Well what do we have here. A $70M TTM company trading at a miniscule $9M market cap.

The stock began trading back in 2020 and after some initial interest nose dived in mid 2022, and since then has been muddling between the 13 and 23 cent range primarily.

A few requests have come in recently. I’m guessing it is due to the only guy I can find who’s been talking about this lately - my buddy Cam over at Common Sense Investing. He intro’d the stock a couple of weeks ago on his YouTube channel, so that is a great place to start for a primer to get your feet wet.

So, what do the financials tell us? Is this a 2025 sleeper in the making?

Balance Sheet:

We start off with a less than ideal current ratio just below one (.96) that is made up of $3.1M in cash, $7.4M of receivables and $600k in other assets overtop of $11.66M in liability commitments due over the next twelve months. The company doesn’t produce aging reports for their A/R, but since most of their A/R is government based, no concerns here except these are never overly beneficial to a cash flow statement.

The company has $2M of current debt and $3.67M owed to Bloom & Burton, who are the largest shareholders of the company, owning just more than a third. That current debt is made up of an RBC loan and $1.2M in debentures payable at the beginning of May. The company also has more than $3M in available room under a revolving facility.

Cash Flow:

Operational cash flow is quite good and stable with $2.2M generated through three quarters, just $70k less than what they generated at the same point in 2023. They utilized $850k via an acquisition and asset purchases and have paid $1.35M in leases costs so far this year. Overall, their cash position has changed very little from the beginning of the year.

I think the discussion on their cash flow situation will carry through in my overall evaluation at the end of the review.

Share Capital:

Decent sized float of 56.4M shares with basically no dilution in the past year

4.2M options, about 2.9M currently ITM but don’t expire for 5 years

836k of broker warrants related to their debenture raise at 15 cents expiring in February and 4.5M warrants at 25 cents expiring around the end of 2025

Modest 2% insider ownership with 34% ownership by the investment firm Bloom Burton.

Insiders have hands firmly in their pockets when it comes to any buying in the open market

Neupath announced a NCIB on Nov 27th. I’d suggest their balance sheet doesn’t dictate that this is the greatest of ideas. This just feels like the company trying to signal to the market it feels it’s undervalued, but I do not expect them to be buying back a significant amount of shares.

Income Statement:

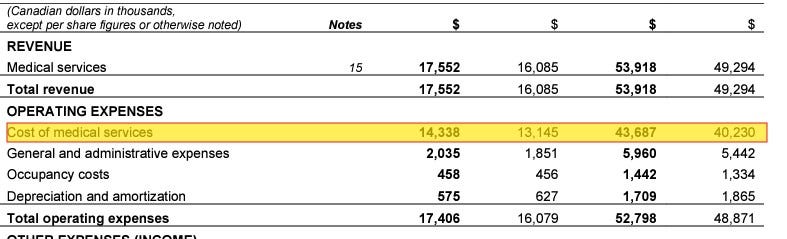

Some eye catching revenue totals for a company with a market cap under $10M. Neupath had revenue of $17.55M in Q3 and $53.9M through nine months, both up a little more than 9% for both the quarter and YTD. On a QoQ basis, revenue was down 7%, but that seems to be a Q3 vs Q2 trend over the past few years.

The company doesn’t report a typical margin line or number but I think it is pretty safe to say that the ‘Cost of Medical Services” can be used as COGS and I imagine this would be reimbursements to their physicians.

The good news is this number is relatively stable, and it’s always nice to have a stable number for forecasting. The bad news is this calculates to a margin of just a little over 18 points.

Total operating costs including cost of services was 99% in the quarter and 98% YTD. After you tack on interest and transaction costs it works out to a $300k loss in both the quarter and YTD, so prior to this quarter they were basically break even on the bottom line a slight set back in Q3.

Overall:

I think overall what we are looking at is a company with minimal downside risk but the upside potential is unknown and in fact may be limited.

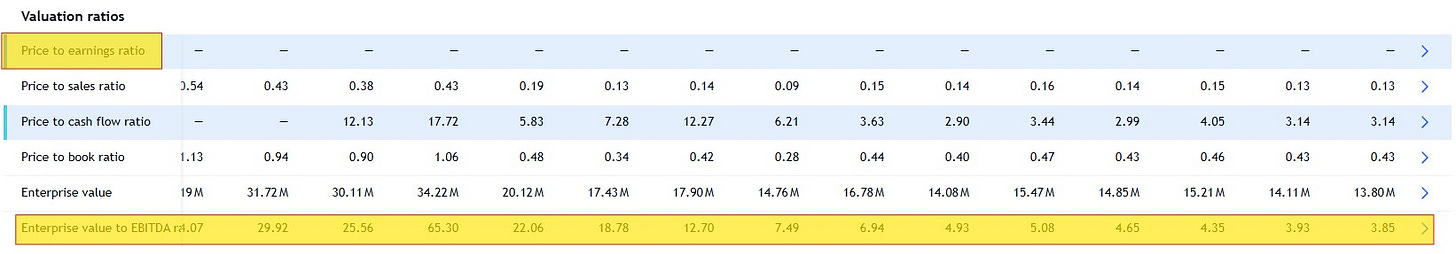

You can see from the above valuation trends that they have been able to grow EBITDA, but their biggest hurdle thus are is having no E, and all ITDA.

If my above assumptions are correct about the stable gross margins, then the future profitability path is growing the top line faster than their G&A and occupancy costs. The ongoing improvements the company refers to here (from their 2023 year end deck) haven’t yet taken shape with G&A costs rising as fast as their revenues.

Improving their capacity utilization will be key. The company states they are currently at 74% utilization compared to 67%. My concern here is with this increase in utilization this year they have not converted at all on their G&A expenses which are 11% of their YTD revenues this year and last. This has to change - if they get to 90% utilization and G&A expenses remain 11% of revenues then there is pretty much little to no upside here.

The good news is that while they are about break even from a profitability standpoint, they do generate operational and free cash flow, and risks of dilutionary measures are small outside of potential acquisitions.

I wouldn’t question anyone taking a stab at this down here (16 cents currently) with a .13 Sales to MC cash flow producing company. If they show any improvements that drive the bottom line up just a little bit, I think the market would re-rate it much higher. For now it gets three stars and if I’m feeling frisky I might slap the ask myself.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.