I have quite the history with this one, as this will be my ninth published review. The first came in November of 2022 where I gave it 3.5 stars. I made my initial entry around the $2.50 mark, and shortly thereafter picked KITS as one of my 2023 picks of the year. With the $10 close as of yesterday, that’s a four bagger. I’m also a customer as I sit writing this donning a pair of their glasses. My wife thinks they make me look like the old guy from the movie “Up”, so I continue to wear them just to annoy her.

They received an upgrade a year ago at this time to 3.75 stars when the stock was around $5.

After doubling once again in late summer, I started seriously questioning the valuation and began thinking about an exit strategy. Then on September 6th, with the announcement of the $11M insider block trade (which turned into $13M), I decided it was time to cash in on my windfall, selling off about 80% of my position.

Financials are out this morning as well as a change to their board. Let’s see how they did.

Balance Sheet:

Current ratio comes in at 1.45 (deferred revenue removed) and consists of $19.1M in cash, $2M in receivables and $17.1M worth of inventory against $26.8M of liabilities due over the next twelve months. That current ratio is about bang on to where it was last time we looked with a slight reduction in cash and an $800k increase in inventory. KITS has $5.5M worth of debt, $2.3M long term plus a $2.15M promissory note.

Cash Flow:

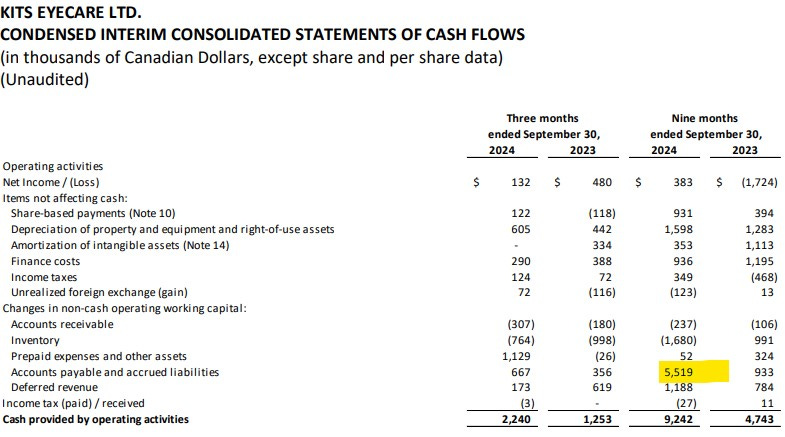

The company generated $9.2M in operational cash flow compared to $4.7M a year ago through three quarters, a 95% improvement. But is it really that good?

I’m going to suggest it is not due to the working capital adjustments, particularly around the adjustments in accounts payable which has grown from $16M from the beginning of the year to the $22.5M at the end of September. Once they start paying down those bills, this should balance out somewhat.

After paying down $2.8M in debt and investing $2.06M worth of equipment, they have still been able to improve their cash position by 22% through three quarters of their fiscal year.

Share Capital:

31.5M shares outstanding in a very attractive, well managed small float. Less than 1% dilution over two years from RSU’s and options

2.7M options outstanding, all well ITM

With the late September news, insider ownership has changed fairly substantially from where we have seen it with multiple insiders cashing in on that late September block trade. I don’t think any of the websites have an accurate insider percentage and I’m too lazy to try and calculate it.

Income Statement:

Another banger on the top line for the first time smashing through their first $40M+ quarter coming in at $41.9M, a 34% increase in Q3 which is even better than how they were trending for their first two quarters. Their YTD number now sits at $114.5M, 28.9% better than at this stage last year.

That additional revenue came at the expense on margin with gross profit taking a slight hit, off of last year by 130 basis points to 32.9%. YTD now sits at 32.6%, 80 basis points less than a year ago.

KITS converted pretty well on their controllable expenses which grew by 24.5% across their three major spending buckets, Fulfillment, up 15%, Marketing, up 32% and G&A, up 27%, all coming in at a lower rate than their revenue increase. Unfortunately, they took a massive hit on foreign exchange, about a $1.25M turnaround from a year ago. That one line killed all of the goodness above it with their total Net Income coming in at just $132k vs $480k last year, a decrease of 73%. YTD Net Income is better at $383k vs a $1.7M loss.

Overall:

The exchange bogey is a massive kick in the junk for KITS on an otherwise pretty stellar quarter. That bottom line number of only $383k on over $114.5M makes it really hard for me (or anyone) to justify a $300M+ market cap. The P/E ratio on extrapolated profitability is north of 600! As much as I like the company and what they have done, a lot more has to translate to the bottom line to justify this valuation. Insiders appear to have made a wise decision cashing in when the going was good. I know I’m feeling damn good about following their lead.

Have to downgrade a half point here to 3.25 stars due to the FX hit and current valuation.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Like the company, management, and they keep executing. Valuation can make sense if long term they can keep the 25-35% growth and keep expenses within reason. Another hold and add on weakness. Problem is in the microcap space there are a lot of “cheap” companies with similar growth opportunities.

Any chance of an update on Biorem? Solid report.