Happy Belly Food Group $HBFG.C (2023 POY)

Q2 2024 (3 / 5 stars)

If you’re a frequent reader, then you’re likely aware of the journey. In November of 2022, I upgraded Happy Belly to three stars when the stock was a sub $9M market cap, and trading at eight cents. A month later, it was chosen as one of my 2023 picks of the year at a dime. At a fifty three cent close yesterday, it is up 663% from that upgrade and 530% from that annual pick. I’ve held a position since both of those timeframes and have only added to it since.

I believe it’s been seven consecutive three star reviews since that November 2022 review. Now at a $67M market cap, expectations are clearly higher than what it was when it was $9M, so I’m not expecting to reward upgrade here yet. As they are in their early growth stage, the financial results are always going to lag their significant news flow. One important thing my readers should know is while two stocks may receive the same number of stars, that does not mean I feel they are equally “investable”. It’s more nuanced. With that, let’s review how their Q2 shook out.

Balance Sheet:

Current ratio is an an improving 1.5 that consists of $4.1M in cash, $563k in receivables and about $600k in other short term assets, against $3.5M worth of short term liabilities which include $2M in obligations to issue convertible debentures. With that $2M to be issued in stock, the balance sheet looks even better than the initial look from a cash flow perspective, noting that these are future dilutionary measures however. Happy Belly has a rather non substantial $280k worth of debt.

Cash Flow:

Operational cash burn through six months improved by 15% to $1.16M. While I was hoping to see this improve more than this, before working capital changes the improvement came in at 39%, with much of the gap coming from taxes receivable and other liabilities. YTD they have received $3.6M via debenture raises and options and warrant exercises which has overall improved their cash position by over 3x from the start of the year.

The latest debenture raise was a little out of the blue as their previous cash flow didn’t telegraph that a raise was needed but they took advantage of interest from a strategic investor with an above market raise and now should be cashed up for quite some time assuming they do not utilize that windfall for more acquisitions.

Share Capital:

126.7M shares outstanding, up nearly 15% since the start of the year as the dilutionary measures from the debentures and incentive options have started to take effect

27M share performance related warrants outstanding, 3M exercised in the quarter and 5.2M exercisable and ITM at twenty cents

3.9M options, all ITM

Per YF, an understated 12% insider ownership with a much larger percentage closely held

Regular insider buying from multiple members of the leadership group, many recent near current share price

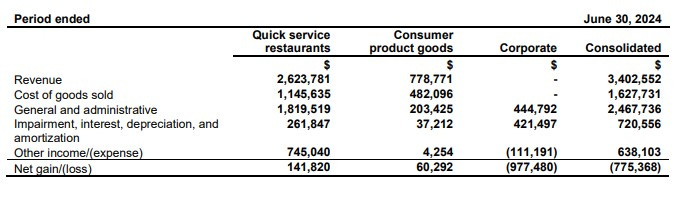

Income Statement:

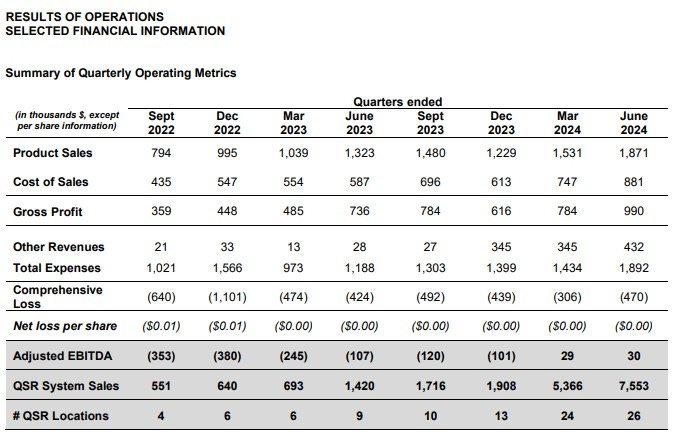

Product sales of $1.87M in the quarter, up from $1.32M in the comparable timeframe last year, and through six months $3.4M, compared to $2.36M, increases of 42% and 44% respectively. Gross profit has also improved YTD by about 50 basis points to 52.1%.

While it is mentioned within their press release, for the average investor, I don’t feel the company does a great job in their financial reporting outlining their total revenue performance and successes. I urge the CFO and leadership to add a total revenue line (or income before expense line) which would take the total gross profit number plus other revenues from franchise fees, royalties and services and list that total before expenses. As this company grows with more storefronts, this is what I will call where the “gravy” is to be made. With the relatively small number of units they have open today, that other income line was $776k vs $41k last year, and they have another 20 units scheduled to open before the end of the year which would nearly double what they have open today. The level of ongoing expenses on this other income should be relatively minimal as a percentage, and this will be their path towards profitability. So total revenues are actually $2.3M in the quarter, up 70% from a year ago.

Total expenses YTD came in at $3.33M, up 54% to last year, so I’ll be looking for more conversion here at year end as more of that “gravy” is added to the mix. That all translates to an improvement of 14% on the bottom line YTD but it should be noted that the quarter was a little worse than flat from increased finance costs and higher G&A expenses, partially driven by legal costs for acquisitions.

Overall:

I’m pretty pleased with the overall progress here. Both the QSR and CPG segments are profitable on a Net Income basis individually with the corporate side adding almost $1M worth of expenses. As you can see from my words on the other income lines, this could potentially be offset by year end with the near doubling of store fronts they have scheduled to open by year end. There doesn’t seem to be anything to ‘fix” here within the business in order to achieve profitability - as I have said for many quarters this will come with scale and that is beginning to take shape.

I also want to commend the company for the additional disclosure they have added to their MD&A. This will make it much easier for new investors to see where the company is today, and where it can potentially go in the future.

They have increased QSR system sales by 15x in a short period of time and in two quarters this metric could double again from going from 26 to 46 locations by year end.

Heal is by far the biggest contributor here so I’m looking for some more traction from other brands moving forward. If they could get a couple more brands to have the surge of recent success that Heal has had in terms of franchise signings, then look out.

Some may question the valuation here which is probably reasonable, but one has to factor in the incredible news cycle and the previously mentioned impact of other income - using a typical revenue multiple solely the top line would be a mistake here. Clearly with my substantial position one has to factor in my bias - something that I am always cognizant of as I always try to strike a balance in my reviews whether I hold a position or not.

For me, the accomplishments over the past year are four star plus. The financials haven’t quite caught up as previously warned and discussed, but I’m banking (literally) on the fact that they will. Three star FINS. Keep it going team.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email me at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I see everyone commenting in your discord about the Wall of stock on offer. Is it not possible/likely that it is in fact insiders selling down their ITM warrants . When do those 5.2mil warrants expire/ how many do you think have been exercised ? Cheers