First look at this company trading on the Venture who’s boring corporate logo looks like the CEO’s nine year old created it in Microsoft Paint. The request for a review came from one of my Substack paid subscribers.

SECU also has one of the most boring charts you will see, down 5.1% YTD. That boring trading pattern actually extends all the way back to November of 2020 virtually trading between $2 and $2.80 that entire time. Boring isn’t always a bad thing though. So what gives? What’s the story here? Let’s find out.

Balance Sheet:

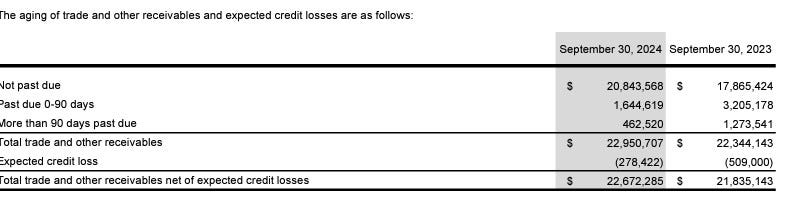

SSC Security has an excellent current ratio of over 3.1 that consists of $13.3M in cash, $22.7M of accounts receivable and about $3.6M in several other short term assets against only $12.7M in liabilities due over their 2025 fiscal year. Their cash position alone covers those liabilities so liquidity is strong.

A/R does account for 57% of current assets but given their volume it appears reasonable and 91% is current with little history of sustained credit losses. SECU carries no debt but does have over $3M in deferred tax liabilities.

Overall, this is a solid looking balance sheet and start to their financials.

Cash Flow:

SSC produced just shy of $2M of operational cash flow in 2024, down a disappointing 21% from 2023 of $2.5M. Much of that variance is due to working capital changes and a relationship to SBC which I’m sure I’ll get into in the next section. Also during 2024, received a net of $1.5M through investing activities, paid out $2.3M in dividends and bought back $1.65M worth of stock. Overall, SECU’s cash depleted by 10% during the year.

Share Capital:

Very tight float with only 18.7M shares outstanding, nearly 1M shares less than two years ago via renewed NCIB’s

SECU pays out a dividend which has yielded 4.5% over the past five years but with a current problematic payout ratio of 450%

400k options & 475k DSU’s outstanding

625k SAR’s (Share Appreciation Rights) which entitle the holders to a cash payment equal to the appreciation of the stock price over a five year term.

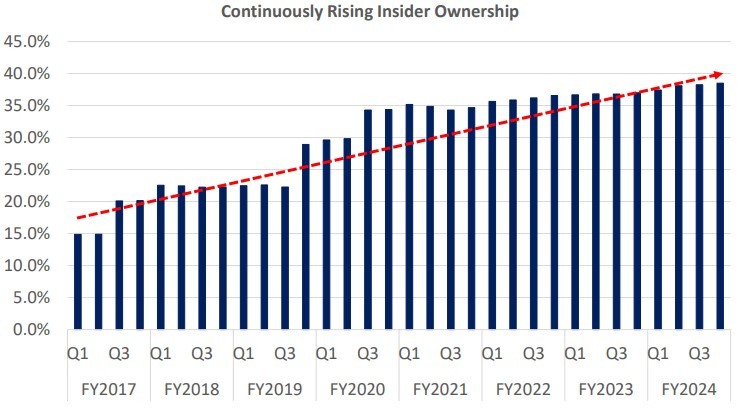

Insider ownership of 38% (per the company investor deck)

Minimal participation in the open market by insiders

Income Statement:

SECU has a pretty big business for a sub $50M market cap with $120.6M (CAD) achieved in 2024, and growing at a double digit clip, up 10.6% over what they did in 2023. The problems start to show at their margin line with thin gross profit in the mid teens coming in at 14.6% this year, down 30 basis points from a year ago. Once you tack on operations expense of 15% were already at a loss from operations. Now they did reduce cash burning operational expenditures by nearly 3% on double digit growth, so they had some nice conversion there, but it still amounted to a loss from operations of a half milly, $1.3M better than a year ago when they lost $1.88M.

The company does have gains from their legacy businesses which puts their total net income into a profitable situation of nearly $600k, but these gains cannot be relied upon long term and IMO should really be ignored.

Overall:

So here we have another company trading at an extremely low P/S multiple of around .4, so what’s the takeaway here?

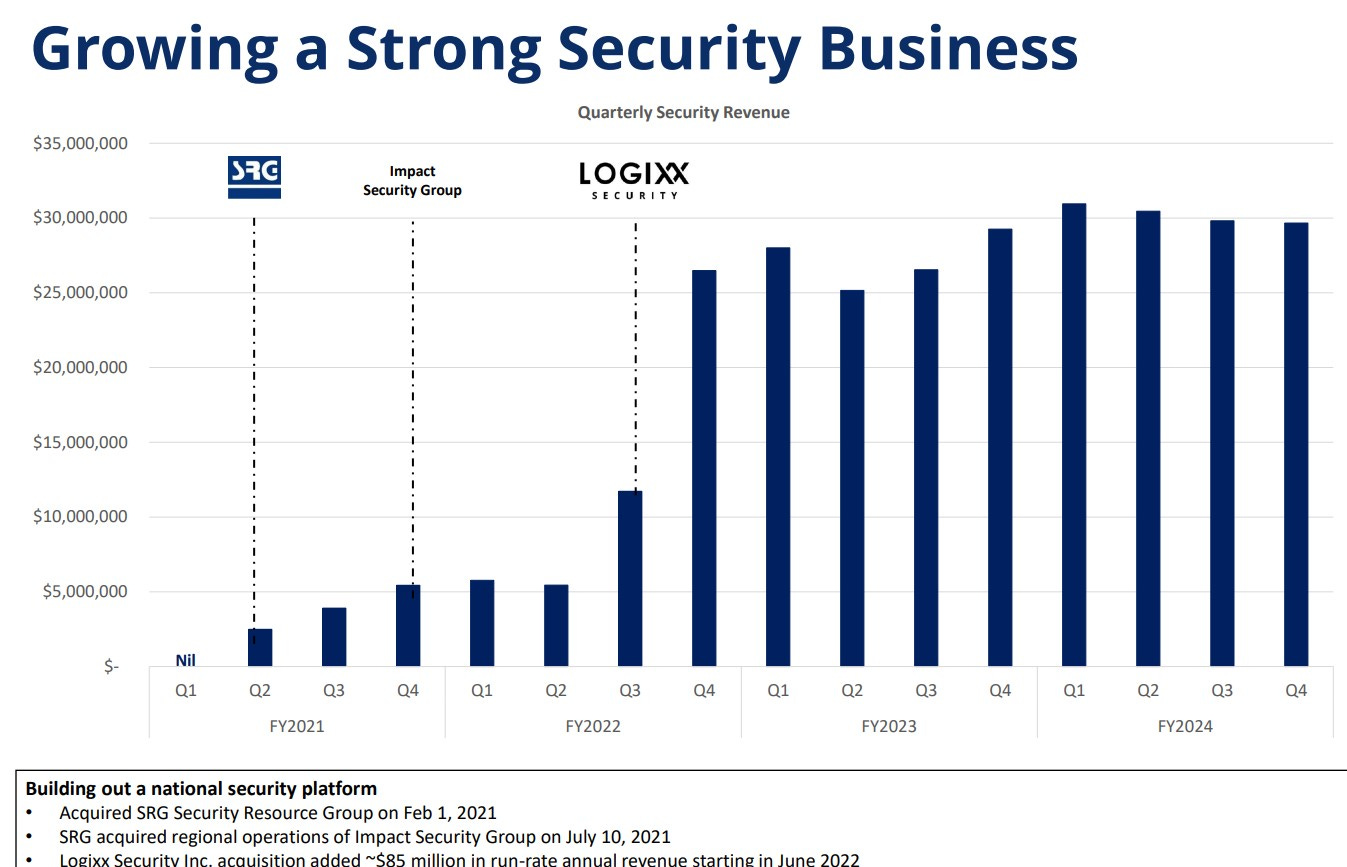

After a couple of acquisitions in 2021 and 2022 they were able to achieve double digit organic growth but over the last three quarters have seen their QoQ revenue decline. On the plus side they do have a very nice blue chip client list and over 80% of their business is recurring monthly revenue. Their SBC plans and structure is also aligned with retail shareholder interest.

But mid teens gross margin with mid teens opex just isn’t going to get it done to attract significant interest from shareholders, at least shareholders like me.

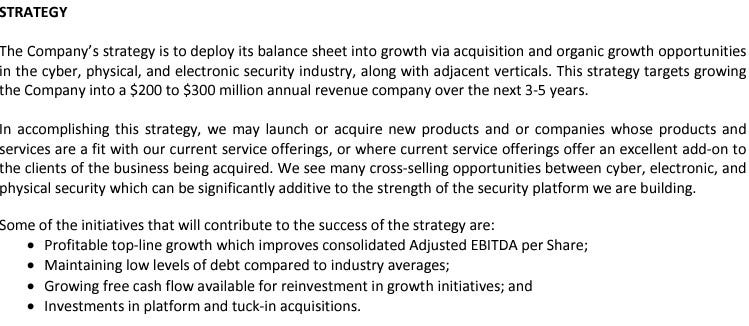

The company talks a big game with bold MD&A statements of growing the business to $200-$300M in the next three to five years, and considering they are at $120M today, that is significant growth.

The paragraph that follows is a little bit fluffy however with vague statement of “may” doing this or that to achieve that growth. My experience tells me that successful companies who have goals of doubling their business usually have pretty concrete ideas on how they plan to get there, and I’m not sure these guys do. If they planned on doing it through more acquisitions then I question their dividend strategy with a high payout ratio rather than be in a capital conservation mode. Dividends are nice but that is typically not the draw for retail investors looking on the venture.

Acceptable financials but to me these guys are about as exciting as their corporate logo. Yawn - 3 stars.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Lol i’ve been in and out of this one a couple times, and you hit the nail on the head its just boring af and nothing ever happens, dividend is pointless theres just better companies to grab