I had a peek at these financials yesterday so I already have an idea of which path this is going to take. Sometimes I’m surprised by something once I get into the details so let’s see if this is any different. As a former Well Health shareholder, I’ve obviously been interested in this one from the start. This will now be my fourth review of Healwell. It has never gone particularly great, receiving a maximum of 1.5 stars.

Financials aside, the stock has performed very well on a YTD basis, growing by 148%, but down 12% from my latest review and down 44% from it’s high back in June. So if you’re a shareholder here you may be elated or pissed depending on when you made your entry. It is certainly on a very nice swing right now, up 66% in the last couple of weeks and closing up 2.26% after the release of these financials yesterday.

Let’s dig into the review. It consists of 43 pages and 35 notations.

Balance Sheet:

With deferred revenue removed, Healwell has a current ratio just bordering on acceptability of 1.05. That is made up of $15.2M in cash, $8.4M of receivables, $5.8M of prepaids, against $28.2M worth of liabilities that are due by Sept 30, 2025. Liquidity is not their strong suit right here with their current cash situation making up just more than half of their commitments over the next twelve months and this is before shelling out a few million in cash for a post financials acquisition.

Healwell’s balance sheet looked quite healthy just three months ago with a current ratio of 3.1, and now looks sketchy at best. Receivables have more than doubled since last quarter, but revenue has outperformed that and the company has never taken a credit loss, but it is notable they do not provide an aging report. Reliance of payment from government agencies is never a good thing for cash flows.

Healwell has $13.1M of debt, $5.9M of it long term, $7.8M in contingent consideration from acquisitions, $4.1M of it long term and $2.67M of debentures payable which bear 10% interest and are convertible at 20 cents a share with full warrants.

Cash Flow:

Healwell continues to be a cash burning pig, with $19.1M of operational cash flow burned through nine months, including $5.8M burned in the most recent quarter. YTD, they have utilized $15M through acquisitions and other investments and have raised a staggering $29.6M via private placements and warrants. Despite all of that influx of capital to the treasury, their cash position has depleted by over 20% from the beginning of their fiscal year.

Post financials, AIDX utilized $3.1M in acquiring controlling interest in a private Cdn corporation. That would reduce their cash balance to a little over $12M. At their current burn rate that would give them a maximum cash runway of about six months. Given much of their $7.9M in acquisition payables appear to be within six months, I would expect a raise much sooner than that, with the over/under probably around mid-March when they need to report their annual financials. If I was a betting man, and I am, I would take the under, particularly given the recent rise in share price.

Share Capital:

165.9M shares outstanding with a eye popping 308% dilution in the last twelve months and this isn’t slowing down anytime soon

40.4M shares outstanding, all currently ITM including 7.4M just fitting that criteria at $1.80

2.9M options, 2M ITM with the majority not expiring for four years at 69 cents

5.9M RSU/PSU and DSU’s outstanding in what can only be described as a self fellating Share Based Compensation program

Fully diluted float including ITM options and warrants takes it to 213.3M outstanding shares

Per yahoo finance, 36% insider ownership with no activity in the open market

Income Statement:

Healwell achieved $13.7M in the quarter vs $1.6M in the comparable quarter last year and on a YTD basis, $23.8M, 440% better than the $5.4M through nine months. The last year figures exclude discontinued operations of $6.4M in the comparable quarter and $24.5M YTD.

Gross profit for the quarter came in at 39.8%, considerably less than what they achieved in Q1 which was over 60%. The two new acquisitions at the beginning of the quarter having a major impact on their margin rate and based on the below chart, the major culprit appears to be Biopharma, although both if acquired at the beginning of the year would be significant losers on the bottom line.

$34.3M of operating expenses on $11.2M of gross profit dollars is absolutely horrendous and to make it worse, the vast majority of them are cash burning. Excluding one time items which includes big brothers (Well Health) debt forgiveness their net loss would amount to $24.8M through nine months. That’s losing $1.04 for every dollar in revenue generated. This is one horrific looking P&L.

Overall:

This stock is up 66% in the last two weeks and gained a few pennies yesterday? You have to be fucking kidding me, right?

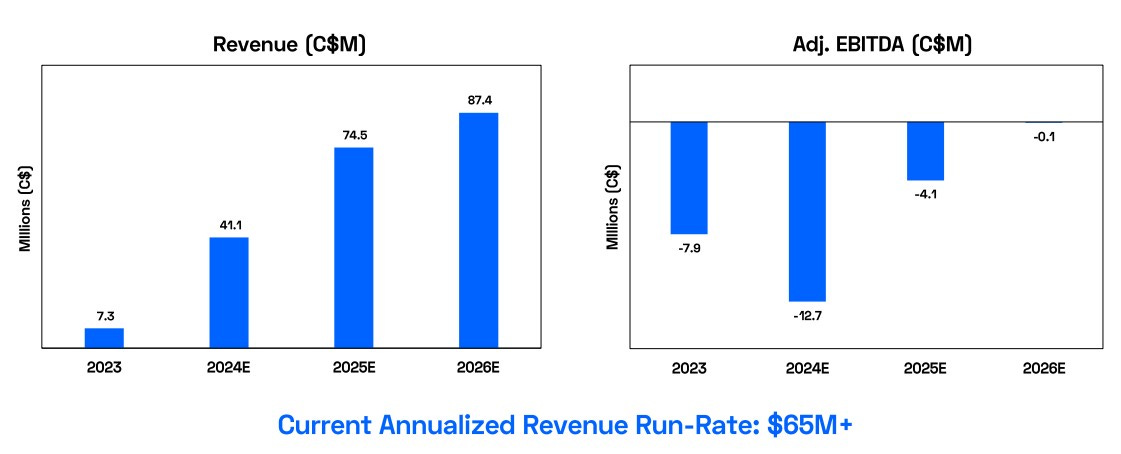

Even on an Adjusted EBITDA basis the company isn’t forecasting profitability until 2027 on $87M in revenues which means negative EPS for another two years plus. Extrapolating their revenues and net income through nine months, I have their break even point at around $83M, but that is assuming they don’t spend a penny more.

The Biopharma acquisition when announced was touted to drive $35-$40M in revenue with 10% EBITDA, but through nine months their contributions would have only been $16.5M in revenue with a $6.8M loss. Something doesn’t jive here unless more than 50% of their business typically comes in Q4.

Granted, the company will experience some acquisitions related expenses within these financials that they won’t in future, but not enough to account for $3 of operating expenses for every gross profit dollar they have generated YTD. And management thinks that type of performance is worth granting themselves $4.4M in share based compensation YTD.

I could continue to go on, but I don’t want to destroy my appetite for my soon to be served breakfast.

Depending on which site you use for a current share count, you will get wide variations in market cap figures from $300 - $360M. If you use the mid point of that you get 4x 2026 revenue projections for a company that isn’t within a sniff of profitability and doesn’t expect to be until at least 2027. Implied market cap with baked in dilution would be even higher.

In my last review I gave it an upgrade due to a perception of improved margins and potential improved profitability. Instead their margins went from 60% to 40% with these two new acquisitions and the biggest one (Biopharma) potentially missing their first year revenue projections by a big number.

I think the shorts are going to eat this one for lunch, and are currently licking their chops. But is a pump/raise currently in progress first?

Downgrade to one star. Where’s my breakfast?

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.