Have not reviewed TRIP in about three years. Doesn’t look like I missed much for this piss poor pure excuse for a business on the lowly CSE. That may have been an overly harsh stance out of the gate but the five year chart is enough to make a grown man cry and investors pull their hair out. Request came out of my paid Substack on this one and it was just too hard to pass up. I’m all done my Christmas shopping and it just passed scotch o’clock, so let’s get into it.

Balance Sheet:

TRIP has a solid looking current ratio of nearly 3.9 that consists of $12.8M in cash & equivalents, $1.8M in receivables and $1.3M in other short term assets against just $3.1M of current liabilities.

Receivables look relatively clean and they have been able to increase business on the same level of inventory improving their turnover ratio, and they also hold no debt. All good stuff.

So things look alright up until this point but if you look back a few years back to 2021 when they raised a mammoth amount of cash, their current ratio stood at over 27 with their cash position dwindling down from over $31M, to the $12.8M they sit at today. That likely tells a story about their cash flow before we even get there.

Cash Flow:

TRIP has burned $1.5M in operational cash flow through their first six months of their 2025 fiscal year, roughly 10% less than what they burned at the same stage a year ago.

So where did all of that $32M worth of cash go from their 2021 year end? Well their last four years of operational cash burn have been $3.36M, $4.88M, $4.34M and $3.22M last year in fiscal 2024. In addition there have been several failed acquisitions that have resulted in millions of dollars of intangible and goodwill impairments over the last few years.

Not a lot worth noting within their investing and financing sections of their cash flow statement, but their overall cash position has depleted by about 11% from the beginning of the year.

While their burn rate has not been a great story, they still appear to have a run rate exceeding two years based on the last 18 month trend.

Share Capital:

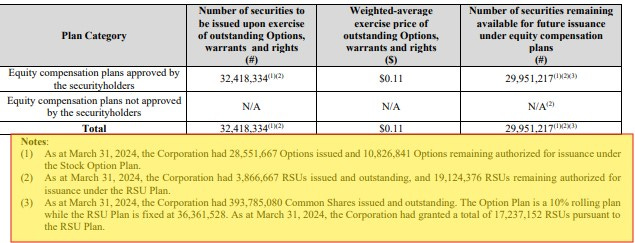

Bloated float of 401M shares outstanding. From a percentage standpoint, they have not experienced large dilutionary measures in the last couple of years. This float was blown up long ago.

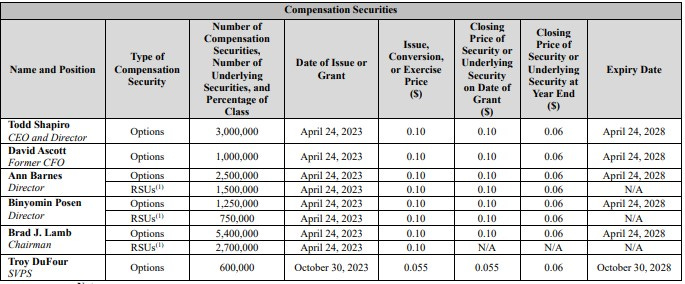

27M options outstanding, all well out of the money including the 20.2M that were just awarded last year.

Company has an ESPP that allows employees to purchase shares with the company matches share for share, but has received no participation in the last two years. That alone is pretty telling

1.9M RSU’s

16.2M well out of the money warrants. The company has had over 76M warrants expire unexercised in the past two years

Approximately 7% insider ownership (per YF). Not a lot of activity from insiders on the open market outside of the CEO digging deep to find $6k at 4 cents back in September

TRIP has had an NCIB available to them since September but to date has not bought back any shares

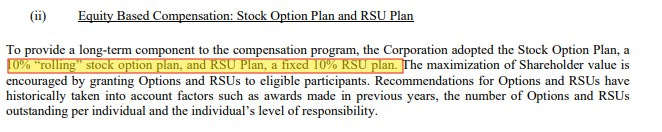

Let us take a peek at the company’s SBC plan.

Essentially the company has a 20% SBC plan made up of 10% options and 10% RSU’s. Frequent readers of mine already know my feelings on this but I’ll reiterate for those reading my drivel for the first time. I don’t invest in companies with 20% SBC plans, nor do I think cash burning organizations should award RSU’s or DSU’s or what I like to call “free” shares.

The rolling plan allows the number of options available in the plan to be replenished when new options are issued, whereas the fixed RSU plan as mentioned above would need shareholders approval to reset the number of stock awards available. That was tabled at their October shareholders meeting. While I could not find the results of that meeting online I would assume this passed even given the small insider ownership. This would essentially restock the available RSU’s to award at around 40M shares with the same number of stock options available.

Income Statement:

Revenue for their second quarter was $1.37M, up 39% over the comparable quarter and now sits at $2.9M through the first half of their 2025 fiscal year, 33% better than where they were at this stage last year. Also notable is on a QoQ basis, revenue was down by 12% in Q2.

That extra business has come at the expense of some margin erosion with the quarter down about 500 basis points to last year and YTD margin about 400 basis points lighter. The end result of that is 22% more margin dollars delivered on 33% more on the top line. They did have some pretty good conversion within their expenses which on a YTD basis is down by about 10%, but about 80% of those expense reductions came from non cash based SBC reductions and there are six more months to make use of that new SBC plan.

After some one time gains relating to reversal of sales taxes, convertible debenture revaluations and interest income from their strong cash position, TRIP’s net loss came in at $2.04M, almost $1M better than a year ago mid way through their year.

Overall:

Outside of a good looking balance sheet, there isn’t a heck of a lot to be proud of within these financials, and when you look back at previous balance sheets it looks a lot less impressive. Their break even point is roughly double the business they are doing today and they are no where near on that pace to project they will do that any time soon. Now I’ll admit that my DD here isn’t strong so if there are future catalysts to change that trajectory I’m unaware of them. What I am aware is retail investors are not very enamored with current leadership.

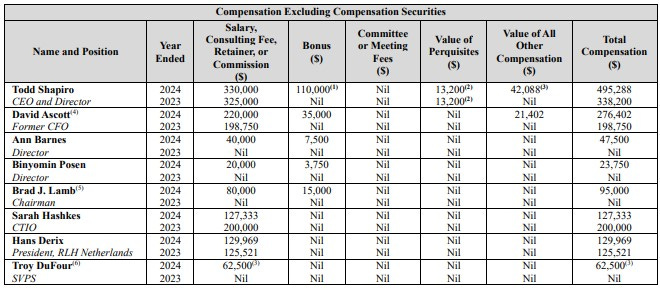

When you have a CEO raking in nearly half a milly in total compensation, including a six figure bonus with a history of financials that resemble hot steaming dog shit, car allowance, and a 10+10 SBC plan, that’s certainly going to give retail investors the impression that management’s goals are not aligned with them. That’s my initial impression. When the CEO reportedly is quoted to say “if you don’t like it, sell”, that’s not going to make him more endearing either. Now I don’t know much about Mr. Shapiro but a quick review of his twitter account shows that he’s a fan boy of Aaron Rodgers - the ultimate of douchebags so it might be safe to put him in that category as well.

To his credit, he is appearing on Twitter to do a spaces this weekend and is even inviting his ‘haters’ to participate, so here is your opportunity. The problem with most Schroom bros is they are only one step further along on the evolutionary chart from Weed bros, so I wouldn’t expect much fireworks. With insider ownership so low, they have had chances to vote against measures, new comp plans and board seats, but I haven’t seen any evidence of such, including a potential upcoming reverse split - with a potential of 100:1. Good luck with that one.

Awarding 1.5 stars here which feels generous, but their balance sheet and cash runway does present them the opportunity to turn around this ditch pig with a Hail Mary - something A A Rod is pretty damn good at.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Funny wolf I owned shares some time ago and I am glad you confirmed 1.5 stars is generous :-)