iFabric ($IFA.TO) FINS Review (from the archives

Q1 2024 (3.25 / 5 stars) *Originally posted June 2024

Intended to review their annuals about six weeks ago but didn't like the fact that the company did not restate their financials for a comparable 12 month vs 12 month look. Multiple discord and email requests to take another look so here we go.

Balance Sheet:

We start out with a very strong current ratio of over six with $3.5M in cash, $6.6M in receivables and $8.85M worth of inventory and a handful of other short term assets against just $3.25M worth of liabilities due over the next twelve months. The near $4M write off for an aging receivable dating back to 2020 is a massive eyesore sadly, and even though they won an arbitration case to get this deposit back, you would have to think them seeing these funds again out of China are extremely slim. Given this, I find it very disturbing that the company does not provide an aging report on the rest of their accounts receivables. Let's face it, prepaying $2.9M USD during the height of Covid was a boner of a move, so do me a favour and provide an aging report so I can properly gauge your A/R. Inventory turnover improved with a slight uplift in revenue on 7% less inventory. No significant amount of debt to speak of here but they do have a $6.75M facility available at a strong prime +.75%. Never like to see amounts due from related parties and while the amount is small ($48k), the company treasury should not be treated as a bank to loan executives money to buy a house. This should have been paid back by May 7th, but it is not noted within subsequent items.

Cash Flow:

$1.06M generated from operating activities during their first quarter against burning $900k a year ago. Much of this difference is within working capital changes, collecting better on receivables and less inventory purchases. While a good number, I'm going to suggest it's not quite as good as it looks, just as last years burn wasn't as bad as it looked. Nothing significant within the rest of the cash flow statement so overall the company more than doubled it's cash position during Q1.

Share Capital:

Nice tight float of 30.3M shares outstanding with just 475k shares of dilution over the past 15 months from options

1.03M options, all currently out of the money, not including the 600k options awarded post financials under their 10% SBC plan

2/3rds insider ownership, which would make the available float on a daily basis somewhere around 10M shares making it prime candidate for big swings

Some small insider buying previously this year under $1/share

Income Statement:

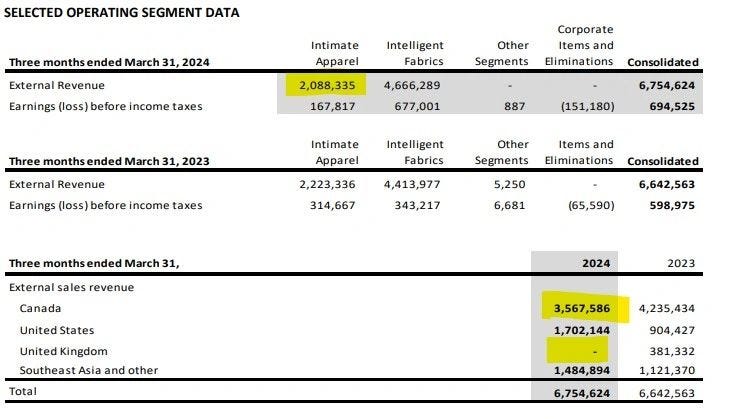

$6.75M of revenue generated in Q1, slightly up by 2% over the $6.64M from the same quarter last year. iFabric experienced a 380 basis point gain in gross profit rate to 43.8% turning the modest 2% revenue increase into a much more impressive 11% gain in gross profit dollars. G&A costs were well controlled increasing by the same rate of revenue while selling costs increased by 9.5% which cuts into those gross profit gains. Bottom line earnings before taxes were up an impressive 16% to $694k vs $598k last year.

Overall:

A pretty solid quarter and solid looking company overall but nothing in here is really getting my juices flowing making me think I need to go out and slap the ask personally.

I have some concerns with some of their segmented data as well. While their intelligent fabrics business had a nice increase, their intimate apparel business was down 6.5%. Their Canadian business was down 15.7% and was non existent in the UK after having nearly $400k of revenue in the same quarter last year. This raises some concerns and the MD&A doesn't tell me any commentary that I couldn't figure out on my own. Why is it down and what are you doing to mitigate is what I want to see here and they didn't tell me anything. Maybe this was raised by the company in another format, but I quite frankly don't have the time to search and this is what the MD&A is for.

At a $24M TTM revenue figure with $1.5M of EBITDA during the same timeframe puts it at about a 1.55 MC/Rev multiple and a rather pricey 24 EV/EBITDA ratio. You'd have to grow at a much better rate than 2% to get my attention at that kind of multiple. While the company has some potentially exciting catalysts in the future, it looks like it's already trading with those baked in here. Meh. Decent looking company with good financials but the minimal growth this quarter, the valuation, and lack of commentary that would alleviate some of my concerns comes with some slight deductions. 3.25 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.