My second review of Hydreight with my first back in June reviewing their Q1 results. I gave them two stars then and I also predicted it was probably my last look as I was rather unimpressed outside of the top line.

I suppose a chart like this would bring someone back and here I am via multiple requests via my Substack and TSA discord groups. Between that review in June and mid October, the stock really didn’t do a heck of a lot, performing much like you would expect two star financials to do.

For those interested, here is what I had to say about them back in June with a very unflattering summary.

They are nearly a 6 bagger since they dropped their second quarter rising from 20 cents to $1.18 at close yesterday. The big move didn’t really start until about six weeks ago, well before their Q3 financials. So what has changed and will I like them better than I did five months ago?

Balance Sheet:

The ugly balance sheet that I witnessed back in June still exists, even with contract liabilities removed. As of September 30, NURS had a current ratio of .68 that consisted of $1.2M in cash, $115k in receivables and approximately $200k in other short term assets against $2.28M in short term liability commitments due within the next twelve months. We’re dealing with pretty small numbers overall and nothing stands out as a major concern except for the fact their current liquidity does not meet their short term accounts payable commitments. So that’s not great.

The company’s only debt is $800k due to their parent, Victory Square Technologies (VST) in a non-interest bearing loan.

Cash Flow:

Hydreight has generated $386k of operational cash flow through nine months, almost an $800k turnaround from a year ago when their burn rate through three quarters sat at nearly $400k. This is also after burning $160k in Q1, so in the two quarters since have generated $560k via operations. Feels like a pretty big milestone for the company moving to a positive OCF generating company.

In addition, they utilized $837k buying an intangible asset and for some reason advances $68k to a related party so far in 2024. So despite turning to OCF positive YTD, their cash position has depleted by 32% since the start of the year.

The question here is the current OCF generation enough to offset the liquidity gap in their balance sheet. It looks tight, which made it even more puzzling when the company announced a NCIB program to buy back shares last month. Post financials, they have only bought back 18,500 shares at 40 cents (have yet to hit SEDI filings), and with the share price where it is today, I’d be surprised to see them continue to utilize it here.

The company prides itself on not raising capital since going public in Dec of 2022. I don’t see why they wouldn’t raise 5M shares at a buck right now, it feels like it would be irresponsible to not at least have that discussion, right?

Share Capital:

40.3M shares outstanding, 5% dilution this year all coming through free RSU’s awarded to insiders

613k ITM options all expiring in July and August of next years. None awarded in 2024.

1.7M RSU’s outstanding in an unusual 15% Omnibus SBC plan

Approximately 70% insider ownership with VST holding approx 26.8M of the 40.3M float.

With that many tightly held shares there is probably only a maximum of 10M available to trade on a daily basis, giving a perfect recipe for the recent huge run

Income Statement:

Total revenues came in at $4.5M, a 47% increase on what they were able to achieve at this stage in 2023, $3.09M. That is very consistent with their YTD trend delivering $12M in total revenue against $8.1M last year. Due to the segmented revenue shift to Pharmacy sales which only carry a goal of 20% gross margin, the overall margin has taken a hit and it was even more significant this past quarter than their YTD trend. Q3 margin came in at 33.9%, 720 basis points off last year while YTD came in at 36%, 560 basis points worse than 2023. So while revenue has grown consistently at 47% this year, they only capitalized on bringing 21% more margin dollars in Q3, and 27% YTD.

What they lacked in margin performance they have made up for in converting within their operating expenses, which decreased by 6.9% in Q3 and 7.2% YTD. Actual cash burning expenses (SBC, Amortization and Depreciation removed) have decreased by 2.1%, so overall pretty successful despite the margin erosion.

The biggest variances within their expenses is from professional and consulting fees and all of that savings from amounts paid to related parties. Their accounts payable due to related parties has increased however so it makes me wonder how much of this expense savings may just be deferred and have a hit to the P&L later.

That didn’t quite get them to breakeven with a $90k loss in the quarter and 81% improvement in their loss in the comparable quarter brining their YTD losses to $426k, a 60% improvement year over year.

Overall:

While these results are certainly a step up from what I looked at two quarters ago, it’s not justifying a 5x improvement in share price since then.

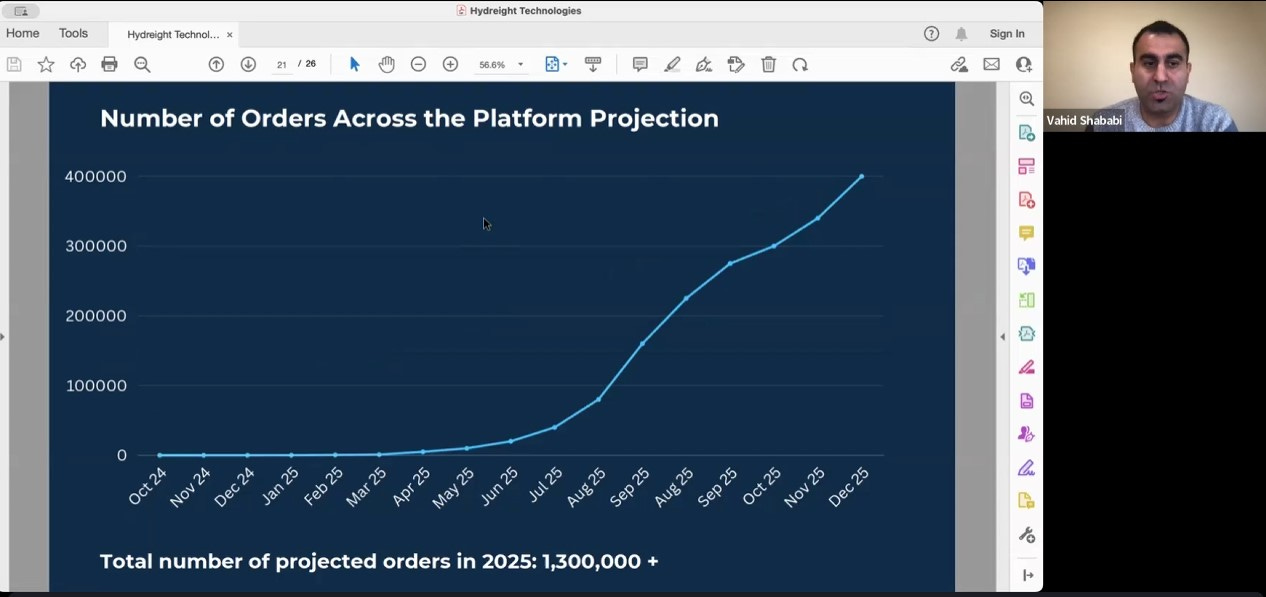

What is primarily behind the significant rise in share price is their new segment, VSDHOne, and hype surrounding it. This is aimed at entrepreneurs in the health care sector who can provide a wide range of services under the platform itself. It’s a very intriguing business and unique business model. It’s available across the entire USA and have signed 300 licenses early on and anticipate this number could be 1000 by the end of 2025. Revenue will be derived from a monthly license fee and a cut of what that licensee sells. There were some pretty staggering numbers thrown about in a webinar hosted by the Investing Whisperer last week. The host, Keith did a really good job on pushing back and asking very detailed questions on the new program , it’s potential and potential metrics from the model. I did not watch it in it’s entirety as it was way too long for my attention span but I think I skipped through and caught the main points, particularly on VSDHOne. I urge anyone interested in learning more about Hydreight to give it a watch. Link below.

It pains me to say it, but we are really looking at almost an irrelevant FINS review here. It immediately turns into a DD play based on your confidence on what they can deliver in the future, and maybe more so than any stock I have looked at in a long time.

I don’t like the VST relationship due to the number of dogs they have given us in the past. I don’t like all the intertwined related party, incestuous transactions and relationships this company has, nor their 15% SBC plan. I also don’t buy anything on a 5x heater over six weeks, particularly with this kind of a float. But I will be monitoring the chart and their progress. Could be a hell of a 2025 story if the company’s semi-vague projections come to fruition. Upgrading to three stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

So...a small position on a pullback then