First look at Sabio via interest from multiple people. Admittedly, I don’t know a lot about them but after taking a look at their investor deck I think I have a decent idea. Impressive list of partners and customers for this $38M market cap trading on the venture.

The stock is up about 65% YTD, but still only halfway back to where they traded for most of 2023. Is there a pathway back to dollar land? Let’s find out.

Note: Sabio Holdings report in USD

Balance Sheet:

Unfortunately we start with a current ratio of 0.74 and an overall balance sheet that looks like ass, consisting of $2.87M in cash, $10.7M in receivables and about $1.5M in other short term assets against nearly $20.4M in liabilities due over the course of the next twelve months. Liquidity is a major concern here looking at these figures with cash just making up just 14% of their liability commitments over the next year. No major identifiable concerns with their A/R, but I’d feel better about them if they disclosed an aging report.

Due from related parties is never a line I like to see on a balance sheet, particularly when one looks like the bag of shit that this one does. I’ll save this for the end.

Sabio has $7.2M of debt, about $1.5M lower than where they began the year so it’s nice to see this moving in that direction.

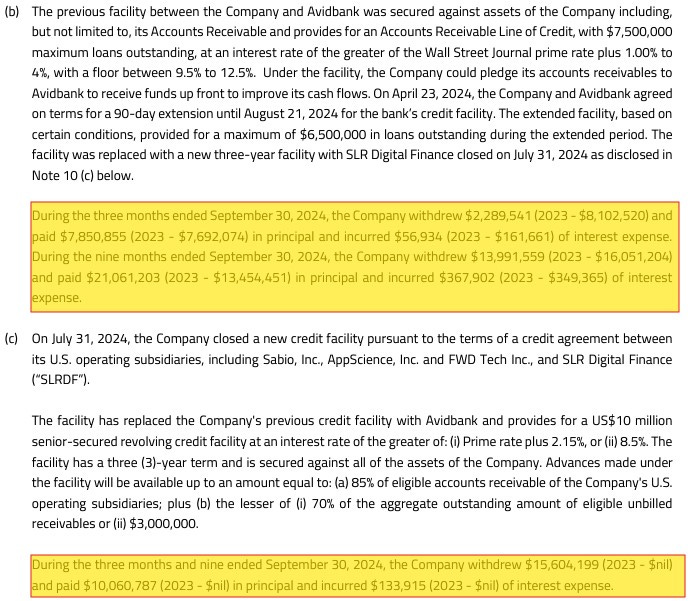

Sabio switched lenders in the quarter and secured better interest rates in the process. The activity within these facilities is quite interesting. In their original $7.5M LOC with Avidbank, they made $14M in draws and $16M in payments, and in the new $10M facility with SLRDF $15.6M in draws and $10M in payments. They are in and out these things so often it would make Ron Jeremy exhausted. This is a lot of borrowing from Peter to pay Paul.

The company also has $1.2M in 14% convertible notes due in August and converting at $1/share.

Cash Flow:

$2.6M of operational cash flow so far YTD compared to burning nearly $5M through nine months last year looks like a major impressive OCF turnaround of over $7.5M. This years figure is heavily influenced by working capital changes however and is mainly due to growth in their accounts payables. Due to this the OCF prior to working capital changes is probably a more reliable comparison. Here they are more cash flow neutral compared to $4.6M of burn last year - improving but not likely the OCF generator that one may think at a quick look.

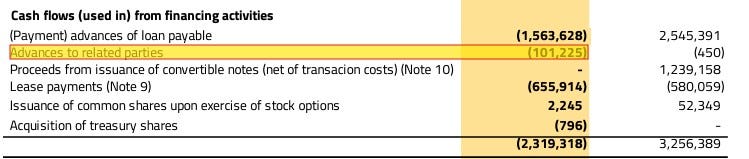

After paying down $1.56M in debt, lease payments of $655k and advances to related parties (seriously?) of $101k, Sabio has improved their overall cash position by about 10% from the beginning of the year.

Share Capital:

Decent sized float of 50.25M shares with 7% dilution over the past twelve months

2.6M options outstanding, with about 1.2M ITM but none expiring within the next three years,

478k of RSU’s and 270k issued post financials. The company has a reasonable 10% Omnibus plan.

Sabio currently has a NCIB outstanding. While the company has not purchased many back, utilizing it given their balance sheet and debt makes me question their priorities

60% insider ownership per investor deck

Income Statement:

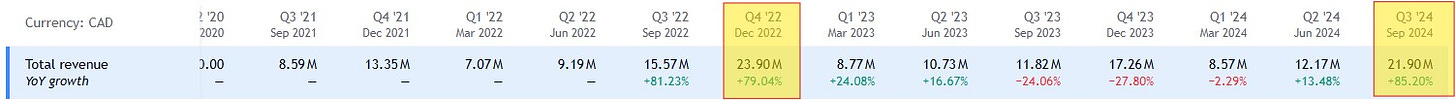

Extremely impressive top line in Q3 with $16.05M in revenue, 82% better than Q3 of last year. This brings their YTD top line to $31.3M, 34% better than 2023. This is also 80% more on a QoQ basis and the vast majority of their YTD increase can be attributed to what they did here in Q3.

Gross profit also came in at 420 basis points better than last years Q3 at a very tasty 63.1%. Their YTD margin rate is also outpacing last year by 150 bps to 61.8%. 95% more margin dollars on 82% more business is an excellent start to the P&L.

Expenses only grew by 42.6% on all of that extra revenue and margin generation which all translates to a vey impressive $1.75M in net income, blowing away the $750k loss experienced in the comparable quarter. On a YTD basis the company is still experiencing a loss of $1.3M, but that is a $4.6M improvement over the $5.9M they lost in 2023 through three quarters.

Overall:

So they hit the Wolf trifecta in Q3. Massive increase in revenues with improved margins and converted well on expenses which produced 11% worth of net income. So this feels like it may be some kind of inflection point. But is it?

It appears they have excited investors in a similar way almost two years ago with nearly $24M (CAD) in the final quarter of 2022 with record net income there as well. They have yet to match that record quarter almost two years later including this very good one. Another factor is the reliance on political ads which drove about 30% of their Q3 revenue. This contributes to lumpy revenue, particularly in non election years.

It’s also hard for me to get past their balance sheet and the fact they aren’t producing enough cash flow to remedy that any time soon. I think the risk of dilutive measures sometime in 2025 is pretty good.

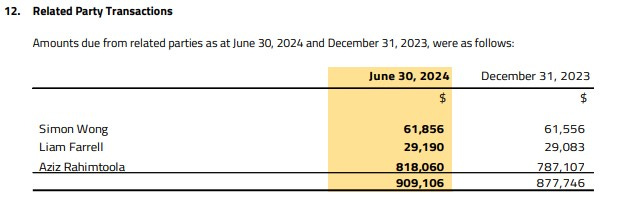

Next we have some yellow flags with related parties owing the company money. I find it very disturbing when I see a cash burning organization (or any for that matter) loaning insider company funds from the treasury. A $60k loan at 1% interest from more than two years ago. A $29k loan allowing an insider to exercise warrants over a year ago. And over $800k due from the CEO which in most part appears to be from participating in the convertible note raise. So he never actually paid the company the funds which were needed for operations, am I getting that right? Is he earning 14% on the note too? More than happy for the company to email me any clarification on that if I’m misinterpreting.

The NCIB also gives me a lot of pause. It’s not a lot of money they are throwing at buying back shares, but with a poor balance sheet, and massive utilization of a line of credit, it just makes me think the focus is not where it should be.

I came into this review with some optimism and hope and finishing it with sadness mixed with a sprinkle of disdain. 2.5 stars at best here until they can prove Q3 might be a trend rather than a one-off.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

That picture 🫣😂

When you word your final comments with " sprinkle of disdain" I take them very seriously... although that company may focus and become something to invest in next summer, it seems worthy of a watchlist listing and hearing your review on it then.

Thanks wolf, proffesionell to a tee.