Covalon’s eagerly awaited financials just dropped to close out their 2024 fiscal year. I covered them once previously back in the middle of June and awarded them an encouraging 3.25 stars.

Since that favourable review the stock has jumped 226%, coming awfully close to a four bagger in about a five month window and in the past two months the stock has pulled back some. I wasn’t part of that run as a shareholder sadly, but in the last couple of weeks as the stock has pulled back it has been on my watchlist and identified a potential bounce area or buy zone with my subscribers just above the $3 support area and took a position late last week. Do these annuals and more importantly their Q4 support a bigger run? Let’s find out (I’m listening to their earnings call as I write).

Balance Sheet:

We begin with an eye popping current ratio of 7.4 that consists of $16.7M, $3.6M in receivables, $7.7M worth of inventory and about $900k of other short term assets against just $4M of short term liabilities. They are extremely liquid with just their cash position covering all of their liabilities by a factor of 4x and that includes zero debt. This is easily one of the best balance sheets you will ever see on the Venture.

Cash Flow:

An incredible twelve month turnaround story within their operational cash flow. In 2024 they generated just shy of $3.5M in OCF compared to burning nearly $3.2M in 2023 for a greater than $6.5M improvement. They had some small investing activities but the company also had a $5.5M windfall from warrants being exercised during the year. Overall, Covalon nearly doubled their cash position in 2024, growing by $8M or 90%.

Do you notice how short these sections are compared to most reviews? That indicates a well run company.

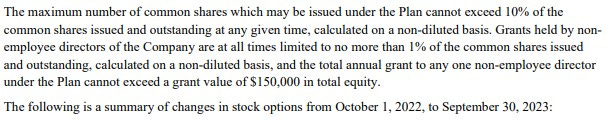

Share Capital:

A relatively tight float of 27.4M shares outstanding as of their year end (Sept 2024)

11% dilution during their fiscal year, all via warrants exercised which was responsible for adding $5.5M to the treasury

200k remaining warrants out of the money at $4

1.3M options outstanding, all but 75k in the money (note to mgmt - your table kinda sucks, particularly when it spans over two pages) and 180k DSU’s

If you’re wondering what a SBC plan looks like that is retail shareholder friendly, this is one

Strong insider ownership of 49% (per Yahoo Finance) but no insider participation in the market to speak of

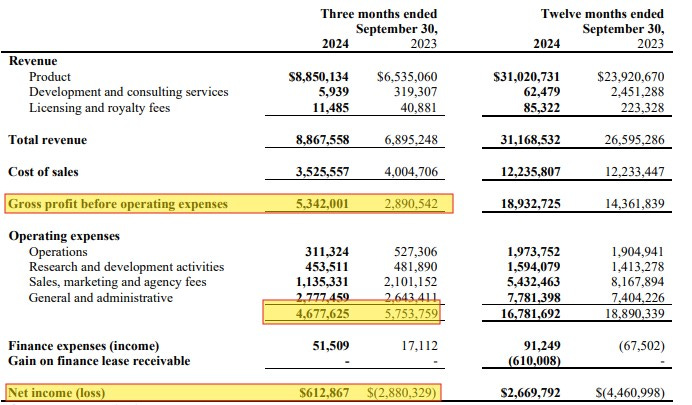

Income Statement:

Total revenue for their 2024 fiscal year came in at $31M which was a 30% improvement over last year. COGS were flat on 30% growth which translates to a nice improvement in margin of 100 basis points to 61% gross profit. Perhaps the biggest story of 2024 for Covalon was the improvements they made within their operational spending as they took out more than $2M off of the expenses lines or 11% compared to last year while growing the business by 30%. Strong top line growth, margin improvement and expense reduction awards them the “Wolf Trifecta”.

Overall:

As we’re approaching 10 am here the stock is pulling back and it’s likely due to their Q4. So let’s dig specifically into that.

Revenue in Q4 outpaced their annual performance which grew by 35% to $8.85M. The company was up against a terrible gross profit quarter from a year ago which they blew out of the water by nearly 1600 basis points (60% vs 44%) growing their GP dollars by 84% over last year. They also cut operational spending by 18.7%, once again outpacing what they did on a year to date basis. Some investors are choosing to focus on the G&A costs which rose by a mere 5% while seemingly ignoring over $1M of savings elsewhere. Are you fucking kidding me? This all results in a $3.4M turnaround IN JUST Q4.

It’s certainly more than fair to point out that the company delivered $1.45M on the net income line in the previous two quarters and this is certainly off from that on a QoQ basis. I also thought the company did not do a great job on the Q&A portion of the call reading questions about the G&A expenses on multiple occassions after addressing it once with what I thought was quite reasonable rationale. That being that some bonuses were paid in Q4 (deservedly so) which will be spread out (I assume on an accrual basis) next year and some one time consulting expense focused on 2025 growth initiatives. Reading similar questions after being addressed turned a positive message into a perceived negative one.

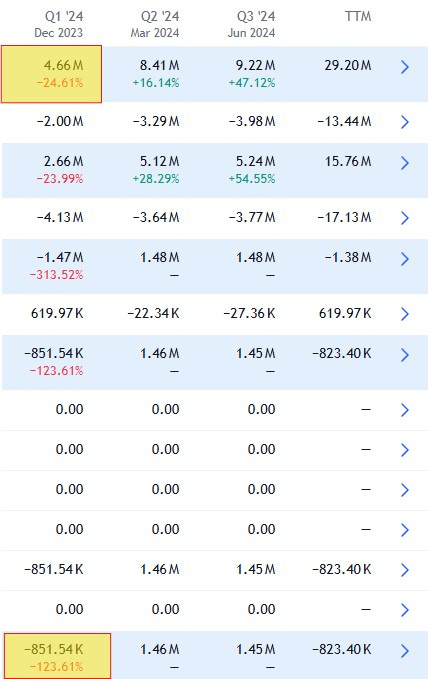

So from a valuation perspective this one does get a little more interesting. We are currently looking at a market cap of around $85M on this morning dip. Therefore it is not trading cheap at a 2.7 P/S and a 31 P/E. But to be a little more realistic, one has to take a look at the very soft Q1 the company had before they really found their stride in this years second quarter.

If you annualize their last three quarters it would work out to $35.3M of revenue and $4.7M in Net Income bringing their P/E down to a much more reasonable 18. Again, not what I would consider cheap, but not outrageous with their positive outlook for the future.

I’m not thinking about adding to my position right here based on those metrics, but I’m more than comfortable holding through their upcoming first quarter of 2025, which we should see in approximately 6 weeks. I’m also giving them a quarter star upgrade to 3.5.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Excellent summary - and fast too! I was also listening in on the call while frantically reading their FY2024 audited financials which had been released at the same time.

- agree that ~$3/share is a very fair price given where Covalon is at. I'm certainly not selling in disappointment and the low 3s seems a very stable base for the stock to build from. While the price might not move much, there is little downside. All the space to move is up. Assuming the story continues to play out, I'd expect a new higher base price level to be established after their Q1 report in late February/early March.

- while the firm is doing well and the growth story remains intact, I was slightly disappointed with the quarter, imagining sales at +40% (vs +28.6%) and EPS of ~$0.05. I guess the market was feeling similar as the price dropped ~10% at the open.

- my main conclusion from the call is that the CEO is going all in on being bought by one of their larger competitors. It's not up to him, of course, but he is doing what he can to bend reality in that direction.

- Covalon now seems sustainably cash flow positive and has over $10M in surplus cash on their balance sheet. I asked what plans they had for that cash and the CEO said he preferred not to answer. Earlier in the call he talked vaguely but with excitement about 'numerous' partnership, merger and acquisition opportunities. It is a realistic possibility that Covalon is bought by one of their major competitors, who Covalon appears to be beating in narrow segments. In that case, $3/share is pretty cheap. Johnson and Johnson, one of their competitors, trades at 4x sales. If they offered 4x FY2025 sales for Covalon, that would be ~$5.90 a share. Give it a year and another 20% growth in sales, it becomes $7/share. Noting the CEO's prior industry experience and contacts, I expect this might be exactly the kind of pitch he is making and his real strategy is to be taking their business in mainstream US hospitals enough that they big guys notice and buy them.

- according to their FY2024 annual report, Covalon has C$4.9M and US$11.1M of accumulated tax losses. This would be a sweetener if someone was to buy them, or helps them amp up their cash flow for the next several quarters of profits as they use up those tax losses.

- Covalon has basically abandoned Canada and overseas markets, focusing instead on the US. This is probably a consequence of the new CEO 'cutting costs and focusing'. They didn't get to my question about these markets. FY2024 US sales were $27M while Canadian sales were $40K (!!). Mid-East sales dropped from $5.9M to $2.7M. I'd assumed the answer would be something like 'we've focused on the US and gotten excellent traction, which we continue to build on. Now that we have that traction, we've got a strong story to go back into other markets we have traditionally done well.' Presumably, the home market of Canada would be ~10% of the US market. However, that they didn't get to my question suggests to me that the real reason is to go all in on doing what it takes to get noticed by a big guy. Selling to Canada and Saudi Arabia doesn't do that. Covalon taking flagship US hospital after flagship US hospital does. ~$200M is a cheap price to pay to make the hurting stop and add leading SKUs to your global offering. Your sales people are probably begging you to do that for them already.

- as of the big warrant conversion in September, Covalon disclosed that 51.8% of their shares were held by insiders. Today's FY2024 report has 40% of shares held by insider Abe Schwarts and 17% held by insider Goldfarb Corp (the corporate entity of one of the people on the Board). Existing management has lots of RSUs (I've not looked it up). I've not seen corresponding filings of insider transactions, but we are at something like 60% of the fully diluted outstanding shares held by insiders and the CEO repeating, again and again, his confidence that the firm has a lot to grow into.

Nice, mate. My blood pressure has come down a bit