Light on financials to review at this time of year and sometimes I just need to sit down and pound keys for therapeutic reasons. This is one of those times.

Not familiar with New World Solutions? If not, I’m not surprised, but if you’ve been in the Canadian small cap game for a few years then you will likely remember Graph Blockchain $GBLC.CN who had one of the most successful, yet brief runs during the covid era.

Graph nearly became a fifty bagger and made a 2 to 49 cent run over about a six week timeframe back in early 2021 in a phenomenal pump and dump which made some happy and others not so much. By the end of 2022 the stock had crumbled to a half cent where they completed a 10:1 reverse split.

Graph Blockchain & Failed Acquisitions:

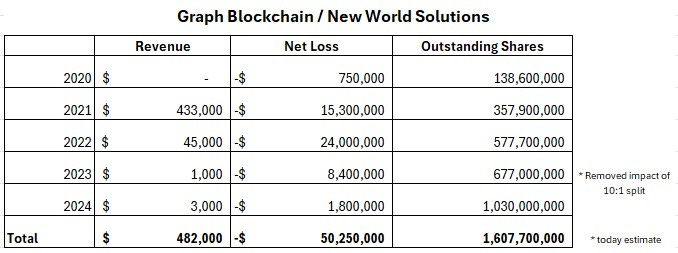

Who were New World Solutions prior to the name and ticker change? The table below can illustrate it best:

In the previous five years prior to the name change the company delivered less than a half million in revenue combined while accumulating over $50M in net losses and diluting shareholders by 11x. I estimate the current float around 160M shares but have shown the impact above without the reverse split the company executed back in November of 2022. That equates to an effective share count of over 1.6 BILLION shares - a number that would make a pure OTC shitco blush.

How the company got there was through a number of very poor acquisitions and most were done via all share deals.

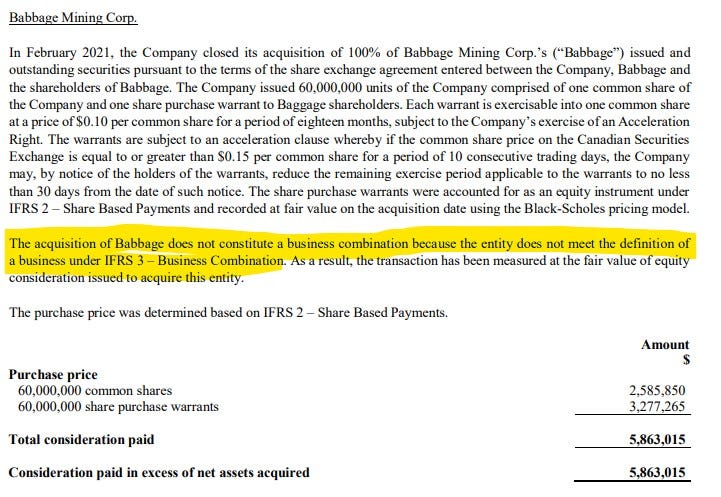

Babbage Mining:

Babbage was acquired back in February of 2021 paying $5.9M via issuance of 60M shares and 60M warrants. The entire purchase price was written off two months later. As noted in their 2021 year end financials, Babbage did not meet the IFRS definition of a business, yet they paid nearly $6M for it.

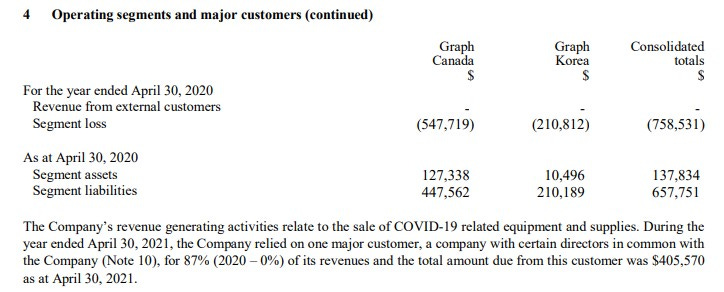

Another interesting tidbit from their 2021 annuals is shown in note 4. Of the $433k in revenue achieved that year. $406k came from the sale of Covid 19 related equipment and supplies to a company with certain directors in common (Justera Health). Two years later that $406k was still unpaid and was converted to a loan to be repaid over 81 months. LMAO.

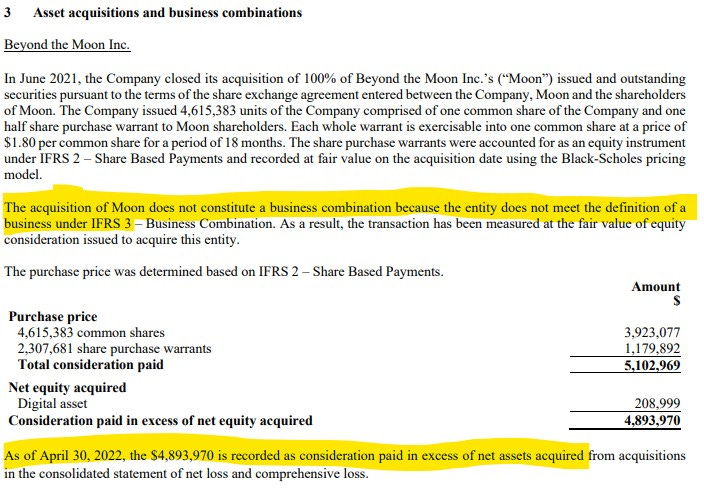

Beyond the Moon (BTM):

In June of 2021, Graph acquired Beyond The Moon for $6M through the issuance of 46.1M shares. Once again under IFRS rules, BTM did not meet the definition of a business and subsequently $4.9M was written off at year end.

New World Inc.

A month after the BTM acquisition they purchased New World for a total of $6M in another all stock deal for 46.1M shares. Unlike the previous acquisitions, this company with exposure to the NFT market did actually meet the IRFS definitions of a business. The original owners of New World could have earned up to $13M in additional milestone payments through achieving revenue and profitability metrics.

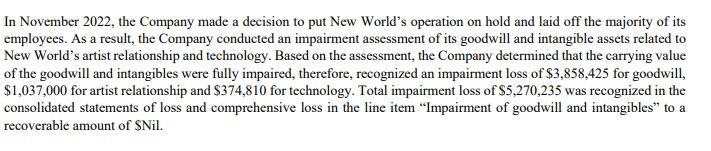

Clearly those were never achieved and just over a year later the company laid off the majority of New World’s employees, put operations on hold and wrote off $5.27M in goodwill and intangibles.

Optimum Coin Analyzer (OCA)

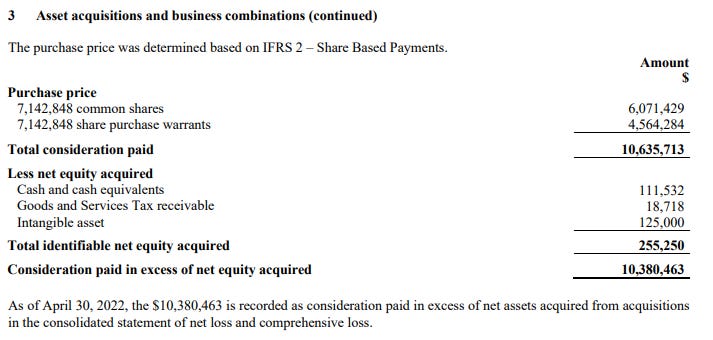

The summer of 2021 was acquisition central for these guys and in August of that year completed yet another acquisition for OCA. This time, $10.6M was paid through the issuance of 71.4 shares and an equal amount of warrants. For the third time in four acquisitions, it did not constitute a business under IFRS rules and as a result, $10.4M was written off at year end.

Nifable

Lastly, in January of 2022 but still within the same fiscal year as the others, the company completed their fifth acquisition of Nifable, another company allegedly in the NFT space. This time the purchase price was 1.8M in another all stock deal for 52M shares. Once again, Nifable did not meet the definition of a business under IFRS rules and nearly the entire amount, less seven grand was written off at year end.

So if you remove the $406k in Covid equipment and supplies from their revenue, the combined five acquisitions during this spree achieved $76k in revenue over a four year period while accumulating nearly $50M in net losses, mainly through asset write offs from 100% share purchases which ballooned the float from 139M shares to 677M.

The CEO:

Surely five years later with another name change to New World Solutions and about to embark on a new venture, it’s under new leadership, right?

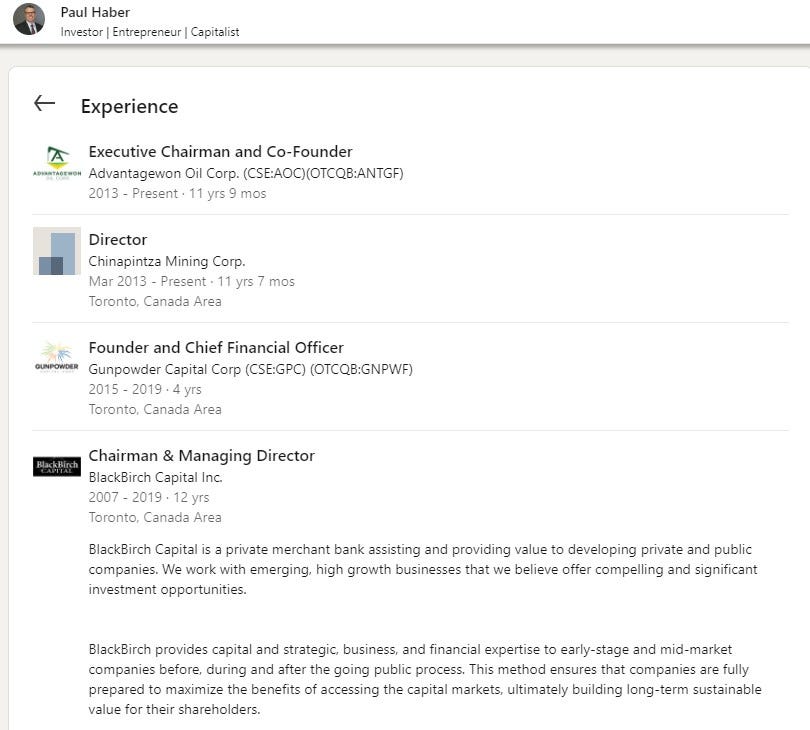

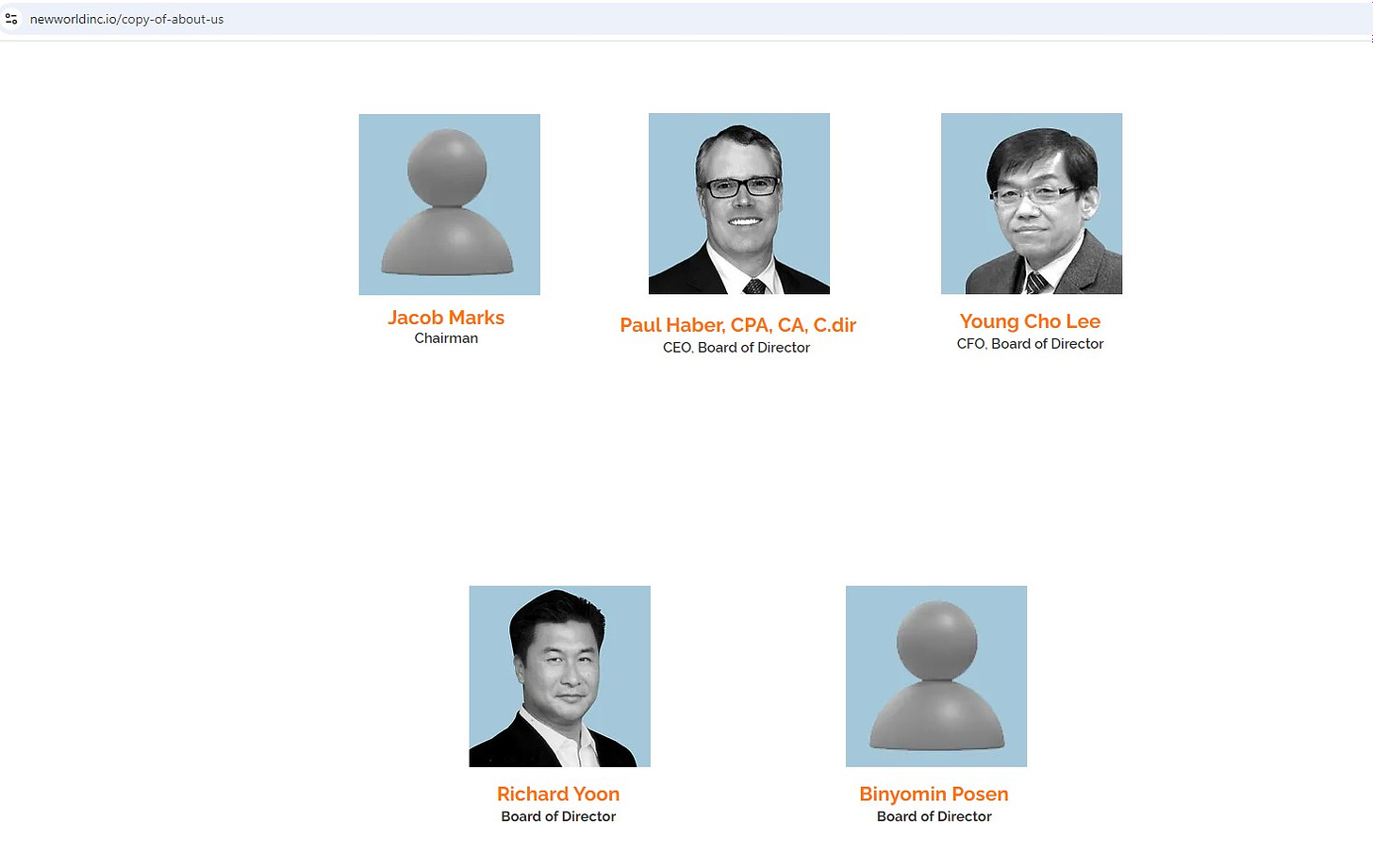

That would be incorrect, as the company is still led by Paul Haber. Interestingly enough, if you view Mr. Haber’s LinkedIn profile there is no mention of Graph Blockchain, New World Solutions or any of the failed acquisitions listed previously, but his mug is definitely on the leadership team on New World’s website.

Mr. Haber is an extremely busy guy so I’m sure we can excuse him for not including everything he’s ever done on his LinkedIn profile. He is also currently the CFO of E-Power Resources, a pre revenue mining play with their sights set on Graphite in the province of Quebec.

The stock began trading in February of last year, opened at a dollar and about a year and a half later, is 95% down trading at a nickel.

Just a couple of weeks ago, Mr. Haber was also appointed as the CEO of long struggling Datametrex. He is not new to DM, in fact was on the board for some time.

Below is the chart covering Paul’s time with DM. The stock peaked at 37 cents in 2021, but now sits at a penny today.

I don’t know how the man does it, but Paul is also the current CFO of Justera Health.

(Hey, I’ve seen that dude on the left somewhere before too)

You know, the company that was responsible for 84% ($406k) of the business that New World Solutions did over the past four years and never really paid for it but was moved to a loan paid over 7 years. What a small fucking world huh? I mean what are the chances of the CEO of one company getting the vast majority of their business from another company that he’s also the CFO of, and then the CFO (usually the guy in charge of the money) not paying the bill for two years. He must have just forgot, right?

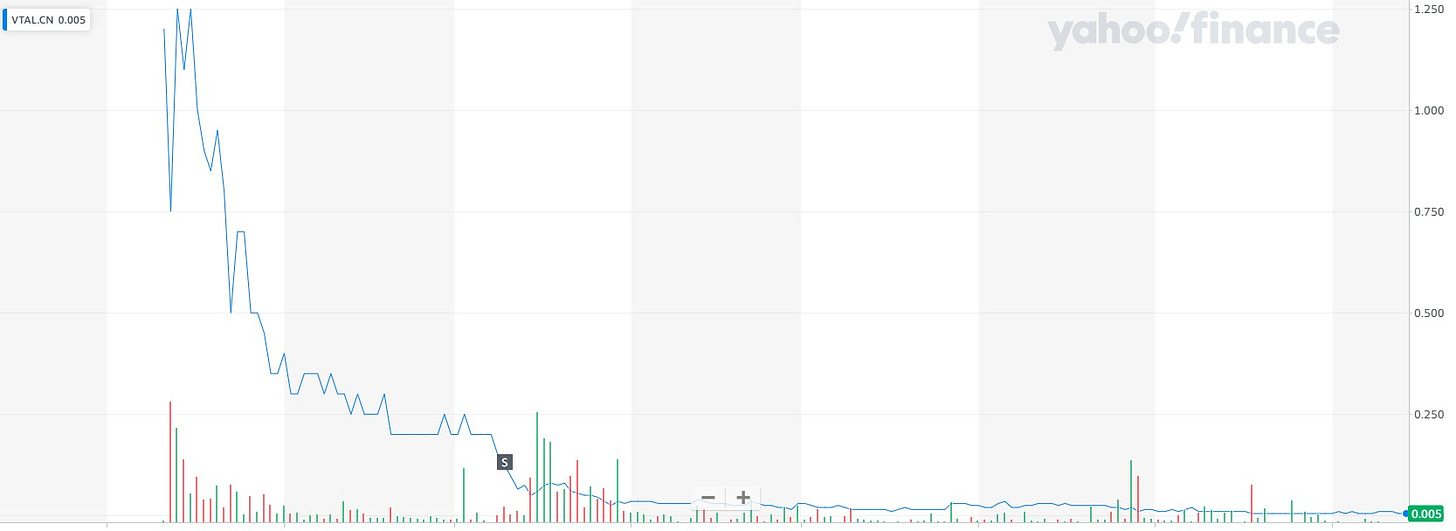

Here’s Justera’s ($VTAL.C) chart:

Justera Health, formerly known as ScreenPro was once upon a time hot stock during the covid days. Paul was CFO of one of ScreenPro’s subsidiaries, Add Biomedical from Feb of 2022.

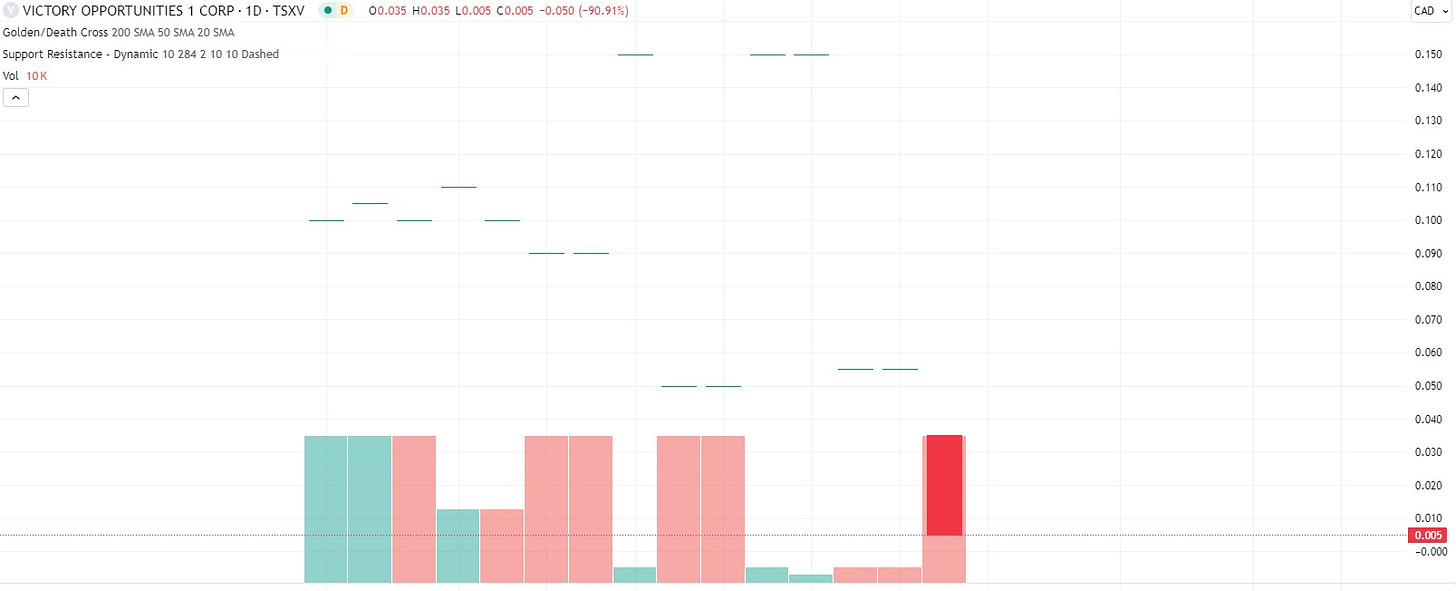

Up until June of this year, Paul was also the CFO of Victory Opportunities, $VOC.P.V which doesn’t appear to be trading any longer as far as I can tell, but traded as high as 15 cents and most recently a half cent as late as this July.

Paul was also the founder and CFO of Gunpowder Capital Corp, which was previously a mining company called Silver Shield Resources, and after he left became BlueSky Digital Assets. During Paul’s tenure it traded over $13.80 and is now valued at four and a half cents a share.

Lastly is the company Mr. Haber does list on LinkedIn - Advantagewon Oil Corp. This just happened to be delisted on the CSE at the end of last month for not filing annual reports.

I cannot provide you with an AOC.C chart as it is no longer searchable within TradingView, but the corresponding stock on the OTC looks like this, trading once upon a time in the $61 range and had 10k of volume in the last ten days at .000001 cents.

The funny thing is that I could go on, but it would seem cruel at this point. He has also held a CFO role for Oremex Gold (OAG.V) , SEL Exchange (SEL.V) , Leitch Technology Corp (LTV.V), and Migao Corporation (MGO.TO), and sat on the board for South American Silver Corp. (TSX:SAC), China Health and Diagnostics Inc. (TSXV:CHO), High Desert Gold Corp. (TSXV:HDG), and IND Dairytech Inc. (TSXV:IND). None of these tickers can no longer be found in TradingView.

Jack Marks:

Full disclosure. Mr. Marks doesn’t like me very much and the feeling is mutual. I don’t plan on taking any personal shots, or insults (today), but just provide some facts and opinion.

Mr. Wall Street Reporter himself is now involved in New World Solutions as of very recently, but there is some history between Jack and Paul which dates back to the successful run of Graph Blockchain back in early 2021.

According to Jack’s website and legal disclaimers, WSR was paid $250k for three months of paid promotion along with 2 million options at 28.5 cents. WSR made a handful of videos with the CEO, Paul Haber beginning on March 2nd and the last on June 15th. This is at least as far as I can tell as some if not most of these videos are now market as “private” on WSR’s YouTube channel.

The ironic thing about this is if one assumes that the contract period ran from the first video until Jack’s last tweet, those dates span from March 2nd of 2021 through June 15th, that $250k was not money well spent. The pump was over and the dump was already on by that point. The stock had peaked on Feb 22nd and the day of the first video (March 2), the stock reached $3.24 and closed at at $2.65. By the time Jack mentioned the stock for the last time in 2021 it was all the way down to $0.75, a decrease of 77% (note all figures adjusted for the stock split).

So the dynamic duo are apparently back at it again three years later under the new ticker of $NEWS.C promoting DialMKT, a company that New World acquired a 51% stake in which I presume Mr. Marks was the owner of, and in exchange Jack received 37.5M shares and now owns 22% of New World. With four of five 2021-2022 acquisitions not fitting the definition of a business under IFRS rules, what do you think the chances are that DialMKT met that standard? We’ll find out in future financials.

Jack has had a website up for a few months now called watchreporter.com with several blog posts and videos on the subject of collectable watches and interviewing collectors.

Introduced in New World’s latest press release will be a new e-commerce platform connecting buyers and sellers from the luxury watch community utilizing a “blockchain-powered digital ecosystem”, in what they claim is akin to Carfax for luxury watches. This is apparently going to launch within the next few weeks. How they plan to connect buyers and sellers, what margins, commission or expense structure this will be based on, and what the actual product or platform looks like is a vague word salad so far. I assume that will be forthcoming upon launch.

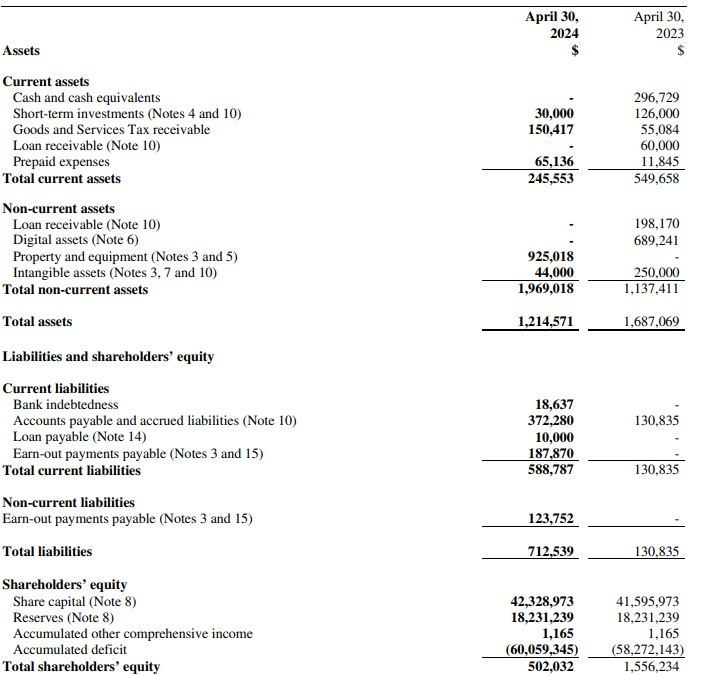

So what shape is New World in today? Well according to their annual filings last month, not so good.

As of April 30th, the company had no cash, $30k worth of investments, along with $150k of GST receivable. Those investments happen to be in Justera Health and consist of shares and warrants valued at $30k (as of April 30th). This is remaining from a $300k participation in a 2022 private placement, so in essence are down 90% on that investment. The company had $600k in short term liabilities and there were no subsequent events or news that I have seen regarding them raising any capital since. How will they be funding this new platform?

They have amended some warrants to five cents, which can be forced if the stock price hits 7 cents for ten days so this appears to be the short term goal to get some funds into the treasury. If the stock does get any sustained bounce you would have to assume they would attempt to raise capital through a PP as soon as it looked attractive to do so.

Jack does have some history of being involved with companies who run hard to some incredible short term multiples, but they all tend to end up in a similar chart pattern as the ones Mr. Haber has been involved with above - down hard with many ceasing to trade all together. CBDT, RHT, BETS, OG are just a sample of pumps or failed pumps of companies that just aren’t trading anymore.

It sure seems like it has been a hell of a long time since he’s had any success with one of his promo’s. Jack also has taken to social media (Twitter, YouTube, TikTok) to disparage and attempt to humiliate previous companies and CEO’s he has worked with (SLHG, VSBY, OG, DM). That seems like it would make it very hard to build new relationships and gain new clients. I don’t believe WSR has had a client within the last eight months, but here is what the charts looked like for WSR’s latest clients (LITM, APAAF, SRCAF).

Has Jack lost the magic touch, or did he even have any to begin with? Who’s to say.

The magic question is are you prepared to throw any of your hard earned investment dollars at this? I’ll be on the sidelines with my Apple Watch. Hard pass.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email me at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

2 quick comments:

-I think there is an error on the sum of total assets of their Balance Sheet (but it is still very early here, maybe I still need more coffee)

-I take the activity as a sign of what stage of the market cycle we are in... Thanks!

Wow, what man can achieve in a lifetime, truly inspiring.