Heading out shortly for some much needed vacation, so why not start the fun with an early Q4 pick.

I reviewed them back in June and awarded them 3.5 stars with plenty of good things to say but it was a mixed review with some concerns as well so I didn’t pull the trigger at the time. Of course it has just about doubled since then.

What I like:

Aggressive growth and 19% net income for starters. They started with zero revenue from Q3 of last year and estimate they will begin 2025 with a $55M annual run rate and most importantly, carrying 19% profitability.

While Q2 was higher, their SG&A expenses are in the mid to high teens so while you may see some fluctuations from quarter to quarter as they grow, if they can balance this out to 20% or less with margins in the high thirties or low forties, these type of scalable business models don’t come across your screen every day.

For the lack of a more eloquent word, they have balls. There is something about their swagger that doesn’t come across as arrogant, or off putting, unlike myself. From the outside it has the all the appearances of a smart and aggressive growth strategy. Unlike the vast majority of microcaps, they are not afraid to put out guidance and update it often as new results and initiatives occur. That brings some element of risk if they don’t hit their targets, but give me a company with the balls to put targets out there ten out of ten times.

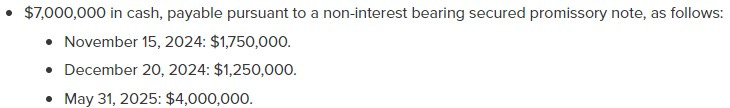

I really like this most recent acquisition too. A 3.2x net income multiple on a max earnout is an incredible payback. While HASH has a decent balance sheet, they are far from liquid with inventory making up the majority of their assets, so they very deftly deferred the payments as follows:

The accompanying announcement of warrant acceleration should bring in enough to cover the 2024 payments with 2025’s coming out of what I expect to be much improved operational cash flow.

Concerns:

This is small cap land so it’s not going to look perfect.

The biggest one for me is their inventory levels (I know they have addressed these concerns so save your DM’s - I’ll give them credit when it looks better). As of the midway point in their fiscal year they were trending to do approximately $10M in net revenue but while holding over $12M worth of inventory. That is absolutely terrible inventory turnover and the correlating problem is the negative impact it has had on their operational cash flow. I don’t care about the shelf life quite frankly, this needs to get better. In my mind, their new annualized $55M guidance should be doable near current levels.

Dilution is another factor that can’t be discounted. All dilution shouldn’t be measured the same however. Some dilution is less beneficial to retail shareholders such as Share Based Compensation, and though fiscal 2023 and midway through 2024, have awarded only $160k or so. The dilution has come from private placements and an additional 6M from the recent acquisition, but in both of their recent raises the momentum of share price appreciation has not slowed. With all outstanding dilutive measures being ITM and the company producing near 20% net income, that is going to translate to excellent operational and free cash flow which should quell future needs for additional raises barring anything unusual like another acquisition.

Overall:

With the accelerated warrants and acquisition shares accounted for would bring the float just shy of 100M by my math. So when you see a $37M market cap, the implied market cap is really closer to $50M.

That’s 5x forward earnings with a minuscule EV/EBITDA and just shy of 1x revenue. I don’t get the sense they’re about to slow down either. For me, that’s all I needed to see and I’ve compiled a position over the last two days.

One Wolf pick down with the rest likely coming mid December. See you in about ten days.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email me at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Couldn't Biorem be early pick too?

Is there anywhere where you post a deep dive content?

I mean, your content is awersome, but I wonder if this is the first time you talk about this company or you have explained and reviewed it somewhere else and this is just a resume and uptade following that first in deep evaluation of the company.

I would really love to read something like that, I couldn't find it in the discord either.

Anyway, I love your content and really apreciate what you do for us.

Thank you <3