First review of these guys per a request out of the TSA discord. I do recall this name popping up during the pandemic days. Stock is slightly up since their Q1 financials and just broke out of a downward 18 month trend, so technically it might be in an interesting spot here.

Their opening statement on their homepage is as follows, "Intouch Insight is a customer experience (CX) solutions company specializing in helping multi-location businesses achieve operational excellence so they can earn customers for life." The terms "Operational Excellence" and "Customers for life". give me flashbacks from my retail days in the 90's so it feels a little dated to be honest, but those could just be my career scars talking,

Let's evaluate their recent financials.

Balance Sheet:

Decent current ratio of 1.5 that is made up of $563k in cash, $5.55M worth of receivables with a sprinkling of a some other small current assets against $4.25M of liabilities due over the next year. A/R stands out here as it makes up 85% of their current assets, and when you dig in some concerns arise with 42% of it overdue. They are only booking $11k as anticipated credit losses and did speak to this in their annual financials as being from customers with good credit. This alleviates concerns somewhat, but companies with good credit also pay their bills on time so this is something to review quarterly as it negatively impacts their cash flows and liquidity. They have $120k in short term borrowings within a $3M facility at 8.2% and $2.6M of debt via promissory notes and a long term bank loan.

Cash Flow:

$504k of operational cash flow during Q1, about $300k less than what they achieved in the same quarter a year ago, but last year was heavily assisted by working capital adjustments so not overly concerned about the decline. They paid down $650k of debt and $118 of financing costs so overall their cash position depleted by 37% during Q1.

Share Capital:

Very tight share cap here with 25.5M shares outstanding and virtually no dilution over the past five quarters

2.4M options outstanding with about half currently ITM

Per the May 24 Investor Deck - 30% insider ownership

Some small insider buying in the open market in Q4 of last year, and one insider sold 120k of shares in Feb

Income Statement:

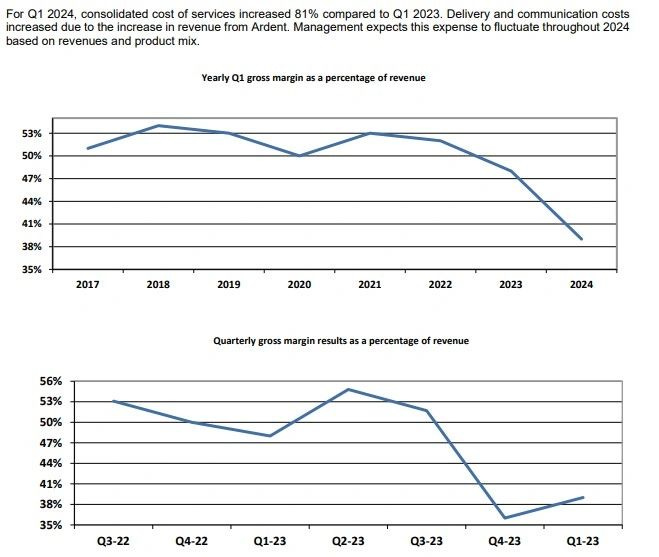

Strong top line growth to $7.85M in the first quarter against $5.1M last year for an increase of 54%. That came at the expense of a big reduction in gross margin rate however losing over 900 basis points from 48.2% to 39.1%, so on 54% more business only took 25% to the gross margin line. Under 40% is pretty thin for a software company, and this is after seeing their margin decline from 50.7% to 46.2% during their full fiscal year in 2023. The attached chart from their MD&A is quite concerning and they're not providing me with any rationale that makes me feel better about it.

Total operating expenses were only up by 8.6% on 54% more revenue so they converted pretty well there with relatively flat selling costs with the increases coming from G&A and product development.

At the bottom their net earnings before taxes came in at a little better than break even at $70k vs a loss of $184k in Q1 of last year, a turnaround of $270k on $2.75M more in revenue which I would classify as ok at best.

Overall:

So a strong float which brings along some illiquidity with an average daily volume of 12k shares, they have some growth and are reducing their debt. There may even be some slight value here with only an $11M market cap with $32M in revenue on a TTM basis and a EV/EBITDA ratio of slightly under 10. But I'm not sure I can personally get over this margin erosion. I'd need to feel better about that before contemplating making a move here and nothing within their investor deck, nor the MD&A addresses this to my liking. Watchlist worthy perhaps. An initial three star grade from me.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.