Back to back reviews of one of my annual picks but this one from 2024.

As of yesterday’s close, up 140% from my pick of the year selection (one of five), and those two rectangular areas on the chart are buy zones that I highlighted that turned out to be fairly fruitful to anyone who acted (yes I did but they didn’t stay there to acquire as much as I had hoped) . Their Q1 FINS were upgraded to 3 1/4 stars - a much improved company from the initial two stars I awarded it back in August of 2021. Interestingly it was about the same price then as it was when I made it one of my 2024 picks - once again proving that often you can wait for fundamentals to improve.

The market initially enjoyed the financials once released earlier this week with somewhat of a pullback on Friday. Let’s dive in and see if I am in agreement.

Balance Sheet:

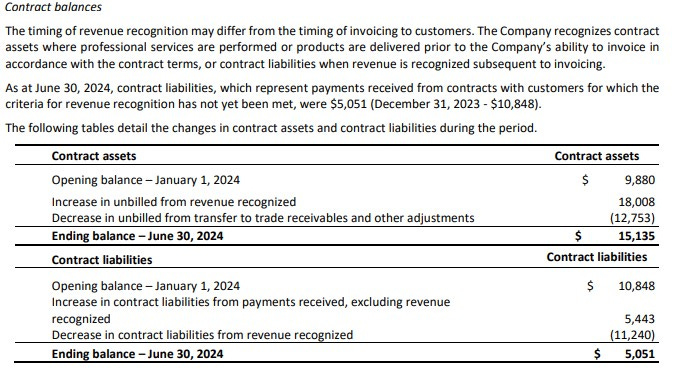

A greatly improved current ratio of 2.7, up from 1.2 last quarter strengthened by the $20M raise in May. They now sit with $20.4M in cash, $7.4M in receivables, $15.1M of contract assets and $17.8M worth of inventory against $23.9M of short term liabilities due over the next year. Sadly once again aging of their receivables are no where to be found but 49%, down from 72% are due from two customers. Kraken has $16.2M worth of debt which is 50% more than they had at the beginning of the year mainly through drawing $14.7M on their $35M credit facility. That’s quite a curious number considering they also raised $20M of cash in the last six months also. Perhaps the cash flow statement will help us understand that better.

Cash Flow:

On the surface, quite a disturbing reversal with $6.6M of operational cash burn through six months compared to generating operational cash flow of $7.6M, over a $14M turnaround going the wrong way. What gives here?

Unfortunately, as I pointed out last quarter, the company does a pretty disappointing job within their cash flow statement disclosure.

As you can see, there is over a $20M negative turnaround within their working capital changes. With almost every company I have ever reviewed, you will typically see a number beside this line which translates to a note further down in the financial statements that breaks this down for you. For whatever reason Kraken does not and I can’t tell you how unusual that is. This has prompted me to inquire with the company into the rationale for this and to consider that inclusion in future reports.

Typically, large amounts you will see in working capital adjustments are for variances in accounts receivables, payables or inventory. If a company has a great revenue quarter but much of that business comes at the end of the quarter, they will show receivables growth for cash they have not received, which temporarily negatively impacts their operational cash flow.

For company’s with more complex revenue recognition, like Kraken, large variances can occur within their contract assets and liabilities. In the screenshot above you can see that they recognized $18M of revenue for which the client has not been billed so far this year and decreased their liabilities for revenue they did recognize by $11.2M. The large gap from where they started the year is the main difference for the negative looking operational cash flow.

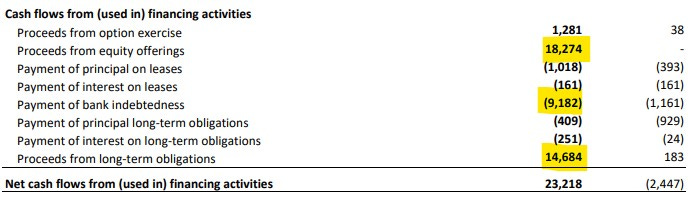

A question you may have next is “Is this good or bad”? My answer would be that it may be just the nature of the business to see these wild fluctuations in cash flow. However, the negative part is that temporary lack of incoming cash could cause a company to dip into a line of credit, thereby incurring financing costs, or force the company into a raise which may not be necessary under ideal conditions. This year the company has done both.

As you can see from their financing activities, they received $18.3M in proceeds from their May raise, and have borrowed $5.5M more from their line of credit than payments made. Overall their cash position has improved by $15.1M from the start of the year.

Many investors including myself were a little surprised by the May raise, particularly the size. It gave some the belief that something may be in the works. It turns out it may have simply been done to solve a temporary cash crunch due to the nature of the business. Do I know this for sure? No, in part due to the lack of company disclosure and lack of MD&A commentary.

In my working days I coached many of small franchise business owners on improving their cash flow, and most often was able to save them money on interest expense from dipping into lines of credit less and sometimes finding ways to reduce their operating costs as well making their overall P&L look much better.

This may be the longest cash flow section I’ve ever written. I didn’t intend this to turn into a Cash Flow Ted talk, but here we are. Hopefully someone learned something.

Share Capital:

230.1M shares outstanding with 11.4% dilution occurring since the beginning of the year, most of that within the last quarter with the PP and there were also 2.4M options exercised YTD

5.3M options outstanding, all well ITM but all expiring two or more years out

6M options awarded to insiders post financials at $1.14. I have to say even with the company’s performance of late, this feels a tad rich and will negatively impact their Q3 financials with higher SBC costs.

A share consolidation was proposed back at their June meeting and was approved for a potential stock consolidation with a ratio of between 2 and 7:1. I still think this was a ridiculous motion to put in front of shareholders with that wide a range.

10% insider and 10% institutional ownership per YF.

I wonder how Ocean Infinity feels after divesting over 20M shares at 50 cents and the former founder and CEO who sold 5M shares at .46 cents feel right now seeing it triple since selling their Kraken shares?

Last insider buys on the open market were significant buys in January of this year.

Income Statement:

Incredible top line performance of $22.75M in revenue in Q2, increasing by 67% over last year and now sit at $43.6M halfway through the year, more than double the $21.2M they did a year ago, 105% up.

Due to the majority of those revenue gains occurring within the product side of their business, their gross margin rate suffered by nearly 800 basis points in the quarter and nearly 1000 basis points YTD. So on 67% and 105% more business, converted a much less 50% and 71%, respectively to the gross margin dollar line.

What they may have lacked in margin performance, they have made up for within their controllable spending within their administration expenses. YTD Admin expenses rose by 22% on 105% more revenues, and only 11% on 67% more revenues during Q2. These are the kinds of quantum leap improvement signals you look for in a P&L that will dramatically improve profitability. And that is exactly what we have here with Net income before taxes improving by 50% in the quarter, and by 5.6x YTD. The improvements are even better when you exclude a couple of one time items from last year.

Overall:

While there are a couple of things I am not fond of here; the SBC awarded post financials and the cash flow issues which I believe should eventually correct themselves, it’s been a pretty kick ass start to the year for Kraken. Obviously the top line is the most headline worthy, but for a company to make those kind of gains while limiting their operational spend is what turns good company’s into great ones.

Shareholders have been rewarded with a 140% increase in share price in around nine months since the pick of the year suggestion. So how does that effect the valuation?

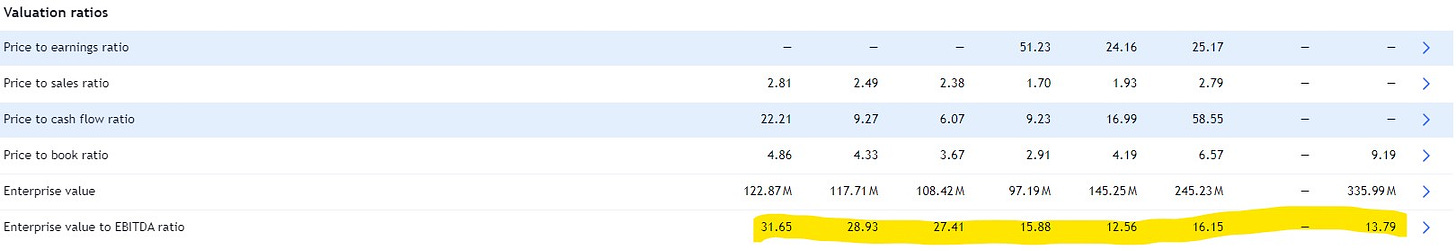

The company is now at $92M TTM or a 3.6x Sales/MC ratio and on the profitability side an EV/EBITDA ratio of 13.8.

Nearly 14 EV/EBITDA doesn’t scream undervalued but with the operational spending growing at a much lower rate than the top line it’s trending towards greater profitability so I don’t feel we’ve hit the end of the tracks on the value train. While I don’t often tout analysts I have seen a couple of reasonable and perhaps soft $2 targets over the next twelve months. I’m holding strong, and despite the minor cash flow concerns, I’m also awarding a 1/4 star upgrade to 3.5 stars.

Fix this cash flow disclosure shit though.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Great summary and well written.

Very good write up Wolf, keep up the amazing work !