Only one review in the past for Imaflex that dates all the way back to Christmas of 2022. I gave them a rather favourable review of three stars, but the stock has seen some tremendous overall volatility dipping to a low of 70 cents just a few months ago, but doubling since and having a tremendous run since releasing these latest financials.

The financials actually caught my eye that morning which caused me to say this in the TSA discord that morning:

That turned out to be an understatement as the stock rose 24% on the day and is on a 100% run since the end of April. But all that just brings it back to a very similar market cap to when I reviewed them about twenty months ago, in that $75M range.

Let’s dive into their quarter and see how they’ve progressed since my last look.

Balance Sheet:

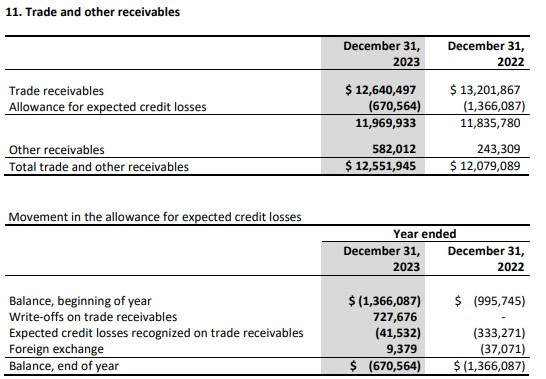

A very good current ratio of 2.8 which consists of $700k in cash, $16M of receivables, $13.4M worth of inventory and about $1.7M of other short term assets over top of $11.3M of short term liabilities due within the next year. While the ratio itself is good, liquidity is not with just 6% of their current assets in cash with over 50% in A/R which is up by 27% since the start of their fiscal year. Disappointingly, Imaflex does not provide A/R aging - something which I mentioned in my old review back in 2022. Even with their annual reporting, disclosure relating to their accounts receivables is a little lackluster.

Last year they wrote off nearly three quarters of a million dollars in receivables. In a business with thin margins like we have here that is pretty significant, and on a $93M business like they had last year those write offs were greater than their annual net income in 2023. So the lack of continuous disclosure of receivables aging is a bit of a yellow flag for me. Rightly or wrongly, if you’ve had some issues in the past and are not disclosing details to help me gauge risk, I’m going to assume you’re not for a reason.

The company has two small loans at a low fixed rate totaling $560k which is down 57% from where their debt started at the beginning of the year.

Cash Flow:

Operational cash flow in the quarter was excellent with $6.07M in OCF generated, compared to burning $1.8M in the same quarter last year. This comes after a rather poor showing in Q1 with operational burn of $2M which was highly impacted by working capital changes and the majority of that with, you guessed it, increases in accounts receivables.

YTD those working capital adjustments are still hurting their overall cash flow, but even with that have generated $4.08M in OCF, 145% better than the $1.66M achieved last year. They also utilized $2M in asset purchases, paid down their net debt and overall sit with a very similar cash position from where they started the year.

Share Capital:

Nice sized float of 52.1M shares outstanding and the company has a history of minimal dilution

1.08M options outstanding. With the recent rise in share price all are currently in the money

Per yahoo finance, 45% insider and 10% institutional ownership and sadly the only activity on the open market has been some continuous selling by their CEO

Income Statement:

Impressive top line in the quarter with a 17.7% revenue increase to $28.8M and that extends through YTD with a 17.8% increase to $56.2M compared to $47.7M from last year through two quarters. Their gross profit which is historically pretty thin jumped by 850 basis points in the quarter to 21.8%, and now sits at 18.3% YTD, up 470 basis points. That big jump in the quarter increased their gross profit dollars by 88% on a 18% top line increase, which is absolutely incredible. Their two main expense buckets, Selling, and Administrative costs were a combined 3.4% less than last year. Take on a $600k birdie to last year in foreign exchange and their income before taxes grew by over 8x to $4.1M, up from $494k. YTD that same profitability line is $6.25M, nearly 4x better than the $1.59M they produced a year ago.

Overall:

Their last two quarters have really blown away anything in recent memory, driven not only by the top line, but with significant margin growth while maintaining the same level of operating expenses which have all combined to drive significantly higher profitability.

How sustainable are these improved metrics is the question, and with a bit of DD it appears that is possible, but the proof will be in the pudding. They will be soon going through a CEO transition with the long time leader and founder moving to the executive chairman role.

I’m also seeing some opportunity within the valuation as well although the manufacturing industry is likely not going to see the same multiples you would see in other sectors. They are sitting at $102M TTM revenue giving them a .75 MC/Revenue multiple with high EBITDA returns and an EV/EBITDA of under 7.5.

Over the past eighteen months they have invested rather heavily n capex spending to increase capacity and provide greater margin opportunities, and they did this while virtually eliminating debt through positive cash flow. I think an entry in the April to July timeframe was an excellent mid term. An EPA approval on their newest product for which they have already received patents for could be a needle mover also.

Added to my watchlist. Give me a dip. 3.5 stars.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.