First review, but not my first look as I’ve had these guys on my watchlist for sometime. Never acted on them sadly as Firan has been on a very nice run for the last fourteen or so months, doubling in value, but now retracing since these financials were released.

I wrote about Firan and my concerns about their upcoming financials back in my first “WWW - What’s Wolf Watching?” (paid subs) article back at the end of January. These results at first glance came in better than my expectations, but the stock has still retreated by 15% since their release. So what gives and what should we place their value at today?

Balance Sheet:

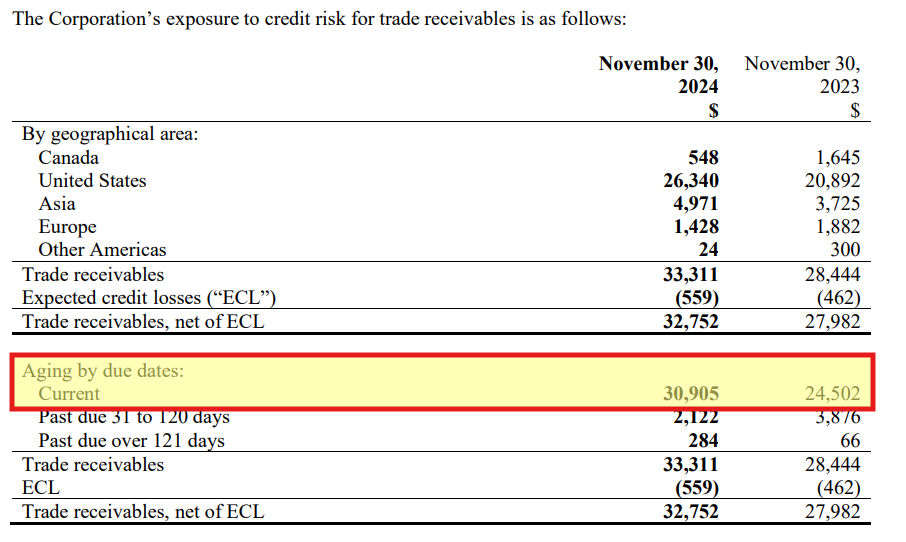

FTG has a very solid current ratio of just over 2.5 that consists of $10M in cash, $33.7M of receivables, $34.4M worth of inventory and approximately $4M in other short term assets against $32.3M of liabilities due over the next twelve months.

Liquidity isn’t the strongest with a 2.5 ratio as 83% of their current assets are made up of receivables and inventory.

The aging report is pretty solid and does not raise any red flags and their inventory values are $2M less on double digit revenue gains so they achieved a much more efficient turnover ratio YoY.

Firan has about $9M in long term debt which is easily manageable with their ability to drive cash flow.

A good start.

Cash Flow:

Firan produced $14.1M in operational cash flow during their 2024 fiscal year, a 25% improvement over a year ago. They utilized $7.3M in asset purchases and outside of lease expenses did not have much occurring within their financing activities. Overall they improved their cash position by 50% during the 2024 fiscal year.

Share Capital:

23.9M shares outstanding with zero dilution in 2024

258k PSU’s , 100k RSU’s and 98k DSU’s outstanding

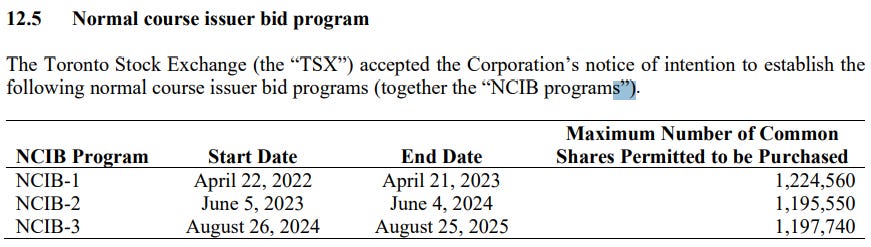

FTG has bought back 3.6M shares under their NCIB program over the past few years

31% insider and 12% institutional ownership (per YF)

Last insider buys were relatively minor back in April

Overall the company has been exceptionally responsible with float management including their SBC

Income Statement:

A very solid year with 20% more revenue at $162.1M against $135.2M a year ago. That revenue did come with some margin slippage with the margin rate declining by 180 basis points to 27.3% with margin dollars increasing by 12.4%. FTG did an ok job converting on expenses, which rose by 15% which isn’t great on 12% more GM dollars, and their main SG&A expense grew at about the same rate of revenue, 20%. In fact, without their forex and gains in value of contingent consideration, they wouldn’t have brought another penny to the EBIT line on 20% more revenue. Due to income taxes coming in $1.9M higher than 2023, their net income actually came in at approximately $750k worse.

The quarter looks marginally better. Revenue grew by less than their YTD trend, up by 13% to $45.2M. Margin bucked the YTD trend which rose by 140 bps to 28.3%. Expenses as a whole were relatively flat to last year thanks to the above mentioned birdies, but their main expense burning bucket of SG&A grew by 21% or $1M, significantly outpacing their revenue growth.

Overall:

I thought they were in for a potentially tough quarter but when I saw them exceed last years Net earnings numbers I was initially impressed. After seeing that without one time items, they would have actually produced less net income on a double digit revenue increase, I’m much less so. The now $1+ drop in share price since these financials dropped last week are starting to make a little more sense.

With that said the company had a quantum leap improvement in profitability from 2022 to 2023, so to expect them to replicate that was probably too much to ask. There is some expense to growth sometimes after all.

I wouldn’t call it a setback but at a 17 PE and 13x cash flows, they are probably trading around where they should be. With nearly 80% of their business taking place in the US, this is certainly one that has up until last week unaffected by tariff threats, if that’s part of the reason at all. Backlog numbers suggest another 20% revenue increase could be in the cards, but if expenses are going to continue grow at the same rate (or higher) than revenues, than I’m not sure I’m so interested at this valuation. Watchlist worthy, and if you’re long, watch for a buy zone just above $7.25 support. 3.5 stars.

Want your stock reviewed, or have an idea for my next scholastic series? Request via Substack DM or email me at thewolf@wolfofoakville.com

Paid Subscriber Benefits:

Priority Review Requests

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat. My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Wolf I Love how comprehensive your reviews are. Plus I really appreciate visual charts. I am a stock holder I like that they have that material peer reviewed for the hospital garmet this has a huge potential in revenue especially because it hasn't been factored in yet

Thanks for the review, Wolf.

I remember you writing about them in your WWW as you mentioned.

Sounds like a solid company, but can't see myself investing in them at the moment, given all the uncertainty.

But now that I know them a bit better, I'll keep an eye on them.