After getting my ass handed to me over the past couple of weeks in the market over tariff issues, the headlines from NTG Clarity’s 2024 annual results is a welcome breath of fresh air we all needed absorbed into our wheezing lungs.

Originally selected as an annual pick back in December of 2023 at 3 cents (15 cents post split), NCI was one of the bigger stories in 2024, actually peaking at a 15 bagger when it hit $2.30 back in February. It has since pulled back to $1.60 which is still a 10x from the original pick.

NCI actually sits just below my most recent buy zone. As a result I added to my position at $1.38 in the “Liberation Day’ market fiasco that occurred last week. In my initial review of NTG Clarity in late 2023, I only awarded them a pedestrian 2.25 stars. They had some balance sheet issues but I felt if they did “ABC” they could turn into a fantastic risk/reward play. I’d argue that they not only did ABC, but did a little bit of XYZ too. My most recent review was upgraded to 3.5 stars back in November. If you want to preview that before you dig into these results, I’ve included it below.

NTG Clarity Networks ($NCI.V) FINS Review

What a ride NTG has been since announcing the company as a 2024 WolfPick longshot about 11 months ago. Are you still riding it, or has it bucked you off yet?

Sometimes the actual financials do not live up to the headlines in the press release and annual picks are looked at with a more critical lens - let us see if it these financials live up to my high expectations.

I’ve seen company’s with 5x the market cap who can’t even use a consistent font within their financials so how impressive is a $68M market cap who can produce such a beautiful looking annual report?

Balance Sheet:

We begin with a very solid current ratio of 2.3 that consists of nearly $5M in cash, $16.9M in receivables and $300k in prepaids against just $9.5M of liabilities due within the next twelve months.

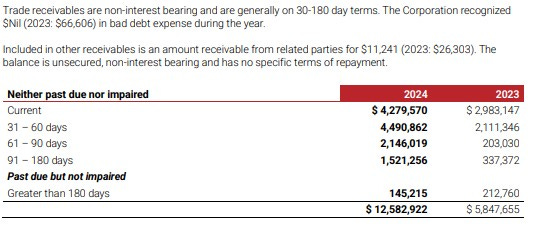

If you have read my previous reviews on NTG Clarity then you are aware that their receivables have been a bit of an issue.

After showing what I felt is improvement last quarter, I’m not so sure I can say the same here. Current receivables were 80% of the total last quarter, and is much lower at 34% here. I also take a bit of an issue on not only their terms but how their aging is reported. If ones billing terms are more than 30 days, then they could still technically be current if outside of 30 days. Generally when looking at a company’s aging report, seeing amounts in these buckets means the customer is late paying their invoice, but if your terms can range between 30-180 days, that is not necessarily the case. On a more positive note, their trade receivables are about 8% less than they were in Q3 and the company did not write off any amounts during their fiscal year.

NCI has just shy of $6M of long term debt, down from $6.6M a year ago. That is friendly debt which is owed to the top two insiders of the company without any specific repayment terms. While the agreement allows for a prime + 2.05% interest rate, the amounts charged in 2024 were minimal, experiencing only $49k of interest expense related to the insider loan.

Cash Flow:

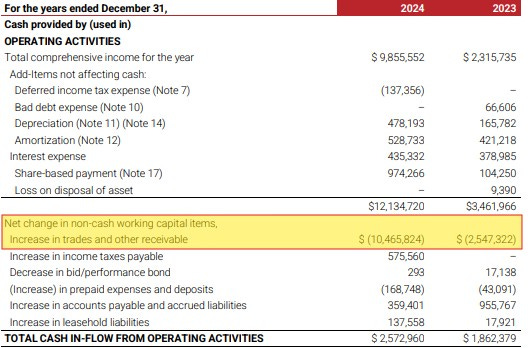

Total operational cash flow (OCF) of $2.6M, 38% more than 2023.

Prior to working capital changes, their OCF was greater than $12.1M but was negatively impacted with the growth of their accounts receivables. When a company grows at the rate they are, that is to be expected, at least to some extent. More positively is their OCF was $1M in Q4 alone and $1.6M in the back half of the year.

NCI raised $5M back in September through their LIFE offering at $1.40. They also paid down $1.8M of debt including interest payments and utilized nearly $1M worth of hard asset purchases.

Overall the company is in significantly better shape moving into 2025 with a cash position near $5M than they were a year ago with less than $400k.

Share Capital:

There is no difference between now and when I looked at them back in November. You can see what I said then by clicking on my earlier review shared above.

Income Statement:

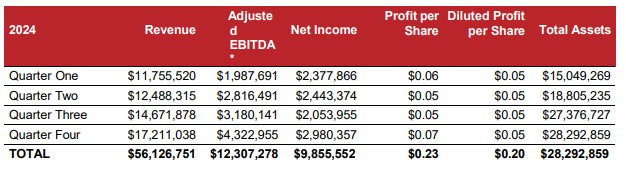

What a year with $56.1M achieved during 2024 which is a 102% increase over last year. When you couple that with their 530 basis points of improvement in gross margin rising to 37.1%, their margin dollars grew by 137%. It’s a truly incredible feat growing their top line by that extent while also having tremendous improvements in your margin rate.

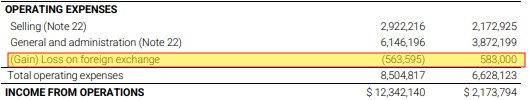

They also showed great conversion within their operational spending which in total only rose by 28% but this includes a $1.15M birdie to last year in foreign exchange costs to 2023. Selling expenses rose by 35% and G&A by 59% year over year which is still fantastic conversion on 102% more revenue and 137% more margin dollars.

Sales growth, margin improvement and expense conversion awards them the rarely awarded Wolf Trifecta.

Even after $1M more in taxes, NTG Clarity delivered $9.86M in Net income for 2024 which is 17.6% of revenue. A phenomenal P&L.

In terms of their Q4 results, revenue grew by 109% to $17.2M and delivered 17.3% net income of nearly $3M against a loss of $390k.

Overall:

The only negative or fault I can find within these financials is the A/R issue and that seems to stem around their actual payment terms. Typical western businesses usually have terms of 30-60 days. I don’t know if this is a regional issue within the middle east where extended payment terms are more typical or not. Some basic research on my end suggest this may be the case but it certainly isn’t a blanket issue. I do wonder if the company had shorter payment terms if the September LIFE offering could have been avoided, or at least less than the $5M they did raise. It will be important to see how this progresses over the next couple of quarters.

Outside of that issue which could be perceived as rather minor, this was a year of transformation for NTG Clarity, which currently trades at a 6.9 P/E with expected revenue growth of 33% next year.

You also have to respect a sub $70M market cap company who provides annual guidance, and they are projecting $75M in revenue next year. Unfortunately they are moving to Adjusted EBITDA guidance, and after providing Net Income guidance in previous years, this is not a positive development. We do know that the company is planning to spend some dollars on various resources to continue growing their business. It will be interesting to hear what further details they have to share on tomorrow’s call. At 15% Net income on next years guidance would generate $11.25M. A basic forward P/E of 10 would then value NTG Clarity at $112M which would represent a 67% increase from today’s share price putting it around $2.70.

That appears to be a very reasonable target, therefore I will continue to hold. I’m also holding my rating of 3.5 stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.