The financials are quite old now and usually I’d decline requests to review when they are about seven weeks beyond their drop. But these guys were just too tempting to ignore with all of the news, events, promo activity and share price appreciation recently. That and two of my six annual picks this year are in this sector, surprising most including myself since I’ve done nothing but shit on it for the last five years.

Leef Brands, formerly known as Icanic Brands, formerly known as The Integrated Cannabis company and CNRP Mining (yep) before that, all within the span of the last six or so years, so this one has been trading for a lot longer than the TradingView chart below suggests.

It’s significantly off of its high going well left on the above chart, but it has also gone 7x since it’s low from this past October. So is there anything behind this actual recent share price performance or just the shitco it has looked like for multiple years under four different names? The financials and supporting notes as always we be our guide. All amounts unless otherwise stated in USD.

Balance Sheet:

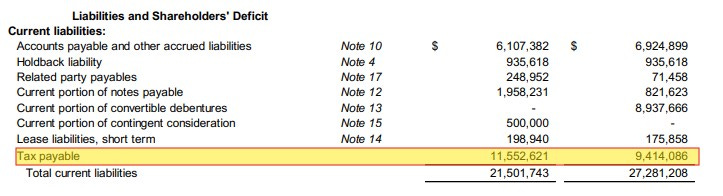

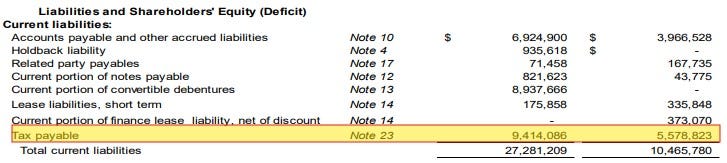

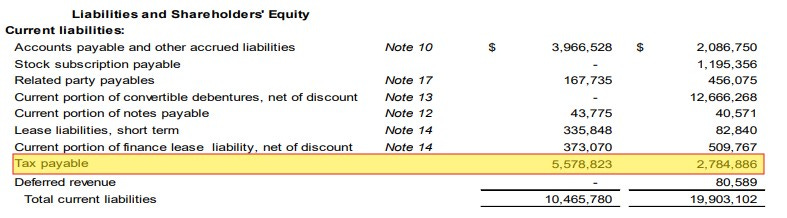

It’s harder to get off to a worse start than a current ratio of under 0.5 but here we are. As of September 30th the company had $2.2M in cash, $3.4M or receivables, $3.4M worth of inventory and $1.7M of other short term assets against $21.5M in liabilities due over the next twelve months.

$11.55M of those liabilities are in the form of taxes payable, an issue which has been growing for some time. In fact, the company’s tax liabilities just continue to grow as it doesn’t appear they have actually paid any since 2021. Wow, can I do that too? Just how long can that go on I wonder?

YTD revenue is down while A/R is up by 39% which raises an eyebrow but the company does not provide an aging report to gauge the potential health of those receivables.

In addition to their short term liquidity issues, Leef has $11.4M of long term notes payable, $8.6M of convertible debentures, another $1M in deferred tax liability and $855k in contingent consideration payable.

Post financials the company raised $1.8M at 25 cents. That is barely a sniff of their working capital deficit and even if added to the balance sheet they presented as of their quarter end, it would still be in rough shape.

Cash Flow:

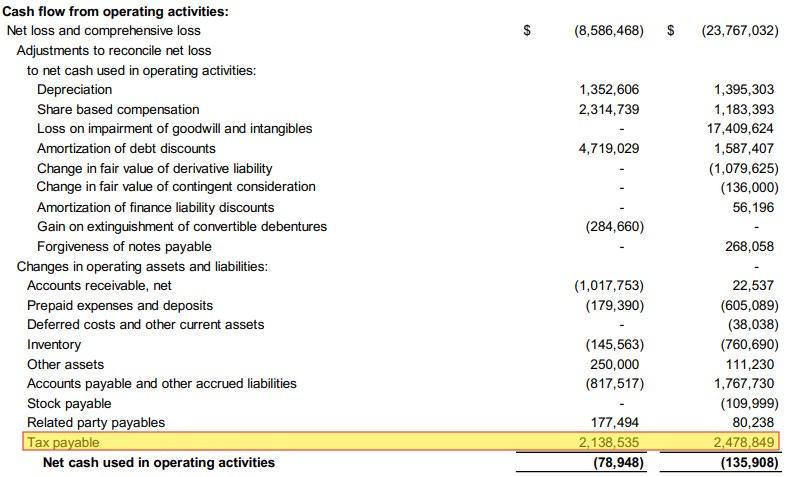

The company appears to be relatively close to cash flow neutral with $79k in cash burn through three quarters compared to burning $136k during the same time frame a year ago.

But I’m going to discuss that pesky topic called taxes payable again as without those working capital adjustments from not paying their taxes on time (like the rest of us contributing members of society), they would have experienced burn of over $2M in both years after three quarters.

They have spent $5.2M in equipment and ongoing construction costs YTD, incurred a net $1.33M in net debt via promissory notes, and paid off $578k in loans to a 3rd party. Overall they have seen their cash position deplete by two thirds since the beginning of their fiscal year.

Share Capital:

In a word, the cap table history has been clusterfuck (or is that two words?)

Post financials the company embarked on a 10:1 reverse split. As of quarter end the company had over 1.6B shares outstanding and experiencing 53% dilution since the beginning of 2023.

Post split of 162.5M shares outstanding and any amounts used from here on are split adjusted

Issued 10.5M shares as part of their $1.8M post financials raise

32M warrants as of Sept + 10.8M warrants issued at 40 cents as part of their recent raise

Leef has a 10% options and 10% RSU which combine for a 20% SBC plan. Frequent readers of mine know my feelings on company’s with 20% plans - I do not touch them

12.8M options, the vast majority at 6 cents and 1.1M RSU’s granted this year.

The $8.7M of debentures will have future dilutionary impacts - exercise prices are now likely subject to adjustment after the recent reverse split so watch for details of that likely when they produce their annual financials

On December 16th, announced a $5M debenture raise as part of a Bitcoin reserve strategy. These will convert at 18 cents (USD or 25 cents CAD), along with 5.66M warrants at 28 cents. The debentures are for five years and carry a 10% interest rate payable on the date of conversion. I’m sure I’ll have more to say on this later

Not including the older debentures the diluted float works out to approximately 240M shares

Income Statement:

On the top line, LEEF had a decent quarter with revenues of $6.76M, 19% better than the comparable quarter of $5.67M, but that might be the most positive thing to say in this section.

YTD revenues are down 8.3% from $24.6M through three quarters last year to $22.6M thus far through 2024. More troubling is their recent margin as their gross profit rate eroded by nearly 1100 basis points in the quarter to 21.9% compared to 32.8% a year ago. YTD is much more in line to last year but the margin variance resulted in 20% less margin dollars on 8% more revenue. Making matters worse were operating costs rose by 32% in the quarter therefore resulting in an operating loss that was 123% worse than last last year, at $2.39M vs $1.07M.

Once one time charges from impairments last year and one time gains are removed their net losses are similar to a year ago which through three quarters of this year, amounts to $8.6M.

Overall:

The financials, no matter how you look at them are simply brutal. The balance sheet is terrible, the share cap table has been mismanaged resulting in this recent split otherwise it would be approaching 2.4B shares on a fully diluted basis and YTD they have a net loss of 38 cents for every dollar they produce on top line with their most recent quarter looking considerably worse. To put their quarter in perspective, they achieved $6.76M and lost $3.37M. With their poor margin performance and keeping expenses flat their break even point for the quarter would have been near $15.4M or about 2.25x what they actually achieved. Their cash flow statement which is the only one which looks decent, only looks that way on the operational cash flow line due to the company’s seemingly inability or unwillingness to pay their taxes.

So what does the company do in the following months after dropping quarterly financials resembling a baby’s diaper fed a diet of Indian take out? Two raises post share consolidation; the first of $1.8M and a second one of $5M, not to shore up their balance sheet or make an effort to pay back taxes, but to implement a Bitcoin strategy. Now, I don’t want to start a huge BTC debate, but to implement one here on top of a 123% Bitcoin run in the last year with their terrible financials is a massive risk in my view. While there will be some benefits in this industry with it’s complex monetary policies to having some form of a bitcoin strategy, I don’t see it outweighing the risks for a company who has accumulated losses of over $100M since inception. They will need a Bitcoin valuation of about $159k just to offset the interest on these new debentures and that doesn’t even include dilutionary measures or costs of maintaining this new silo of their business. I think you could make a case for this type of strategy for a much better performing company standing on much stronger legs, but their current performance wouldn’t qualify them to be my Latex Salesman at Vandelay Industries.

Now, the IR promo game is in full swing and these recent announcements have brought out the crypto bros and it is no coincidence that the share price is near 20 month highs since this mid December announcement. Is there any money to be made on a potential swing? Perhaps? Would management take advantage of a jacked share price to do a third raise in a short time frame? I mean, I would if I were them.

Bulls, if there are any out there that are capable of reading words greater than two syllables may point out that I failed to mention they just completed a new facility in California that is touted to drive revenue and margin improvements. That facility is responsible for $7M of the current notes outstanding. It is interest free but did cost 60% ownership of the asset along with 175M pre-split shares. Consider it mentioned.

It feels like it’s time for an edible. I almost want to call these guys the Plurilock of the weed industry but that feels like it might be too insulting to PLUR. Same one star rating though.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Like the reference to Vandaly Industries. George lying on the floor with his pants down and Jerry saying "And you want to be my latex salesman" is the photo on my profile at stocktwits.

Thanks for the review!