A 3.5 star initial review in Q1, and at the end of September I took the unusual step in announcing an early 2025 pick. With that selection comes greater scrutiny. Market puked on it at the bell, in most part due to the announcement of the warrant acceleration. Let’s dig in.

Balance Sheet:

As of Sept 30th a solid current ratio, but with liquidity issues. The current ratio of 2.4 comes from $532k of cash, $2.4M in receivables, $16.2M worth of inventory and $900k in prepaids against $8.4M in current liability commitments over the next year. Liquidity is an eye sore however due to 81% of those current assets made up of inventory.

Of course big events occurred a couple weeks after this quarter ended with the ANC acquisition and accompanying news of accelerating the twenty cent warrants that were outstanding, bringing in a little over $2M.

Cash Flow:

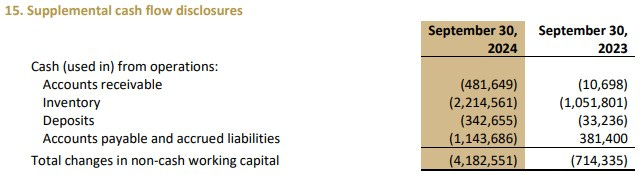

Well fuck me. $3.4M of operational cash burn through nine months vs $442K in 2023. That works out to about $2.9M burn rate for Q3 alone. Before working capital adjustments things look more much more positive with $772k of operational cash flow from operations.

A lot to digest in here but when you get into the weeds I think things look better than the overall cash flow numbers initially portray. The $2.2M in working capital adjustments related to inventory is actually lower than it was a quarter ago due to increased turnover, and the bulk of the increase in inventory QoQ is due to acquiring CannMart. Much of the rest of the working capital adjustments are explainable due to timing differences or top line rapid growth - I would not expect their OCF to trend this way into 2025 the way things stand.

Thus far in 2024, they have utilized $600k via the acquisition of CannMart and other minor asset purchases. They also raised a net of $5M via share issuances.

Overall, they’ve about quintupled their cash position since the beginning of the year, but that only brings it to a little over a half milly.

Post financials we know they raised $2M from accelerating the 20 cent warrants. Along with today’s press release have utilized the acceleration clause from the July raise on the 40 cent warrants which could bring an additional $3.2M to the treasury by the end of the year.

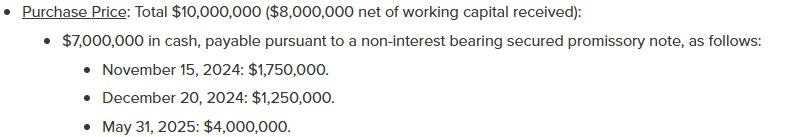

As of last week, much of that $2M went to the sellers of ANC, and these new funds will be used to satisfy the $1.25M next payment with the big $4M payment due next May with potential additional earn-outs.

Share Capital:

This is going to be a bit of a moving target over the next couple of quarters and perhaps beyond

77.7M shares outstanding as of Q3 end, 60% dilution from the beginning of the year

7.3M options. All ITM ranging from prices from 15 - 37 cents with none set to expire until early 2026. Since they are moving up the warrants would be nice to see insiders nut up and early exercise some of them

28.6M warrants. We pretty much know the story on most of these. 10.3M exercised post financials and 8M will be exercised by year end.

16% insider ownership but this is set to move dramatically downwards with the upcoming dilution from warrants

Insiders participated in the last PP and have also made open market purchases in the past two months, prices ranging from 49 to 71 cents.

Income Statement:

As expected the top line is excellent at $4.95M, nearly 4x what they did a year ago and through three quarters $10.15M, more than doubling up what they achieved at this stage last year. The company will speak to gross revenues but I do not for tickers in this sector. There was a 300 bp hit to the gross profit rate coming in at 39.7% vs last years 42.7% and much lower than their YTD trend of 47.3% through nine months. With the move to more branded products, this was expected and 2025 should become more stable on the margin line and hopefully a little more predictable as well.

SG&A costs rose by 3.5x to a year ago with minor conversion compared to the rate of revenue increase and the company also incurred a one time $225k expense in relation to the CannMart acquisistion.

Net Income for the quarter came in at $424k, a 350% improvement over last year or 9% of revenues bringing their YTD net income profitability to $2.15M which includes a $446k one time gain. With that excluded equates to a tasty 17% of net revenue.

Overall:

It’s certainly a little messy to be kind with the liquidity of the balance sheet and the cash flow statement looking like a dogs breakfast due to the working capital changes. As I said in my last review when announcing them as an annual pick, these guys are aggressive and ballsy and sometimes in order to get where you need to go the financials will temporarily look like a monkey fucking a football.

That is what we have here. Due to the working capital adjustments impact on the cash flow statement, the new warrant acceleration was necessary in order to satisfy the promissory notes due to ANC in December and beyond. I was hoping the company would not put this pressure on those warrant holders so soon, but it’s looking like it was necessary to avoid another raise. This will inevitably put some downward pressure on the stock price for the next few weeks.

The awkwardness about a microcap’s third quarter is the long wait investors have to endure before they can see Q4. Given the messy quarter and warrant situation, expect volatility in the share price over the next few months, just as the trading action the past month and this morning in particular have been. There are also a lot of depressed assets in this dysfunctional sector, so more acquisition activity could be in the cards and they have shown if the price is right, they will react.

Bottom line is if you’re going to play this 2025 Wolf Pick, then you’ll need to wear your cup and a helmet.

In the next financials we will see about 75 days worth of the new acquisition and hopefully a more liquid looking balance sheet and a better representation of what 2025 will hold.

Maintaining the 3.5 stars here based on YTD results and outlook, but the quarter itself is probably not worthy of that it on its own.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

“…the financials will temporarily look like a monkey fucking a football” is the greatest line in the history of finstack

Came across your article here while researching this company. Turns out we follow a lot of the same names. What is up with the inventory levels on this one? Why would they need to be holding a full year’s worth of product?