the open market but you would not expect to see any with an ESPP in place, although 4,800 purchased this year does look rather dismal when they can do so at a market price discount

Income Statement:

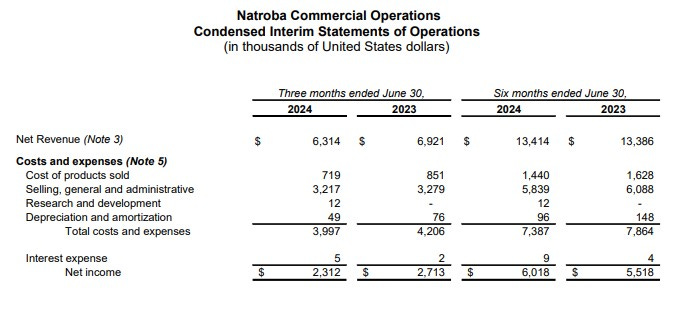

Total revenue in the quarter was $10.4M, up 71% from last years Q3 and through nine months $21.5M, up 33% from 2023, and margins are very strong at a consistent 81% this year. Expenses were up significantly, more than quadrupling in the quarter to $8.1M vs $1.96M in the comparable quarter. Depreciation and amortization was up over 7x in the quarter due to the vast majority of the purchase price allocated to intangible assets which will be a continual hit to Cipher’s financials for some time.

SG&A costs increased by 265% in the quarter, , with $1.6M of the $4.5M of the additional spending relating to acquisition and restructuring costs. The overall hit to the income before taxes was significant with profitability decreasing by 90% in the quarter to $326k vs $3.1M. On a YTD basis $5.8M vs $9M.

Overall:

A very complex set of financials to analyze, along with a lot of DD and potential catalysts for investors to consider. The $90M acquisition itself is quite complex as well. In Natroba they acquired a mediocre balance sheet with a very profitable, yet stagnant in terms of growth business.

Annualized the above numbers work out to $27M in revenue with $12M in net income. That works out to a 7.5 year payback period on the purchase price for a product that they have FDA and exclusivity for about eight more years. Therefore to make this a great value acquisition they will need to find operating efficiencies and growth opportunities. In both instances, Cipher believes they can through expanded Canadian and global markets, and through future acquisitions to maximize their existing sales teams. If they can capitalize on these opportunities, it becomes a potentially lucrative acquired drug - without it, a fairly mediocre one.

The Moberg news earlier this month also had a negative impact on the share price, which eliminated a potential future catalyst.

When I look at the entire picture, my gut tells me it’s a wait and watch play, particularly at today’s valuations. By the same token I understand why many are bullish about Cipher’s future prospects. Sometimes if you wait and watch an opportunity will pass you by but I’m willing to take that risk here.

Three stars.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I owned cipher in the $3s and sold in $15. My concern is that there is now a fair amount of hopium built into the price. Natroba is not really on the radar for most practitioners treating scabies and so I suspect the adoption as either a first line agent or second line agent will take a lot longer than expected with considerable marketing or additional studies needed. There is much better evidence and comfort on the use of oral ivermectin as either first-line or salvage therapy and treatment is much easier and well-tolerated. Topical treatments are difficult to apply. The relative efficacy of spinosad compared with permethrin or ivermectin is not clear and so that will make it even tougher to convince physicians to use. Not saying it wont become more popular, but I think it will take a long time.

financials reflect 2 months of natroba income - did you adjust for that