First review of Snipp. Typing that makes me want to cross my legs and protect myself for some reason. The five year chart also makes you want to protect your groin area.

A lot of interest here from the TSA discord, email and DM requests from subscribers. Disappointingly, before I’ve even started writing my review I already know they will not see any of my investing dollars, so we’re doing this for the people. Let’s go.

Snipp reports in USD.

(Correction: I have reviewed this before - Dec of 2021 before I posted reviews online - it was three stars)

Balance Sheet:

The overall balance sheet is excellent and clean starting with a current ratio of 3.3 comprised of $4.6M in cash, $2.9M of receivables and $1.2M of other short term assets against just $2.6M of short term liabilities (deferred revenue removed). The company has no long term debt and less than a half milly in long term lease commitments. Accounts receivables are up by 40% with declining revenues and that raises an eyebrow. They do a decent job in note 12 but I’d still prefer a traditional aging report. Stellar start.

Cash Flow:

Cash flow generated from operations looks extremely positive with $2.4M through their first three quarters, a massive improvement from burning $200k during the same time frame a year ago. But when the onion is peeled back a little we can see that all of that improvement is due to an increase in deferred revenue. Don’t get me wrong, an increase in deferred revenue is a good thing. The issue is it tends to mask your cash burn when a company has been pre paid for work they have yet to earn. Still a little early to be calling them an operational cash flow generator, but they are not far off either.

During 2024 they have utilized $935k in purchasing intangible assets, and received $276k via options that were exercised. Overall Snipp has improved their cash position by 57% from the beginning of the year, once again mainly due to pre paid work.

Share Capital:

Outstanding shares are way up to 286.1M, but very little dilution over the past two years. The butchering of this float took place long ago.

37.4M options outstanding. With the share price at 9 cents, approximately 11.5M ITM. 18.7M options have been granted this year under their 20% SBC plan. Long term readers knows what this means for me. More on this later.

32% insider ownership and 9% ownership from Bally’s.

Bally’s purchased 25M shares at 25 cents back in April of 2022 for $5M USD. That is now worth $2.25M CAD. Whoopsie.

No real activity from insiders to speak of in the open market, although some exercised options earlier in the year at a dime that are now in the red

Income Statement:

Starting off with a revenue decrease of 22% in the quarter is never what you want to see but that is what we have here with $6.65M for Q3, down from $8.56M last year. YTD is more unpleasant with $16.07M through three quarters, a decrease of 29% from $22.59M. If there is a sign of encouragement, revenues were up 40% on a QoQ basis.

Oddly Snipp does not calculate COGS or a margin figure in a traditional way. They speak to one in their press releases but that is not recognized as an appropriate calculation of gross margin under GAAP. When revenue is down, you’re hoping to see some savings on the expense line and we do have that here, with a 38% reduction in the quarter and 32% YTD, both greater than their revenue erosion therefore you would expect to see an improved bottom line. All of the savings within their expenses have come from a bucket called campaign infrastructure and it amounts to nearly $10M through nine months. Marketing and Investor relations have also been cut back substantially by approximately 50%. Payroll, on the other hand has increased by 42% and that pesky SBC expense increased by 142%.

After all of the above they were profitable on the net income line with $295k vs a loss last year of $184k. YTD they are still in the red with a net income loss of $1.35M against $3.11M in 2023.

Overall:

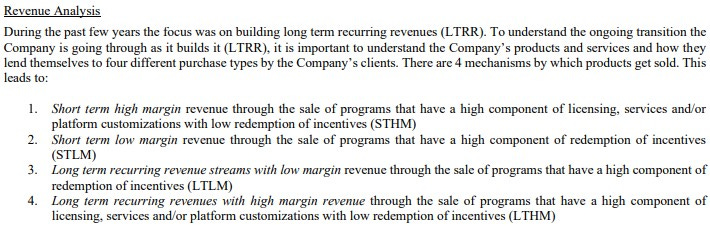

There is a lot of commentary within the MD&A about the shift in revenue streams to focus on LTRR (long term recurring revenues). These guys love their acronyms.

It’s clear that moving away from the Gambit generated revenue (Isn’t this why Bally’s invested), is the right move to make them more profitable. But pegging how much is very difficult to tell. They only segmented breakdown they disclose is one by geography, which doesn’t help much. I’d much prefer to see it segmented between what they consider LTRR and the STLM. If they can significantly grow the LTRR that could make them attractive, simply reducing the STLM isn’t going to cut it long term. If they had significant organic growth, I think they would be shouting it from the rooftops. Maybe they’ll disclose some of that information in their upcoming conference call.

One of the bigger turn offs for me, and this goes with any stock, is a company with a 20% option plan. With the current float, if their SBC plan gets re-approved, over 57M options would be available for them to award. In fairness to Snipp, they have had this egregious plan for years and have not fully maxed it out. But they can and have awarded 18M this year alone while the share price hasn’t done anything for retail shareholders.

I remember working for a $6B organization that had a CEO and CFO, two C-suite titles for that large a business. These guys have five for a $32M TTM business. This isn’t overly unique in microcap land, but the structure looks very bloated. Top level compensation is up 29% this year with revenues down 29% and share price down by 30%. Not the best look.

It’s also worth noting that from July of 2023 to January of this year, the stock was under a CTO (cease trade order) for late filings and leaving investors in the dark on progress for a good chunk of that time. Not exactly a hallmark of a well run organization.

I know there will be some who were hoping to read this with a bit of a different outcome. There are some positive things here and moving away from this anchor of a low margin business was step one. This step has also diversified their customer base as last year 58% of their business came from two customers, now their largest if 15%. But I don’t get a sense of how quickly that revenue can be replaced with their higher margin offerings. Add on five guys who couldn’t get financials out on time, and a potential time bomb of a 20% option plan ready to take the wallet from my back pocket, and I’m just gonna sit this one out.

2.5 stars.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

The style of writing is just hilarious. Always cracks me up to read things like "20% option plan ready to take my wallet from the back pocket". At the same time reading your analyses is always an exercise in humility as you always notice important red flags I didn't. Well done, Mr Wolf