Coming back from holidays a couple of weeks ago I did not actually plan to review NV this time around. I anticipated this could be a slow FINS week so I polled the TSA discord to see if they wanted me to review their latest quarterly, and to my surprise 83% said yes. Wolf always gives the people what they want.

A former 2023 pick of the year and clearly the worst annual pick of the last couple of years, in fact it’s the only one in the negative of the ten. Their financials received three stars for several reviews dating back to early 2022. The love in 2023 was short lived however with a downgrade and I exited my position in May 2023. I didn’t really have the tweet below in mind at the time when I sent it a couple of weeks ago, but it’s is applicable, as that POY didn’t make it half way through 2024. As a result I was in and out of the position for no gain. Had I held until now, I’d be a bagholder, down 60% or so. When fundamentals change, it really is ok to change your thesis and risk assessment.

The stock is down 53% since that May ‘23 downgrade. I downgraded it once again this May to two stars and it’s down 23% since then. The two year chart is a horror show.

NowVertical is all the way down to a sub $15M market cap. So has it bottomed? Does it have a chance to rebound and are they making any progress at all to give retail bagholders any hope? The market certainly hasn’t fallen in love with it since the release a couple week ago, so I’m not optimistic, but let’s take a look.

Balance Sheet:

The balance sheet has been a major issue for sometime. Their Q2 finished with a current ratio of .75 that consisted of $3.3M in cash, $9.2M of receivables, $1.7M in taxes receivables, and about $2M in other short term assets against a jarring $21.6M in short term liabilities (deferred revenue removed). While .75 is far from good, about halfway IMO from healthy, the ratio is substantially better than the last couple of times we looked (.55 three months ago).

They do not provide an A/R aging report, but they do anticipate taking $300k in write downs.

The company has $11.9M worth of debt, $9M of it long term, but to their credit they began the year at $16.5M. They also have $6.4M of consideration payable due this year for previous acquisitions. Good news for the balance sheet is that a good chunk of this will be paid in equity components, the bad news for the float at this depressed share price, but their balance sheet is a bigger priority than the cap table.

Cash Flow:

Through six months, NOW has nearly reduced their operational burn rate by 90% from last year to $575k, from a whopping $5.5M through six months a year ago.

They received $6.4M via their asset sale of Allegiant, a company they acquired back in late 2021. They could receive up to an additional $4M in earn outs on undisclosed revenue targets and milestones. They utilized that cash to pay down $4.2M of debt, $3M of it was loans related to Allegiant and $1.05M in considerations payable.

Overall they have improved their cash position by 18% from the start of their fiscal year.

Share Capital:

87.1M shares outstanding. 13% dilution in the last twelve months almost all related to Acrotrend’s acquisition earnout

1.4M RSU’s and 4.4M out of the money options

Numerous other upcoming dilution measures via their convertible debentures and acquisition consideration. I was too lazy to do the math back in May and that’s still applicable

Insider ownership of 30%, way up this year as the majority of recent dilution was settled in shares for the acquisition of Acrotrend. The recipient, is now the CEO of NowVertical

Post financials, awarded another healthy dose of RSU’s and options. Interestingly, this was not included in the subsequent event section of their Q2 financials

Insiders have purchased a total of $1800 worth of shares on the open market YTD as they continue to keep their hands in their pockets

Income Statement:

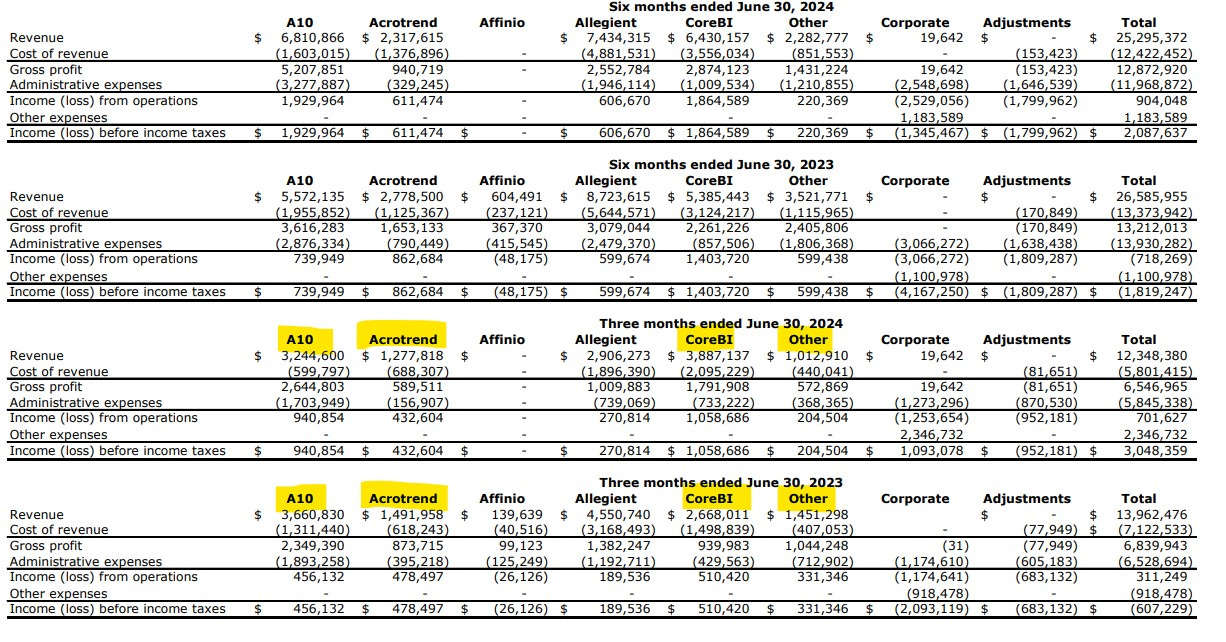

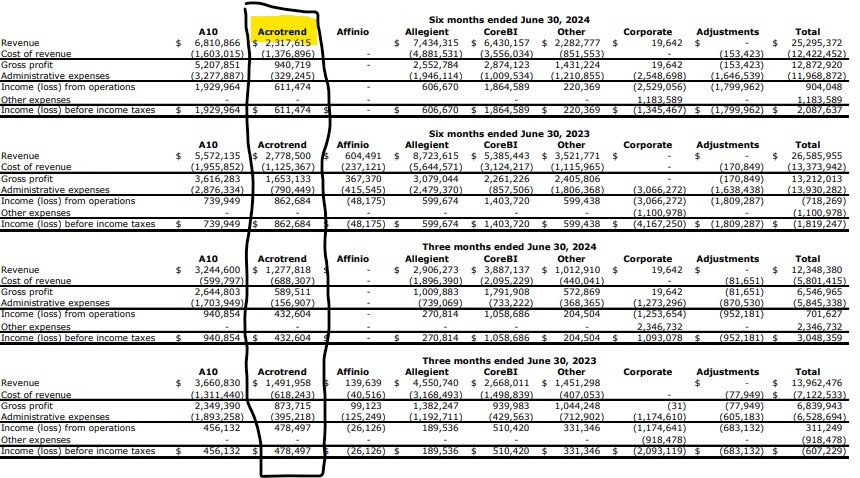

Revenues were down 11.6% in the quarter from $13.96M to $12.35M, and on a YTD basis, down 4.8% from $26.59M to $25.3M.

Last year’s revenue totals for the quarter include some small Affinio numbers (May 2023 sale) and non comp totals from Allegiant which was sold in May of this year. So what is interesting here is if you take the businesses they are left with (A10, Acrotrend, CoreBI, Other), revenue was actually up by 1.6% in the quarter and 3.4% YTD. Not mind-blowing by any stretch, but it does look substantially better than what you see on the top line at first glance. Their two remaining largest business segments, A10 and CoreBI are also their best performers growing YTD revenue by 22% and 19% respectively with the other two, Acrotrend and whatever makes up Other, underperforming.

Wait - Acrotrend is down?

One disturbing thing that I noticed while going through the financials that is worth discussion, and I’ll interrupt the Income Statement section right here. Below is once again the segmented breakdown by business unit:

As mentioned, the A10 and CoreBI segments are performing extremely well with growth of 22% and 19% respectively. Profitability is way up 161% and 33% as well. But then look at Acrotrend, the bedshitter of the three main segments with revenues down 16.6% and profitability down 29%. But Acrotrend is where the current NowVertical CEO came from right? And didn’t he just cash in 8.1M shares in the month of June on an earn out payment? That one earn out diluted the float by over 10% - so is this deserved when that segment of the business is the companies worst performer?

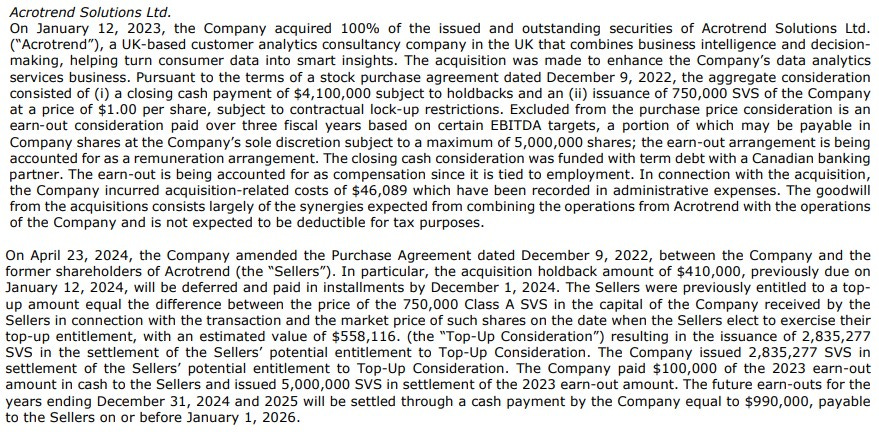

It actually starts to smell worse when you read the above note in the financial statement. One of the first orders of business the new CEO did was to apparently take care of himself, amending the previous agreement between himself and the old CEO and basically renegotiated it with, you guessed it, himself. The original deal called for a maximum of 5M shares. In the new deal there was top up consideration in additional shares added as well as about $1M in cash. The original deal was based on 3 year EBITDA targets, but as I already showed you, profitability was down in this segment, and they are less than 2/3rds of the way through the original deal arrangement. WTF?

Income Statement - Part Deux

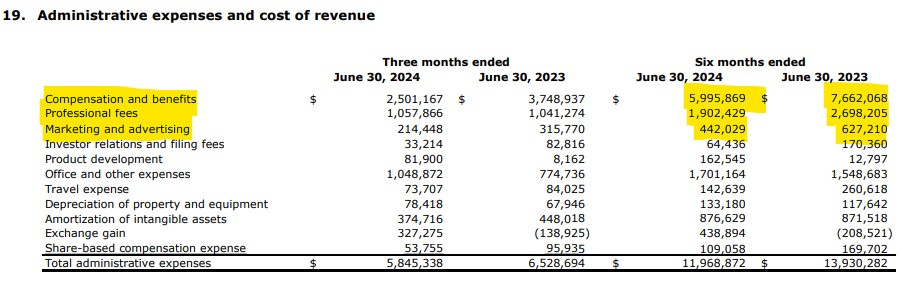

The company has been able to minimize the damage on the top line with improvements in their gross profit rate, improving by 400 basis points in the quarter to 53%, and YTD by 120 basis points to 50.9%. Their YTD GP dollars are 2.6% worse on 4.8% less revenue.

They have also reduced their operating costs by 14.1% YTD, far greater than what they lost on the top line, so when you combine the improved margin rate they actually look pretty good on the Income from operations line, showing a gain of $900k vs a loss of over $700k at the mid way point of the year. Below that which clouds the picture are a handful of one time items - they $3.5M gain on the sale of Allegiant, and $1.6M in one time losses. The number that investors should concentrate most on below the Income from Operations line is the interest costs on their debt, which was $1.26M against $1.68M at the same point last year.

When you drill into the details they have cut $2.5M out of their cash burning expenses YTD so what they have been able to do here is actually more impressive than if you just look at the P&L, as they have a $600k bogey to last year on foreign exchange.

Overall:

Holy shit, I don’t hate these financials nearly as much as I thought (and maybe wanted to). Don’t get me wrong, they’re not great, but they have actually started to make some tangible progress, and the outlook here may not be as dark as I thought say six months ago, particularly when you factor in the current sub $15M market cap. FOBI is worth $12.5M for fuck sakes.

The appearance of extreme greasiness from the new CEO in relation to the Acrotrend earn out is really hard to shake though. This is an open call to IR (not you Glen) or anyone in the organization who would like to explain why I shouldn’t perceive this the way i laid out. That must include however the breakdown of the original 3 year EBITDA targets included in the original deal or don’t bother.

Can’t believe I’m doing this, but I’m awarding an upgrade. Was originally thinking a full half star but given the Acrotrend thing, awarding a quarter star upgrade heavily influenced by the tiny microcap and the overall operational improvements here. 2.25 stars. Feeling frisky (perhaps reckless) and I already have an order partially filled this morning.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.