Happy Belly Food Group ($HBFG.C) From the Archives

Q3 2022 - Originally published Nov 23, 2022

Gave them what I will refer to as a kind 2.5 stars for their Q2 results. Are things still trending up? (Full disclosure: I do own a position here as I like the long term potential)

Balance Sheet:

Extremely solid 3.7 current ratio with $1.65M in cash, $340k in A/R overtop of $590k in liabilities due over the next twelve months. The strengthening of the balance sheet QoQ is mainly due to the recent $2M debenture raise which now sits as it's main long term liability outside of a couple small CEBA and small business loans. The debenture isn't cheap at 12 points, but does convert at double the share price when it was entered into.

Cash Flows:

$1.2M of cash burn through nine months against $3.7M a year ago, and only $128k burned in Q3 alone somewhat aided by higher AR collections in the quarter. With these improvements would suggest they easily have 12+ months of cash runway here with the only risk for a near term raise likely being additional acquisitions.

Share Capital:

No real changes to the float since last covered. Previous review here: https://wolfofoakville.com/fins-reviews/f/plantco-happy-belly-food-group-vegnc-25-5-stars

What is both old and new is the relentless insider buying from Shawn, and newly added Sean has been right there regularly on the bid as well. It is extremely encouraging to see this much regular insider participation.

Income Statement:

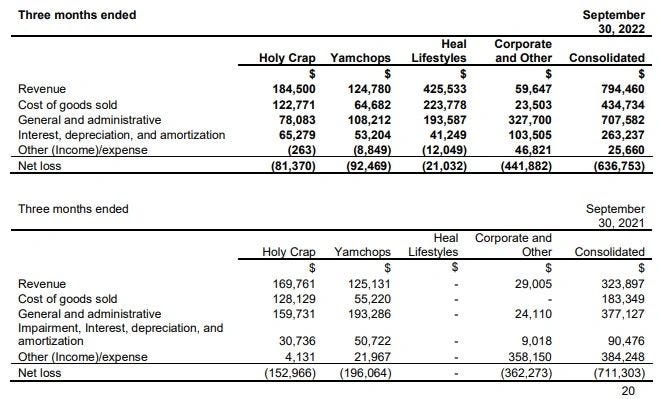

Excellent revenue move in the quarter, up 170% over last year with $794k, upping their YTD gains to nearly 90% to $1.74M. Big margin improvements in the quarter as well, gaining over 700 basis points to 45%. YTD numbers are on par with last year at 43%. Total expenses rose by 33%, which is nice conversion on a 170% revenue increase, but the additional GP dollars were not enough to offset them, so we have a similar operational loss in the quarter of $637k against $606k in Q3 of 2021. On a YTD basis their total losses are dramatically improved, even when the large impairments and stock based compensation is removed.

I really like the amount of disclosure in HBFG's financials statements, particularly when it comes to their segmented information, and I wish more small and micro caps did this as it gives investors a much better glimpse into the company. Kudos for that.

Overall:

The revenue star of the show is the non comp addition of their new Heal brand, contributing 53% of their total revenue in the quarter and close to break even, and most likely cash flow positive on it's own already. Post financials they added two more brands, Lettuce Love and Pirho (LOI), in what appear to be very financially attractive deals, and putting them in the hands and direction of well versed QSR SME's can only improve their performance throughout the P&L. If I have concerns, it's with their legacy brands. Yamchops down 11% YTD and losing 80 cents for every dollar of revenue. Much improved over last year but that's a big hill to climb. Maybe they cut bait with this one as the new QSR brands come online and grow? Holy Crap, which I'm a regular consumer of is faring better, up about 16% YTD, probably shows a lot more potential of the two, given the amount of new doors that have been added this year.

I think we're at two, 2.5 star reviews in a row. They have taken some very big strides forward this year. Upgrading to 3 stars on better financials and the potential of much better ones in the future, not to mention that $8-9M MC should be challenged big time in the next few quarters if these improvements continue.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.