I’ve had people suggest to me in the past that financials and fundamentals do not play much of a part in microcaps. To those feeble minded investors, I present to you exhibit A, the chart for Imaflex.

Two massive sustained jumps in share price this year both occurring after their first and second quarter results with the stock pretty close to doubling in value since their Q1 was released back at the end of May. I reviewed their Q2 and rewarded them a handsome 3.5 stars, and the stock is up 28% since then. It has cooled off and stabilized since and the market reaction to their Q3 was rather muted although it did attract much more than the average volume in this rather illiquid play. I hold no position. Let’s dig into their Q3.

Balance Sheet:

A very good current ratio of 2.85 that consists of $3.7M in cash, $16.2M of receivables $13M worth of inventory and about a million in other short term assets against $11.9M in liability commitments due over the next year. If feels like I have been saying this in a lot of reviews lately, but while the current ratio is very good I would not make the same statement regarding their liquidity. Their cash position makes up less than 11% of their current assets with receivables and inventory making up 86%.

Imaflex has written off large amounts of receivables in the past, and their A/R growth is outpacing growth in revenues. I’ve mentioned my disappointment in the past with the lack of A/R aging reports in their financials, and once again they have disappointingly not disclosed it. IFX has no long term debt but does a $12M line of credit at attractive terms.

Cash Flow:

Very solid operational cash flow results with $9.09M generated so far YTD, including over $5M in Q3 alone (Q2 $6M, Q1 burned $2M). This is nearly a 300% improvement over the $2.34M they generated through nine months last year.

Imaflex has utilized $2.9M in asset purchases YTD, reduced debt by $4M and received $3M from lease agreements. Overall they have significantly improved their cash position from where they started the year but liquidity still isn’t what I would call a strength.

Share Capital:

No significant changes from last quarter. If interested, here’s what I had to say then:

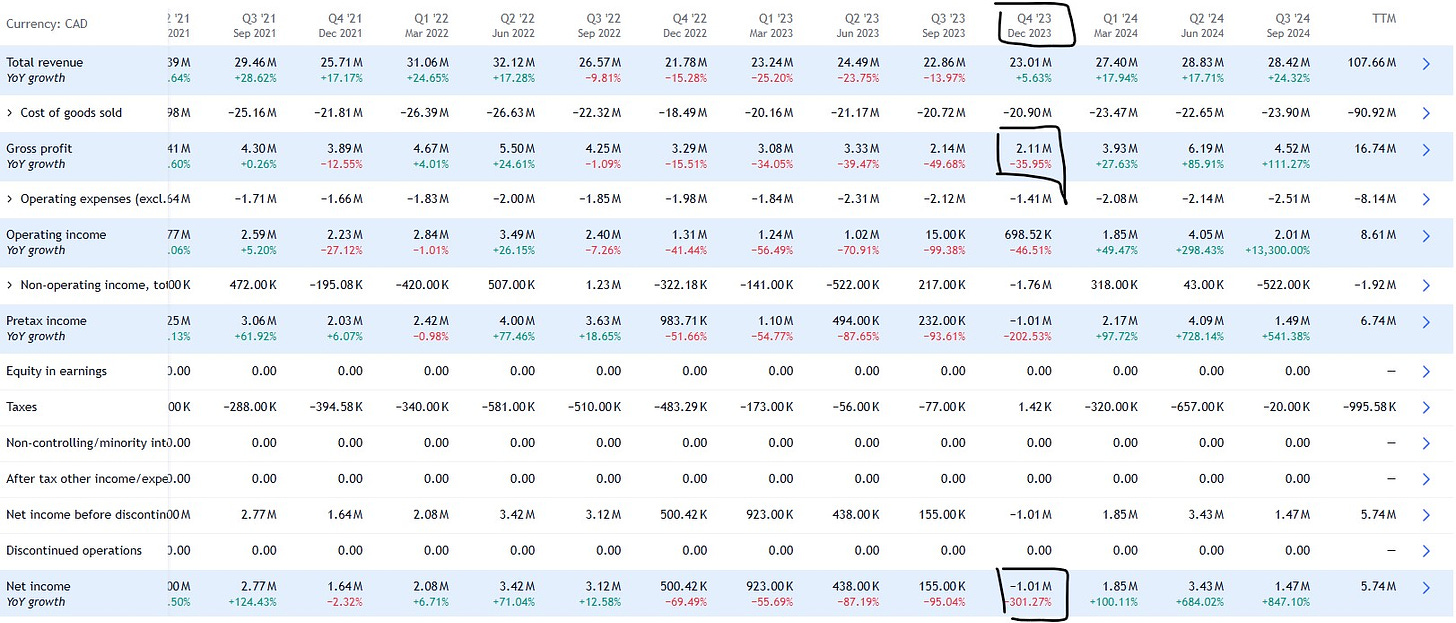

Income Statement:

Another solid quarter on the top line generating $28.4M in Q3, up 24.3% against the comparable quarter. This brings their YTD to $84.7M, up 20% through nine months. Q3 was basically flat compared to Q2. Gross profit is probably a bigger story and for Imaflex this is a very good sign as quite honestly last year their margin was very unattractive. Their gross profit rate in Q3 came in at 16.2%, miles ahead of the 9.1% a year ago. YTD that now sits at 17.6%, 560 basis points better than 2023. In terms of GP dollars, they produced 121% more gross profit dollars than last year on 24% more revenue which is very eye popping.

Expenses on the other hand were up by 69% on 24% more revenue which is not great conversion although that does include an $800k bogey in foreign exchange. Their largest bucket of administrative expenses grew by 31%. Even with that, due in most part to improvements in gross profit, they nearly 10x’d their net income from last year at $1.46M vs $155k. Through three quarters they have achieved net income of $6.75M, a 345% improvement over 2023’s $1.51M.

Overall:

2024 has been quite the turnaround story here for Imaflex. They’ve grown revenues, dramatically improved margins, profitability and eliminated debt.

The company has the benefit of one more soft quarter when they report Q4 but after that they will be up against these three most recent solid consecutive quarters. Since their growth hasn’t come on a QoQ basis over the last two the question will be what can they do for an encore. If we project similar improvements in Q4 then their total 2024 would come in around $113M with $9M in net income which would give them valuation ratios of a MC/Sales of under .7 and a P/E of 8.4, so there is probably still a little bit of value left here. How much will depend on what they can indeed do to top these last three quarters.

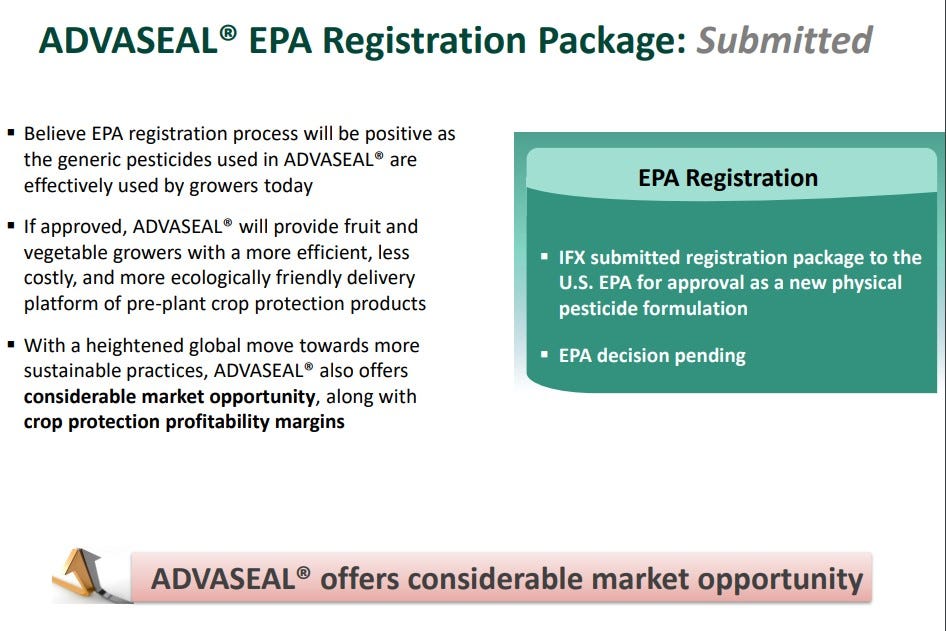

Their Advaseal product currently awaiting word from the EPA could be their next catalyst if approved. One would have to think an administration change may slow this down, but also perhaps more receptive.

Don’t think I’m a buyer right here but certainly worthy enough to maintain it on my watchlist and a continuation of a 3.5 star rating.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.