Easily one of the Canadian nanocap stories of the year. I selected NTG as my longshot pick of the year back in mid December back at 3 cents, 15 cents adjusted for the reverse split. To say it has exceeded my expectations would be an understatement considering the stock is up 533% since. (Full disclosure: I do hold a nice position here from initial buys at 4 and 4.5 (20 & 22.5 adjusted). NTG also received an upgrade to a three stars last quarter.

I’ve been looking forward to these results almost as much as my upcoming golf trip to Scotland. I thought that trip would occur first as their Q2 isn’t actually due until the end of next month. A pretty confident maneuver by the leadership group to release these before most anyone on the big exchange, AND they scheduled their first conference call with the street.

Here I thought I was the cockiest guy in small caps right now. Ashraf just asked me to hold his beer.

Let’s look at some results:

Balance Sheet:

Current ratio continues to improve, now to 1.25, up from 1.03 last quarter and a rather scary .69 when I first reviewed them. However, that consists of only $381k in cash, over $12.4M worth of receivables and $465k worth of prepaids against $10.6M in liabilities due over the next twelve months. NTG still has $6.3M worth of friendly debt, down about $300k from the last time we looked.

Having 94% of your current assets coming from your accounts receivables is far from ideal and can create liquidity challenges. I’ve beaten them up on this line before and will likely do some more today. Their A/R has nearly doubled from the start of the year. That in itself isn’t a problem, nor a surprise when your revenue has doubled along side it. It will have a negative impact however on your cash flows which we’ll review later.

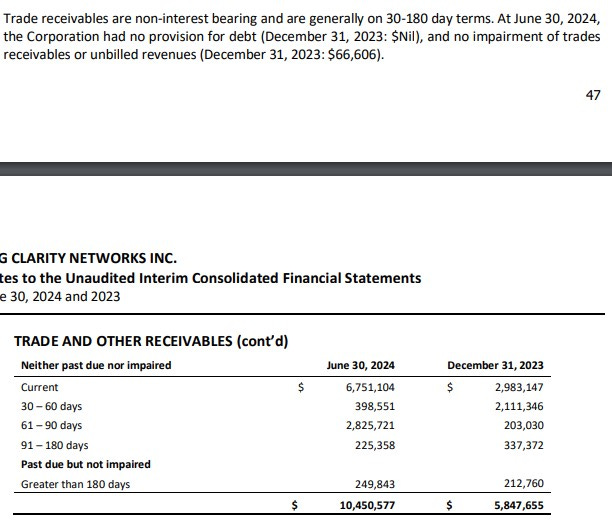

As of June 30th, 35% of their accounts receivables were overdue including over $3.25M that were 60 days late or more. Not ideal and compounding the issue is their flexible 30-180 day terms. Potentially, they could have millions due from customers for work that was completed eight months ago. There is some news of relief within the MD&A that states the company collected $6M of A/R this month. Let’s hope this is a trend. Your A/R or credit manager can’t be the weak link of your organization.

Cash Flow:

$225k worth of operational cash flow during the quarter, down from $845k last year and YTD are sitting at $1.02M, down from $1.26M. This is all related to the receivables issue noted above. With $6M received this month, this could look much different next quarter - but since one would anticipate $12 - $13M in revenue next quarter as well which will in turn create new receivables, better cash flow next quarter is not yet guaranteed. It’s also notable that their accounts payable have grown by $2M since the beginning of the year, mainly through accruals and payroll taxes payable. This actually assists their operational cash flow. Almost all of their outstanding payroll liabilities are due to the two leaders of the company.

The company has paid down about $600k in debt from the beginning of the year and purchased $400k worth of assets so their overall cash position has depleted by 27% from where they began the year which was lean to start with, but the potential is there for this cash flow statement to look dramatically better at the end of Q3.

Share Capital:

This is basically a cut and paste from my previous review. Feel free to skip ahead.

37.6M shares now outstanding after their 5:1 reverse split, which is about 25% dilution from where they sat at the beginning of 2023

3.53M options, which were well out of the money six months ago, are now well into the money at 25 cents with the first batch expiring in Dec of 2025

About 45% insider ownership which includes companies owned by leadership

No open market activity to speak of but the two directors were responsible for 100% of the raise back in December

Income Statement:

Finally I can start praising these guys a little bit. Headlines were pretty amazing last night with their news release with revenues growing to $12.5M, up 96% over what they achieved last year. On a YTD basis, revenues are up by 94% to $24.25M. Gross profit rate took a bit of a hit in Q2 which decreased by 280 basis points to 35.2%, down from 38% so that 96% revenue increase resulted in 81% growth in GP dollars. They are now down 50 basis points on a YTD basis coming in at 37% through six months. After a bit of a tough quarter in Q1 on the expense line they had tremendous conversion in Q2 with total expenses growing by 35%. It’s actually much better than that too, as they had a $300k bogey in foreign exchange this quarter. Controllable expenses only rose by 9.8% on 96% more revenue, even seeing a slight reduction in G&A expenses. This really erases the concerns I had with their spending in Q1 which appears mainly due to investments in their growth.

Other expenses are relatively flat and not very notable so that takes us down to an incredible net income line of nearly $2.5M for the quarter, up 282%, and $4.5M through six months, up 229%.

They also have a $1M birdie to last year on foreign exchange taking their comprehensive income to $4.82M. Obviously very nice but since this can’t be counted on in the future, I don’t factor this in to my evaluation.

Overall:

18.6% of their revenue ended up on the net income line. For a business that I would not consider one to be high margin producing, that is a pretty incredible statistic.

They are well on their way to meeting their guidance of $50M, and at that net income trend works out to $9.3M annually. That would give it multiples of .72 MC/Revenue, a 3.8 forward P/E and EV/EBITDA of 4.4. All of that screams that there is still incredible potential value here. The market is going to discount it based on what is currently going on with cash flow and that 95% of it’s business comes from Saudi Arabia if we’re calling a spade a spade. This 6 bagger YTD could easily turn into a 10-12 bagger by year end if their operational cash flow turns around.

Enjoy this run, which I expect will continue, but please stop talking about ridiculous multiples and an exchange uplist right now. It’s too early for that and you look foolish.

A consecutive upgrade here to 3.5 stars. Looking forward to the earnings call tomorrow.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.