Hydreight Technologies ($NURS.V) FINS Review (from the Archives)

Q1 2024 *Originally posted June 2024

First look through a request via the TSA discord. Got through their investor deck first and think I have a decent understanding of what they do. Market reacted somewhat positively to their financials released a couple weeks ago but has since pulled back and has pretty much traded in the 20 to 40 cent range for the last eight months but well off the eighty cent range it was at a little over a year ago. The ticker is a well thought out one, but the company name seems like a big miss marketing wise.

Balance Sheet:

A pretty ugly current ratio of under .6 and that is even after removing contract liabilities. They ended Q1 with $1.34M in cash, and a couple hundred thousand made up of various small amounts of current assets against $2.7M of liabilities due within the next twelve months. While Hydreight is debt free, it currently only has half the cash needed to meet it's one year obligations of $1.9M of accounts payable and $810k due to related parties. The companies parent is Victory Square Technologies and this is where the related party liability is due. These amounts are non interest bearing and should likely be the last to be paid out when the company is in a better financial position. But even with these removed, the company is still $600k shy for their A/P over the next year. Will their cash flow make this look any better?

Cash Flow:

Sadly, the answer to the above is no. NURS burned $160k of cash during their first quarter compared to burning $184 in the same quarter a year ago. For a relatively young company, burning a little more than $50k a month isn't overly concerning. The problem is their balance sheet looks like ass, and at this rate I do not see how they could make it through their 2024 fiscal year without raising capital through some means. They also invested $200k through VSDH (see note 6) and loaned $34k to a potential acquisition target. Not sure what a company with the state of the balance sheet it has is doing providing loans, as small as it is. Overall, their cash position depleted by 25% during the quarter.

Share Capital:

Pretty lean share count with 38.9M shares outstanding with very minimal dilution over the past five quarters

613k options outstanding with about half in and the other half just out of the money

3.7M RSU's outstanding including 3.23M awarded in just 2023, which is 8.3% of the float. Can't say I'm a huge fan of their incentive plan which allows the company to award up to approx 15% of dilutionary measures through a wide range of options, PSU, RSU, DSU and SAR's. All while unprofitable and cash burning.

VST owns approx 2/3rd with minimal insider ownership outside of that. None of them buying anything on the open market

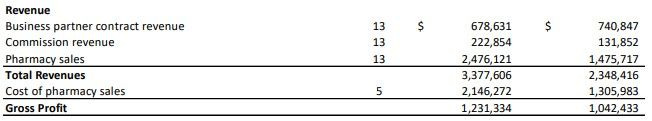

Income Statement:

Top line looks extremely good with $3.38M of revenues against $2.35M, an increase of 44%. Their gross profit rate however eroded by 800 basis points from 44.4% down to 36.4%. This is due to all of their revenue increase coming from pharmacy sales which deliver much thinner margins. So on 44% more revenues, only delivered 18% more in gross profit dollars.

Total expenses rose by a troubling 36%, from $1.14M to $1.55M which is terrible conversion when you only delivered 18% additional gross profit dollars. That will translate to a bigger net loss which actually tripled to $300k vs $100k in Q1 of last year. When you look at the individual expense buckets the story doesn't get any better with Wages and Labour, their largest expense bucket doubling and their G&A expenses rising by 42%. A good chunk of their professional and consulting fees also goes back to insiders.

Overall:

Despite the 44% revenue increase, these results just stink. Eroding margins, poorly controlled expenses and an incestuous looking relationships with insiders and VST is a major turnoff including outstanding advances to the CEO, fees expensed to other organizations with insider relationships and a equity incentive plan which IMO looks unfavorable to retail. All brought to you by Victory Square Technologies which has laid multiple other turds on the Venture including FANS and Turnium. My first and probably last look. Two stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.