Thermal Energy is of five 2024 annual picks announced last December. Sadly, as it is only up by 2% since that selection it is by far the worst performing of the bunch and also lagging all Canadian indexes.

After an initial four star review in January, the last two sets of financials both received downgrades. I not only downgraded the stock twice by a quarter star each (which may have been generous in hindsight), I also halved my position when the market opened on July 16th after a misguided (IMO) press release. Since that halving of my position the stock is off by 21%. I’ve been watching closely and have been looking for an excuse to add back that position at a better price, but they just haven’t given me a reason yet. Are these financials reason enough? Let’s find out.

Balance Sheet:

With deferred revenue removed their current ratio remains relatively strong at 2.1 and consists of $5.05M in cash, $506M in receivables and $2.7M in other short term assets against $6.3M in short term payables due within the next twelve months. That current ratio is less than the 2.3 they ended their fiscal 2024 with.

While the company doesn’t provide a traditional aging report, only 3.4% of their A/R is past 90 days and the company does not have a history of large write offs. Thermal Energy has about $2.1M of debt ($1.2M long term), the majority made up of two loans at rates of 7.7% and 11.4% including a lump sum $1M payment due at the end of 2025.

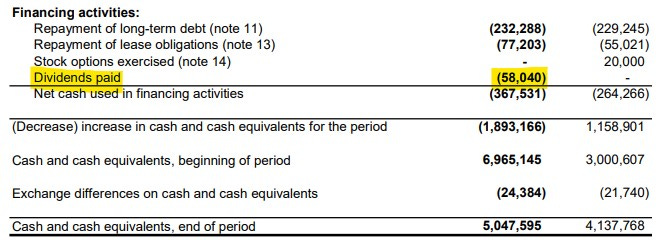

Cash Flow:

Tough start to the year with operational cash burn of $1.5M in their first quarter compared to generating $1.5M in OCF a year ago. Q1 was hampered by a reduction in deferred revenues and an increase in accounts receivables. While I don’t believe TMG is in any risk of trending this way for the remainder of the year, it’s not the start that I would have liked to see.

The company also paid down $232k worth of debt and paid out $58k in dividends. I didn’t get a dividend, did you? Hmm.

Overall the company ended Q1 with 27.5% less cash then they began their fiscal year with three months ago. Need to see this to trend much differently in Q2.

Share Capital:

172.7M shares outstanding. Nothing much different here from my review in September, which you can read here.

Income Statement:

Solid top line performance with nearly $8.5M in revenue during Q1 which is up 63.3% over the $5.18M they achieved last year. Gross profit came in much lower than last year at 41.6%, more than 1100 basis points less than the 53.4% in Q1 of last year. So on 63% more business, they only took 27% more dollars to the gross profit line. While the rationale is due to product mix, the numbers are the numbers.

Admin expenses were up by 19.7% and Selling and Marketing expenses rose by 31.5%. Great conversion compared to the top line increase but I would call it relatively mediocre when factoring in the gross profit rate. That all translates to $309k in net income for the quarter, 91% better than a year ago but in terms of dollars brought in an additional $148k to the net income line on nearly $3.3M in revenue.

Overall:

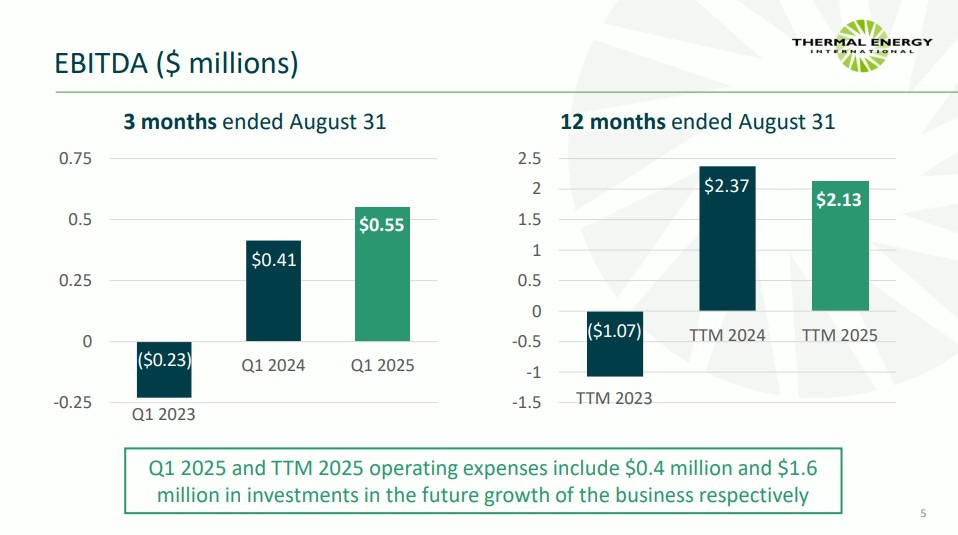

While TTM revenue is up by 26%, the same cannot be said for profitability with both Net Income and EBITDA down, the latter by just over 10%.

The gap between EBITDA and revenue performance is due to the above investments they have made, and those additional investments to this point have just not paid off yet. I think there is an excellent chance they will at some future stage, evidence by their new multinational company announced this week, but that has yet to translate to their financials.

From a current valuation, they are sitting at a $39M MC trading at 1.5 MC to revenue and about a 18.5 MC/EBITDA ratio with a P/E much higher. Those metrics are not pointing me in the direction of adding back to my position just yet. I am still in a hold and watch stage, but I did see enough here to maintain my previous 3.5 star rating.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Nice summary. I have been adding to my position lately, but have to concede that more patience will be needed.

And yes, how do you explain those dividends? I'm stumped.

Is Market Cap/ EBITDA not a bogus metric? EBITDA accrues to both debt+ equity holders. Doesn't make sense to compare apples to oranges right?