I have not been kind to this sector in most of my reviews, and for good reason. Most companies in this space have been absolute trash when it comes to producing results an investor would feel good about. I should qualify that - I mean smart investors. I’m more of a customer than an investor as nobody has come to the table quite yet with fundamentals good enough for me to pull the trigger to take one long.

I’ve turned down multiple requests to review HITI in the past but with an hour to go in my twitter poll, the majority have clearly spoken.

The stock has performed decently so far this year, up about 30% and nearly double it’s all time low. But when you look left the long term performance is vomit inducing like many in this sector, down over 80% from it’s highs. The Nasdaq move, with the aid of hindsight was also probably ill advised at the time as well.

But today is a new day and each new day presents opportunities. Does High Tide fit that description at a $240M (CAD) market cap? Let’s see.

Balance Sheet:

We start with a halfway decent current ratio of 1.3 that consists of $35.3M in cash, $29M worth of inventory, $2.6M in receivables and $8M of prepaids over top of $57.8M in liabilities due within the next year. Liquidity is decent with cash making up nearly half of their current assets and the company is very efficient in their use of inventory.

HITI has about $28M worth of debt, all showing as current between notes payable and a credit facility with First Connect. Almost half of the total relates back to a note with OCN that matures at the end of this year. Given the 15% interest rate I feel the goal here would be to extinguish that and get it off the books.

Overall we’re off to a good start.

Cash Flow:

$25.9M of operational cash flow YTD which is 135% more than they generated last year and nearly $2.9M of operational flow per month. That should really put to rest anyone who has concerns about their debt as they can cover than with ten months of OCF.

So far in their fiscal 2024 have utilized $7.6M in asset purchases, paid $3.1M towards their debt and raised a similar amount via their ATM program. Overall they have improved their cash position by 15% from the start of the year.

Share Capital:

Decent sized float of 80.45M shares outstanding, with 7% dilution this year, the bulk of which from settling convertible debentures.

4.9M warrants outstanding with a whopping 46.3M expiring unexercised this year. Current ones are just ITM but do not expire until mid 2027

3.1M options and 800k RSU’s

Per YF, 9% insider ownership and 10% held by tutes

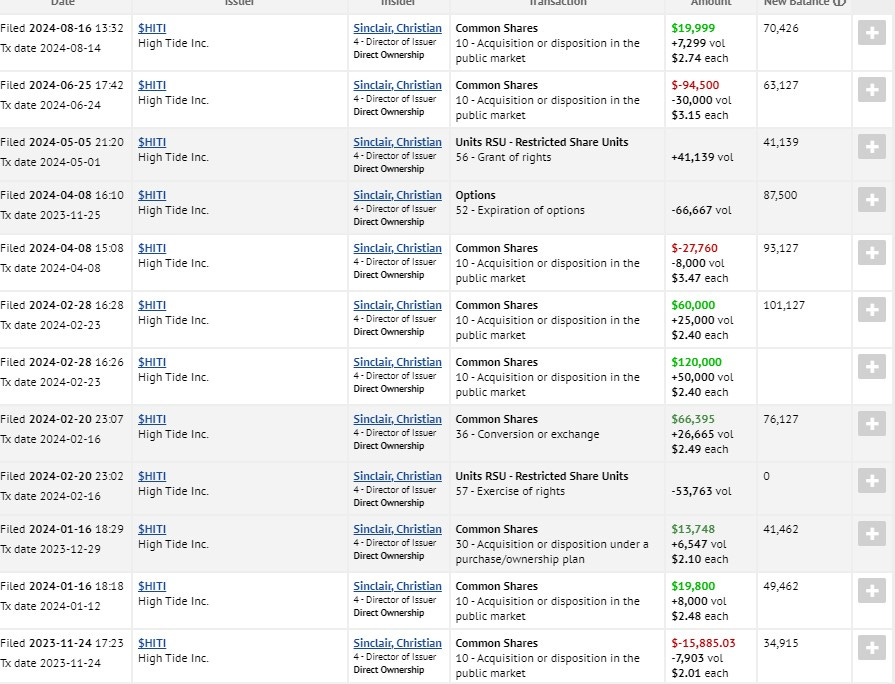

Not much insider activity on the open market except for a couple board members doing more selling than buying including this jerky. Swing trading a stock he’s on the BOD of. WTF Chief?

Income Statement:

A modest 5.8% increase in the quarter to $131.7M and now through three quarters of 2024 have delivered $384M, up 6.5% from the same time frame last year. Slight margin erosion of 90 basis point in the quarter down to 26.9% but on a YTD basis have improved by 60 basis points to 27.8%.

Total expenses are down 6.3% which on the surface appears like pretty good conversion on 6.5% growth but actual cash burning expenses actually rose slightly, still at a lower rate than their revenue increase however. After finance expenses, net income came in just shy of $1M YTD at $991k, which is over a $10M turnaround from the same point last year and the vast majority of that was delivered in this recent quarter.

Overall:

A pretty solid quarter and YTD performance compared to a year ago, but $384M on the top line is a hell of a lot of work to deliver just $991k on the net income line, which works out to just .25%.

As a former retailer, a lot of things about these guys impress me. They are excellent merchants. The sales per sq. ft. numbers are ones to drool over, they manage store inventory exceptionally well in terms of turns and shrink, and their market share is more than double their physical store footprint. Their stores are beautifully designed and merchandised - maybe too beautiful however and I’d like to see what they spend on leasehold improvements and fixturing. SSS increased by 1% in the quarter with the rest of the increase coming from new store locations. Shrinking ecommerce revenue is a little concerning.

So how do you properly put a valuation on HITI? They have surpassed a half billion revenue on a TTM basis and are only trading at about .5 Price/Sales. But as I mentioned, very little of that top line is translating to the bottom and ultimately that is what investors care about most. I like to use EV/EBITDA and they sit at under 7 which on the surface looks attractive. The problem there is it’s mostly ITDA and very little E.

I do like the opportunistic outlook though. A lot of poorly managed operations are starting to close shop, and they may have a better opportunity to capitalize when compared to their larger competitors whom are riddled with debt. But as long as their margins are around 28% and their opex is 27%, it will only be watchlist worthy for me. A semi-optimistic 3.25 stars. Too early for a wake n’ bake?

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.