It’s been a long time. My only previous review of Geodrill was nearly two years ago in December of 2022. I kind of liked it then, giving it 3.5 stars, but never have held a position here.

The stock was trading around $2.10 back then so if you’ve held it since then it has delivered a 37% return. More significantly the stock is up about 90% from their YTD low back in February.

Can it continue it’s momentum or is it about to hit a wall near it’s five year highs?

Balance Sheet:

Unfortunately, we’re starting with one of the goofiest balance sheet formats which makes me feel like I’m reading it upside down. With that said, the overall current ratio is quite strong at 2.5 and that consists of $14.3M in cash, $39.4M in receivables, $35.1M worth of inventory and about $5.8M of other short term assets over top of $37.8M in liabilities due within the next year.

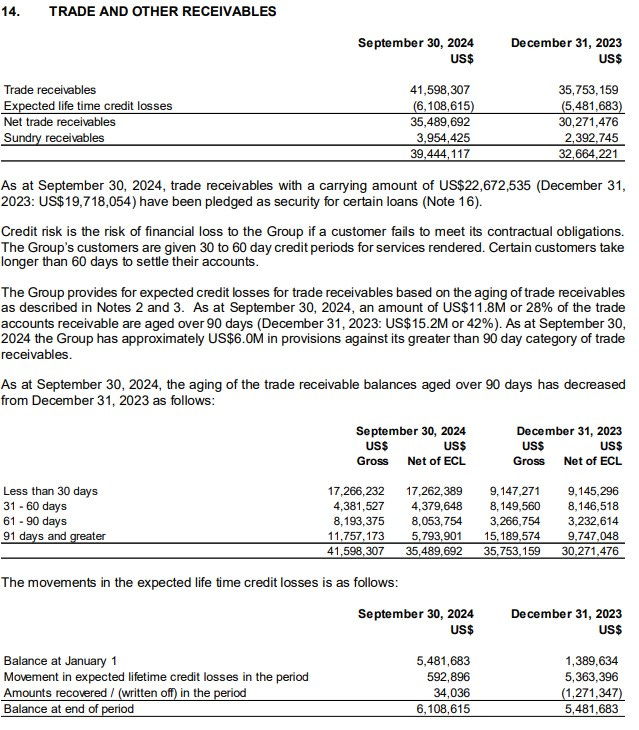

Inventory and receivables make up nearly 80% of their short term assets, but when I drill in it is the receivables that give me heartburn.

The aging report here is just terrible with just 41% of all receivables listed as less than 30 days (which I’ll assume is current) with a very concerning 28% greater than 90 days. Granted this is better than the 42% it was at the start of the year, but at the same time, their 60-90 went from 9% to 20% so now that these financials are six weeks from when they happened, they could very well be in the same boat.

The impact of that is over $6.1M of receivables are expected to or have been written off, and that number has only risen this year. This review might be over before it actually started. I’m sure I’ll discuss this more later, as it is sure to impact cash flows and eventually, their P&L. Geodrill has $10.8M worth of debt, $2.7M of which is long term. The bulk of these loans carry higher than average rates of between 9 - 9.9% including $4M drawn on their line of credit.

Cash Flow:

Geodrill has generated $12.3M in operational cash flow during the first three quarters, 75% better than what they achieved a year ago. The main variance to last year is from paying $4.3M in income taxes last year. This despite an $8M working capital bogey due to the increase in receivables.

The company has utilized nearly all of that OCF windfall through purchasing nearly $12M of assets, paid down their debt by a net of $1.2M and received $223k to the treasury from the exercise of options.

Overall their cash position has depleted by 8.5% from where they began their fiscal year.

Share Capital:

Decent sized float of 47.2M shares outstanding with little history of dilutive measures

4.7M shares reserved for options bringing the implied float to 51.9M

Large insider ownership of 41% and 25% institutional (Sustainable Capital who sold $1.15M of shares in August)

Some insider activity on the open market, but much has been to sell shares for proceeds to exercise options

Income Statement:

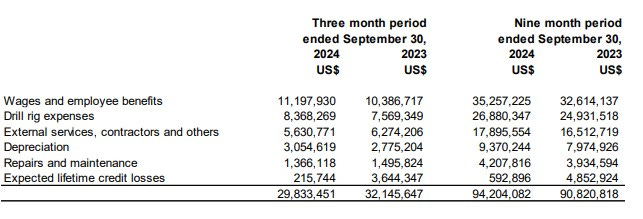

A nice performance on the top line in Q3 with $34.1M achieved, 12.5% above the $30.3M delivered in the same quarter last year bringing their YTD revenue number to $109.9M, 9.4% better than this stage in 2023. Their margin performance in the quarter is more impressive with a 520 basis point improvement in rate to 24.5%, so on the margin dollars line they improved by 44% on only 12% more revenue. Great conversion in the quarter but the YTD margin numbers are much more consistent, delivering 25.9% vs 25.6%.

The quarter also saw a dramatic improvement in their SG&A expenses, over $3.5M to be exact or 46.5% less that last year.

The difference in their expenses however are due to credit losses experienced last year, $3.6M in the quarter and $4.85M to be exact. Typical cash burning expenses in the quarter were actually up 3.3% which is actually still fantastic conversion.

The quarter overall looks outstanding with $2.6M in net income against a net loss of $3M in Q3 of last year and on a YTD basis, $9.6M of net income, 86% better than a year ago despite paying $1.7M more in taxes so far this year.

Overall:

An excellent quarter and would go as far as a “Wolf Trifecta” with excellent performance in revenue, margins and having conversion within their controllable spending.

While the quarter looks good to last year, it must be noted that on a QoQ basis, revenue is off by 17% from what they did in Q2 and is in fact their worst performing revenue month this fiscal year. Margins, again while look fantastic in the comparable quarter, were 700 basis points off what they did in Q2 which resulted in 46% less profitability QoQ.

Onto valuation evaluation and they are running at $19M in TTM revenue at a $135M market cap, so around a 1.5 MC/Sales ratio. On the same TTM basis, they achieved $11.3M in earnings giving them a P/E ratio of 12. Feels about proper given the lumpiness across the P&L.

Add in the fact that they wrote off $4.85M of receivables this year and the current state of their A/R looks like a dog’s breakfast, and it’s hard to suggest there is any huge upside at this price. The weakness of their A/R also causes inconsistent cash flows which means additional drawing on lines of credit, which causes higher interest costs, which causes decreased profitability.

Maybe if Rihanna was the Accounts Receivables manager I’d feel differently. Bitches would have her money.

As it is, too risky for me to touch here. 3.25 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Sustainable Capital's continuous selling is keeping the share price low, in my opinion. News of reinstating the dividend should cause this to breakout to the upside.