My first (and only) review of INX came back in June after their Q1 results. Was a mixed three star review with some margin concerns but also noted some potential value.

The stock was absolutely violated after their Q2 results (not reviewed), but their Q3 released last Thursday sent the stock soaring by 43%, and at one point touched a two year high.

Time to dive in to see if we can explain all of this volatility and perhaps what the future might hold.

Balance Sheet:

Intouch has a good current ratio of almost two (1.95) which is made up of $900k in cash, $4.7M in receivables and about $350k in other short term assets on top of $3M of liabilities due within the next twelve months.

While the ratio is strong, liquidity may not be with their current cash position only able to offset 30% of their 12 month liability commitments, giving more importance to swift collection of their receivables which account for nearly 80% of their current assets.

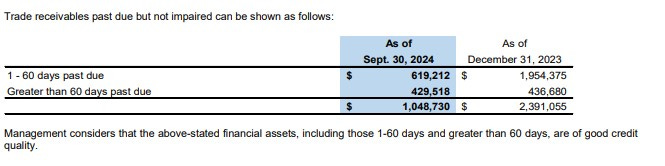

They have cleaned up their aging report quite a bit from the beginning of the year and as of quarter end do not anticipate taking an substantial write offs stating they deem overdue accounts to be of “good credit quality”. I deem quality credit as a customer who pays their bills on time but that’s just me. Nevertheless, it is much improved from where it was. Investors should monitor progress at their year end financials.

The company has about $2.35M of debt, with $1.75M of it long term made up of promissory notes and long term bank loan. The company also has $280k remaining in consideration payable from previous acquisitions.

Cash Flow:

INX has produced nearly $1.2M in operational cash flow so far in 2024, compared to burning over $400k a year ago. The variances within the quarter are even more dramatic with $384k in OCF vs burning $1.7M mainly resulting from working capital adjustments. So 2024 appears to be a transformative year for the company moving on from a cash burner to a cash flow generator.

The company paid down principal, interest payments and contingent considerations of nearly $1.2M which offset their OCF therefore their cash position remains relatively unchanged from the start of 2024.

Share Capital:

Tight float of 25.5M shares with virtually zero dilution in the past two years. No real changes from my last review which you can read below.

Income Statement:

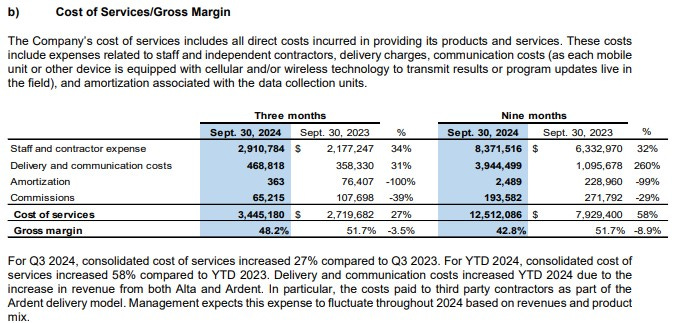

Top line of $6.66M, and 18% increase over last years quarter, and YTD now stands at $21.86M, 33% greater than last year through nine months. Those increases have come at the expense of some gross margin rate however with the quarter down 350 basis points to last year at 48.2% and their YTD number much worse in comparison to 2023, down 900 basis points to 42.7%. So on a 33% top line increase, only delivered 10% more in gross margin dollars.

Total operating expenses were up 7% in the quarter and 8% on the year. While they are getting great conversion on the top line, it’s muted due to the margin erosion.

With that said, income from operating activities is up 42% in Q3 and up 50% YTD. Due to the some big one time gains on gains in the valuation of their contingency consideration, their net income is up 159% in the quarter and 357% YTD. This is not a normalized Net Income that investors can get used to however.

Overall:

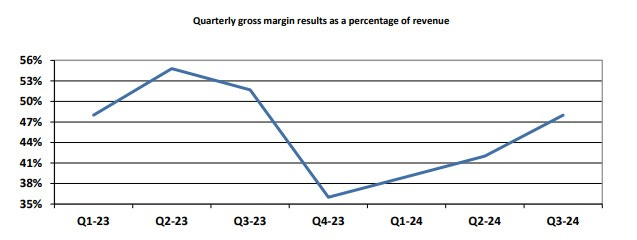

I want to like these guys and I do, but I can’t figure out how much. Recurring revenue outpaced total revenue yet margin eroded by 350 basis points and the lumpy margin makes it difficult to project what I think they could potentially be valued at.

The MD&A commentary clearly shows the delivery and communication costs had a tremendous impact on margin, almost quadrupling. When you have a 900 basis point variance and management says they expect it to continue to fluctuate, it is not exactly comforting and the chart below gives me nightmares.

Due to the well managed float, the stock is pretty illiquid. The benefits are you may get a big dip opportunity and it could turn into a runner on great news or results. The downsize is when you want to get out the liquidity might not be there.

Despite the margin issue the financials do look better, but they are not nearly as good as the net income line shows due to the impact of one time items. I’m upgrading them slightly but still need more information on where they think they are going so it remains on the watchlist for now. 3.25 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.