Importance of Well Health's Upcoming Q2 & Q3 Results

Organic growth and efficiencies needed after a pretty successful roll-up

Bull. Bear. Long. Swing trader. I’ve been all of them when it comes to Well Health Technologies over the past several years. I do hold a position currently, but I’m not sure how I would define the strength of my conviction today. “It depends and varies”, would be the best way to describe it right now. On what you ask? How the next couple of quarters shake out, particularly the upcoming Q2 which we should see in a couple of weeks.

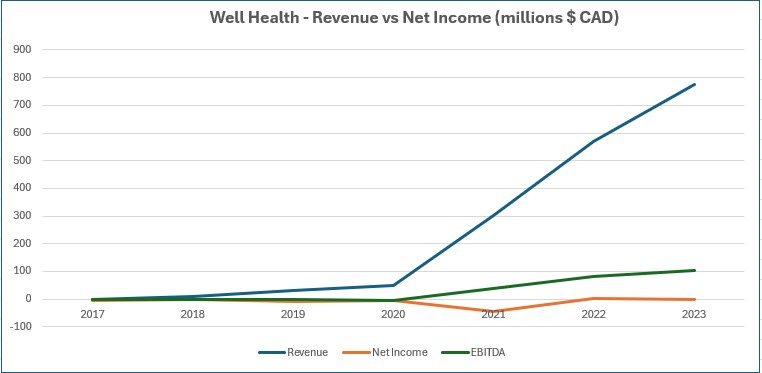

Well Health has been 50 bagger over the past decade. They did $414k in revenue in 2017 (as a Yoga apparel company) and have a very decent chance of eclipsing the $1B mark in 2024. Since 2018 the company completed well over 30 different acquisitions during their roll-up phase amassing over $1.4B in assets, three quarters of which are made up of goodwill or intangible assets. Typically a rollup story such as this, even more so during covid, you would see companies taking massive write downs within a year or two of making this many acquisitions. To their credit, Well Health has not.

ITDA’snt Matter to Me:

Even though the stock has made some decent strides in the past couple of months, it is well off of it’s pandemic high of near $10 and about a dollar off of it’s most recent high in May of 2023. The $4.80 range it’s been in recently has it at about a $1.2B market cap, or 1.2x 2024 revenue estimates. Some feel that is very cheap, but I’m not so sure.

I’ve said this numerous times (not just relating to Well) but the easy part of a roll-up story is the first part - acquiring the actual businesses. As mentioned earlier, Well has done a much better job at this than most. The next part becomes much tougher however - executing on synergies, getting more efficient and ultimately driving better EPS and a return to your shareholders.

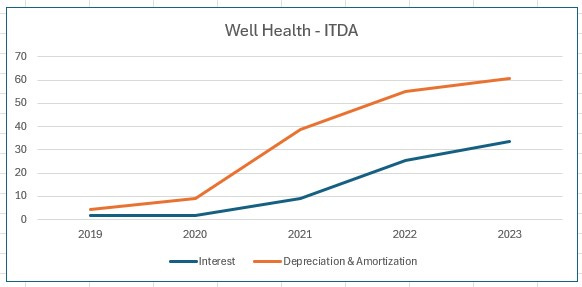

They haven’t been able to do that just yet. The argument could be made that they have been able to grow their EBITDA in recent years from next to nothing to $102M last year. The problem with that is all of that EBITDA is the ITDA with virtually no E. They produced $0.00 EPS last year, a cent worse than 2022.

I do recognize these efficiencies and synergies do not happen overnight and I concede that could be viewed as overly harsh, or expecting too much, too soon. But I so believe the honeymoon period will be over soon in the view of many investors. The period of seeing significant double or even triple digit gains in revenue we have been expecting each time financial statements are released are about to slow down as inorganic growth has slowed due to a lack of significant acquisitions. Will mid single digit top line growth with continued break even earnings be enough once they get to Q4 and are facing matching off revenues of near a quarter billion dollars? I think not.

Concerns:

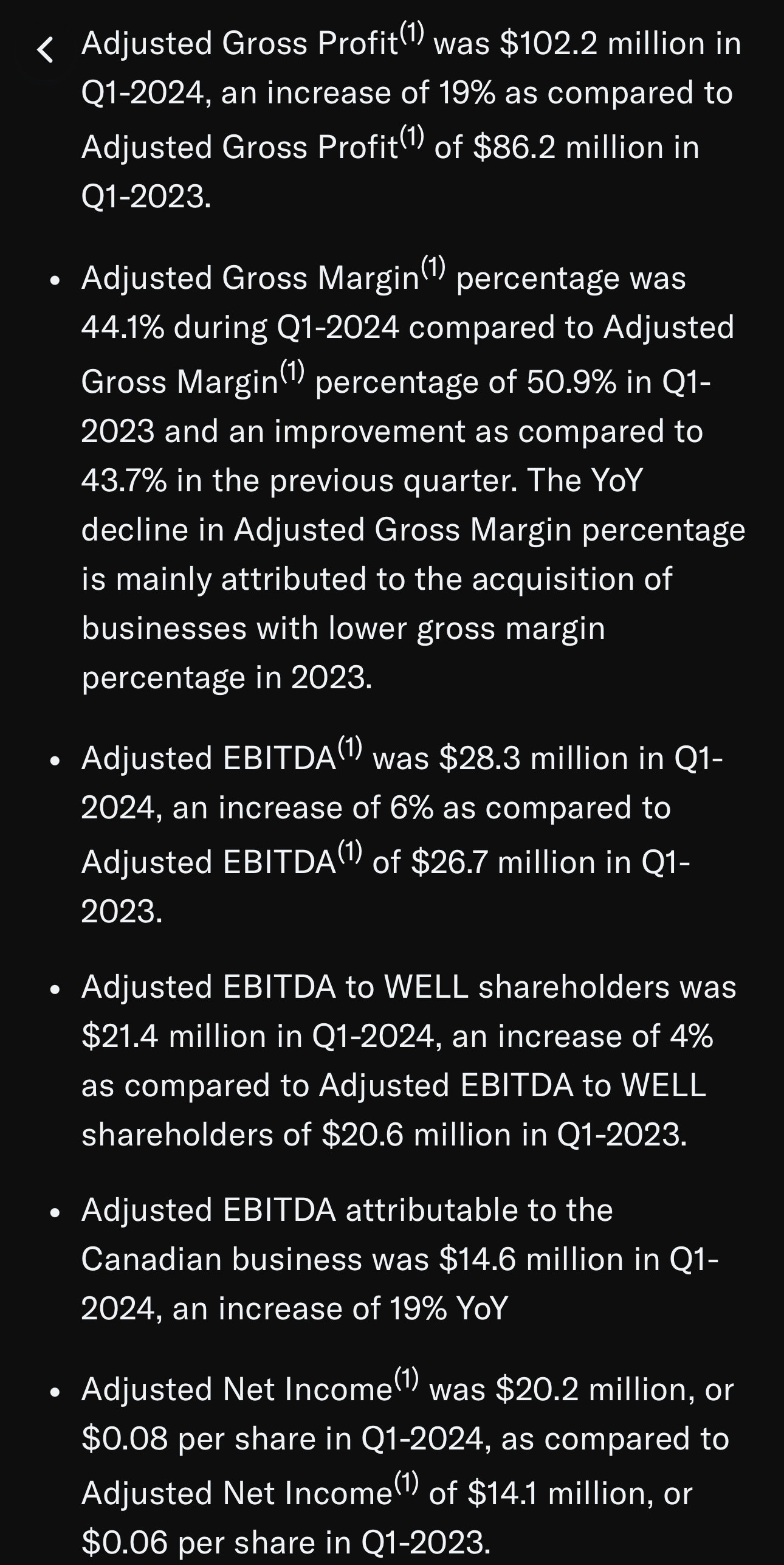

The new mix within their businesses has had a significant negative impact on their overall margin. In their most recent quarter it slipped by 670 basis points. That amounts to $67M to make up for elsewhere on a one billion dollar business. They did find some savings within their general and admin spending which came in at 31% of revenue vs 33% a year ago, but when you couple that with the margin, their operating income was less than $100k better on $62M more on the top line - very disappointing conversion.

Management is very good at what I’ll call “Powerpoint sleight of hand”. This shouldn’t be viewed as derogatory as it may sound. I recognize it when I see it as I was pretty good at it myself in the boardroom. PPT sleight of hand involves the massaging of metrics, setting targets for yourself where the results are pretty much baked in, and sandbagging guidance.

As you can see, there isn’t an adjusted number that Well Health doesn’t like. They’re not the first or only ones to discuss Adjusted numbers in their results, but they are better than most. Overall these adjusted numbers are pretty meaningless and astute investors know to look beyond them.

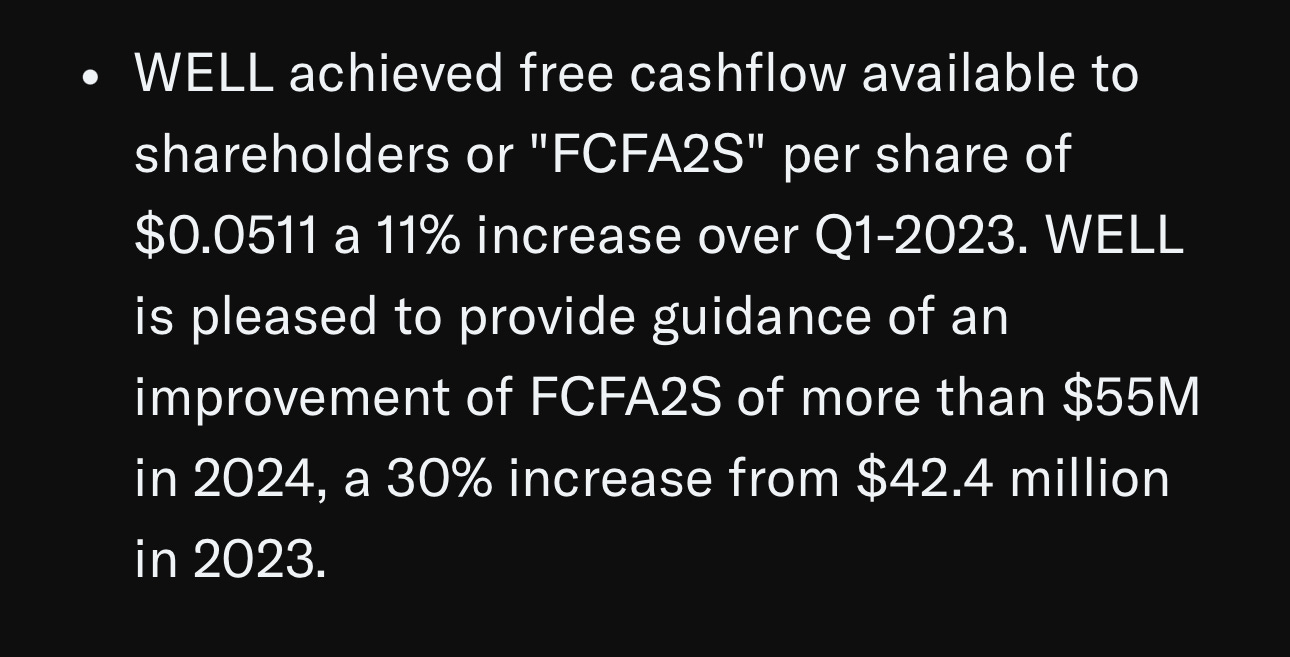

The best example of a baked in target is their usage of free cash (flow per share. Don’t get me wrong, I love free cash flow, but the company spent $66M on acquisitions and almost another $10M in deferred acquisition costs in 2023. There is $14.5M in deferred acquisition costs scheduled to hit the books in 2024 so assuming there are no acquisitions they already have an approximate $61M FCF birdie to work with in 2024. So how impressive is their goal to improve it by $55M? What would impress me more is if they had improvement targets on OCF, a more reflective measure for how they run the business on a day to day basis and a measure they have underperformed on.

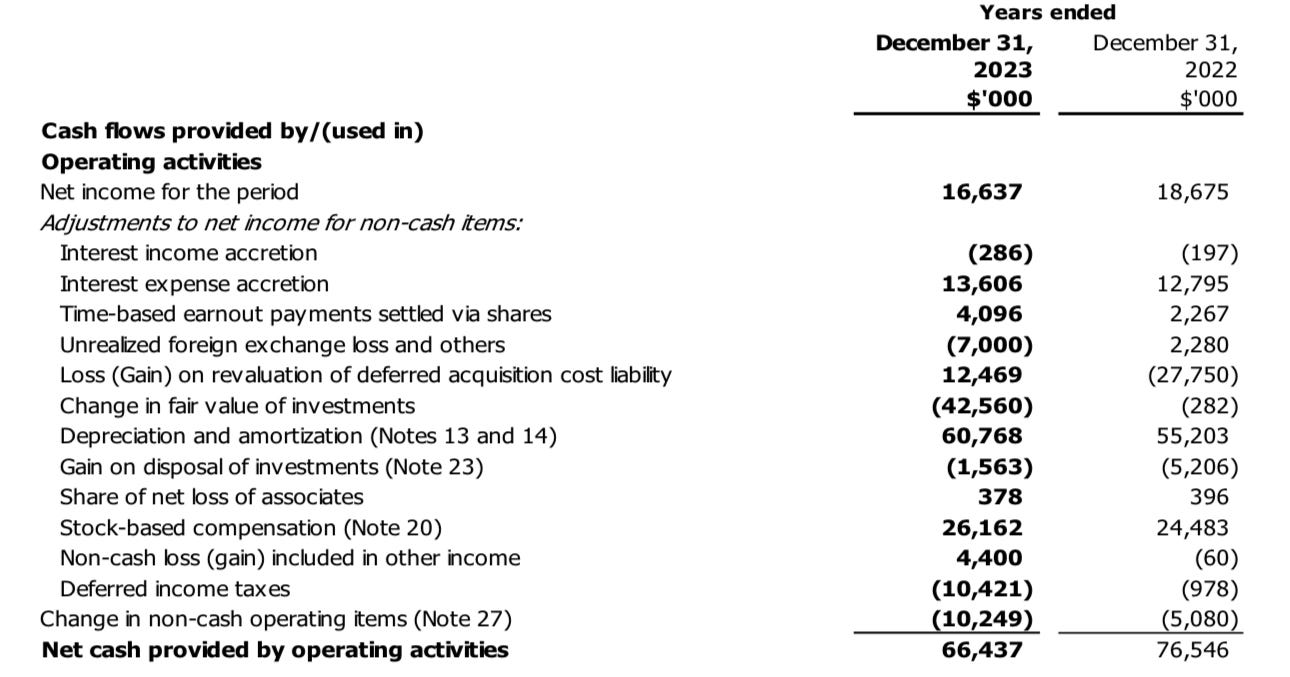

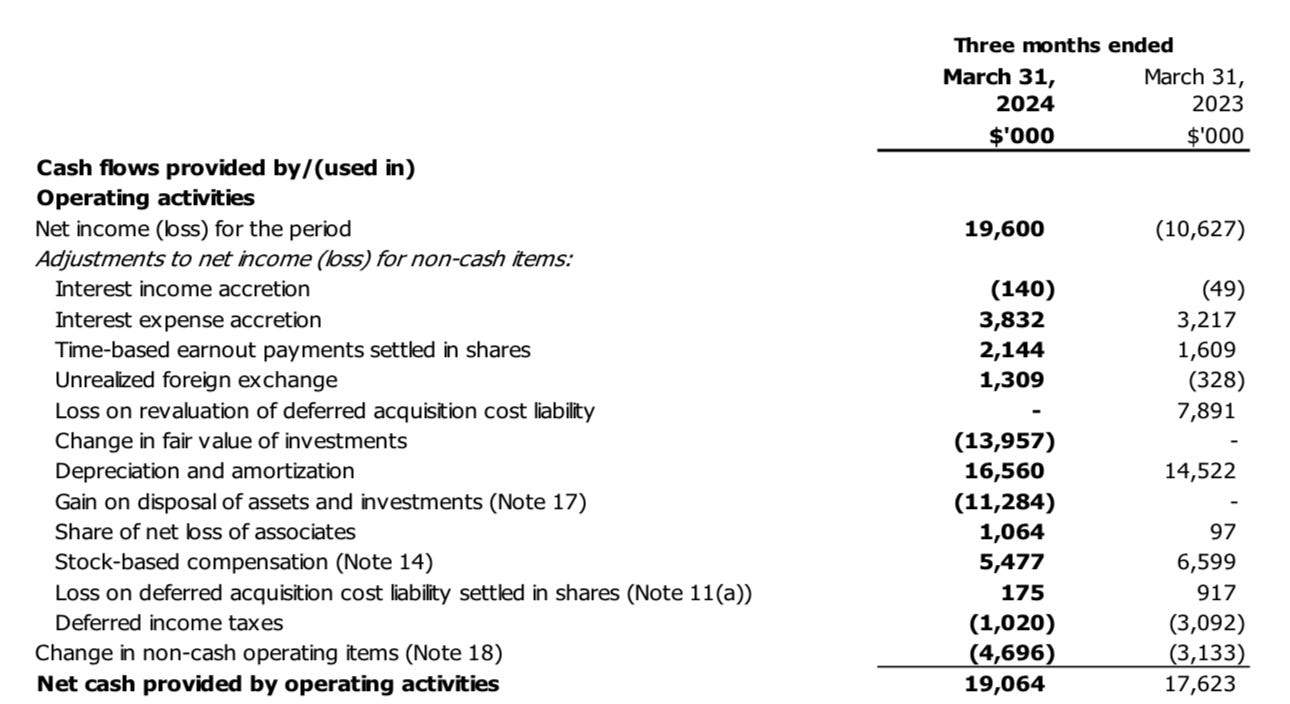

Operational cash flow decreased by $10M or 13% in 2023 on a revenue increase of $217M. It improved in Q1 of this year by 8%, on 37% more revenue. FCF also does not take into account what happens with their debt or NCIB.

Their FCFA2S target is PPT sleight of hand.

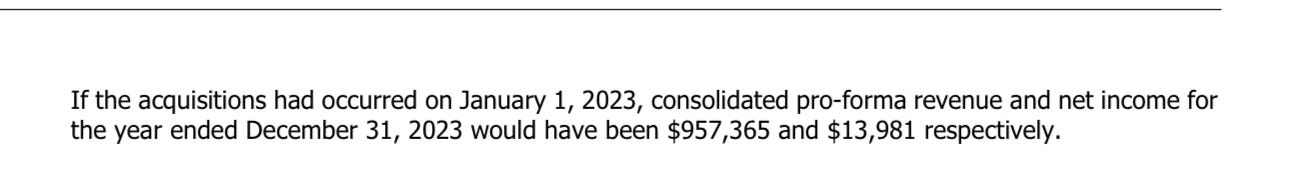

Perhaps a missed line in their annual financial statements was if all of their acquisitions were in place for the full year, revenue would have been $957M. They just increased guidance after Q1 to $960 - $980M. The low end of that range would amount to virtually zero organic growth. Anything less than one billion on the top line in 2024 is a disappointment, and I would look for them to increase guidance during the year to get a nice news moment out of it. Sandbagging.

I don’t hate the game, but I know how it’s played.

Lastly is the overwhelming impact that Healwell AI has had on their business since acquiring it at the end of October last year. The share price appreciation has had a bigger impact, and more profitable to Well than their own $1B business.

Healwell positively impacted their net income by over $67M over the last two quarters with a rise in price from the 60 cent range to 93 cents. The problem is once you strip out AIDX’s number from their 2023 annuals, Well Health goes from profitable to unprofitable on the Net Income line. Next will be the impact in Q2 with the share price closing at $2.53 at the end of June. That will be enormous, potentially $125M in my estimation, and will create massive headlines regarding record profitability. I believe some of this is already baked into the recent gains that Well Health has had. On the two days that AIDX went from $2.29 to $3.26, Well went from $3.65 to $4.05 and that has only continued to grow. The question is what do Well’s financial numbers look like this time with HealWell AI removed? If it looks similar to the last couple of quarters I predict their quarterly results will be sell the news event.

Don’t get me wrong, I don’t dislike HealWell AI, what they do or what they can eventually accomplish. I simply believe they are overvalued while also showing an understated market cap due to future dilutionary measures. My fears have always been on the negative impact a slide in AIDX’s share price could have in the back half of the year, and those look like they could be coming to fruition with HealWell’s stock down 41% from it’s high, and 50 cents less than where they ended Q2. If a 30 cent or so improvement had a $67M positive impact to Well’s financials, you can do the math on what a 50 cent or more decline would do.

There is a wildcard and that is the strategic alternatives that are ongoing which could impact two segments of Well Health’s business in a number of ways and that could happen before year end. Should that occur, I’ll opine with another verbose piece. For now, all eyes (at least mine) are on the next two quarters. Don’t let me down.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.