I had a five minute look at the financials before I took to the road to meet a friend and former colleague for breakfast this morning. My gut reaction was not bad but felt it was not going to hold the momentum over the last ten days leading into the release of their 2024 annuals. Of course I logged on to see the stock down 17% in early trading.

If you’re familiar with myself, then you likely know that Thermal was one of my top five picks for the year, and as of yesterday was 27% up from that pick. Not horrible, but significantly lagging the other four picks which have seen two doubles (E.TO & PNG.V) and one 10x (NCI.V).

After an initial four star review back in January, I downgraded them in April after their softer Q3. In microcap land, dropping a weaker than expected Q3 is always tough due to the length of time between then and when you release your annual statements.

Then on July 16th, the company put out a press release. I would have to assume they did so thinking the the market would react positively, otherwise why bother. I didn’t get a good vibe from it based on what they didn’t say, and I sold half of my position at the opening bell. I took some heat from fellow bulls and even from their IR (Hi Trev), but the stock ended up retreating by as much as 23% over the next three days.

That news or anything since hasn’t really changed my long term thesis on the company as a whole, but I saw it as an opportunity to pull in some small profits and wait for a better day to add them back. I have to admit, I was quite tempted to slap the ask since their announcement of releasing these financials early. I’m glad I decided to wait and see the results. Let’s get to it shall we?

Balance Sheet:

With deferred revenue removed they have a strong current ratio of 2.3 that consists of $7M in cash, $4.2M in receivables and about $3M in other short term assets against just $6.3M in liabilities due over the next twelve months. So even though their ratio is weaker than it was at the end of Q3 (2.9), they are liquid enough to cover all of their fiscal 2025 liabilities with their current cash position. The company doesn’t provide a typical aging report for their receivables but for what they do disclose, I don’t see any issues. Thermal also has a rather insignificant $1.4M in long term debt.

Cash Flow:

Operational cash flow looks fantastic at $5.4M generated during their fiscal 2024, which is almost three times more than they achieved in 2023, when they pulled in $1.4M of OCF. However, due to big working capital adjustments in receivables and in deferred revenue, it’s not quite as good as it looks. It’s probably more indicative of their revenue softening in the back half of the year than to improved operational cash flow. It’s better than a year ago, I’m just suggesting it’s not 3x better.

Share Capital:

172.7M shares outstanding, 5% dilutive activity in 2024 all from exercised options

13M options remaining, all currently in the money but none expiring until fiscal 2026

6% insider ownership per Yahoo Finance

Some insider selling back in March of this year but that looks like it was mainly to fund exercising of options. The CEO did slap the ask a couple of times back in May at a premium to where the share price trades today

Income Statement:

I think I will tackle this by first talking about the annuals and then drilling into the Q4 and back half of the year as I expect it will tell much different stories.

Top line increase of 22.7% to $25.9M compared to last years $21.1M. Margin was excellent on the year at 48%, 270 basis points better than 2023 which delivered 30% more gross profit dollars on 23% more business.

All three of their major expense buckets grew at a greater rate than their revenue however, with Admin costs up 32.6%, Selling and Marketing up 26% and R&D spending 165%. That results in taking only $262k more in net income than they did last year coming in just shy of a million at $982k, which is under 4% of total revenue.

Q4 is a much different chapter in this book and quite frankly so was the back half of the year. Revenue was $7.5M, down 8% from their record Q4 last year. More problematic was the 530 basis point erosion in their gross profit rate going from 46.9% down to 41.6% resulting in 18.2% less gross profit dollars on 8% less business. The third strike comes from a 3.1% increase in expense to last year. That all combines to a 76% reduction in operating income in the quarter vs 2023. Not good.

Overall:

After a great first six months, the last six were a bit of a dud. But at the same token it was not disastrous either.

They have lost much if not all of that momentum that they had when they reported Q2 back at the end of January. They have made some decent attempts at some “Powerpoint Magic” in their presentation today also. I was an expert at this back in the day so I know how to spot it.

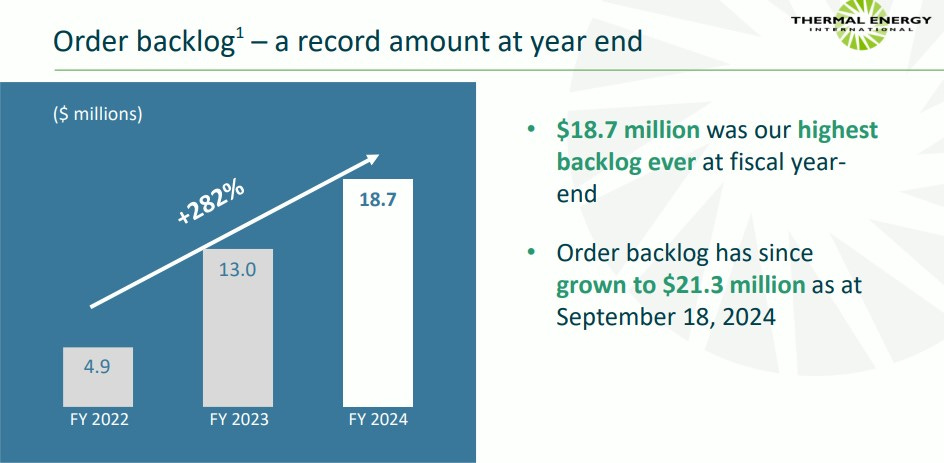

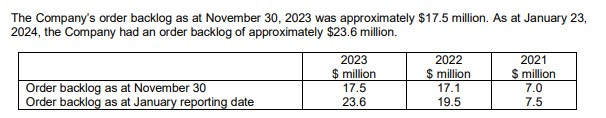

The 2024 comparisons in most of their deck refer not back to last year, but all the way back to 2022 when not many investors were giving these guys a serious look. Both the 18.7M backlog at year end and 21.3M as of yesterday are below the 23.6M reported at the end of January. So not only has the revenue stalled but so has generating future business which further confirms my concerns that I laid out in July.

So how do we properly value Thermal Energy today. It’s currently trading at about 1.5 revenue and after dropping over 700k in EBITDA in Q4 toa last year I now have their EV/EBIDTA at over 18 and their P/E ratio at well over 30. You could make a value argument for those metrics for a company who has momentum, but for the last six months TMG has just not had it. It could be in for a rougher ride perhaps than we have already seen.

Their Q1 results are only 4 or 5 weeks away now. Based on the last two quarters, are you running out to snap up 22 cent shares at those valuation metrics with their next financials out in that short timespan? I’m not. Technically, it’s been trying to hang on for dear life on 22 cent support all day (see chart). The next soft level of support is 18 cents and if Q1 doesn’t impress I wouldn’t be surprised to see it headed there.

While the last few paragraphs turned quite negative, I do think this company still has a great shot long term. The investments they made in people and marketing this year have just not paid off quite yet. When they will in a lumpy business with a long sales cycle is anybody’s guess but I think eventually they will get things right. I have that belief because of their products, customer base and the value those products bring to those customers. But that doesn’t mean you have to have “diamond hands”, “buy the dip”, “know what you own”, and all the other crazy one liner shit you’ll hear people say in the next month or so.

It’s sit back and watch time for me and I’m hoping I’ll see an opportunity to buy those shares back that I disposed of a couple of months ago. Maybe over the next couple of months we will see them gain some of that momentum back and have those investments start to pay off. Nothing would make me happier to have them as a back to back annual pick, but they have to show me a little something before that happens. As for now, it’s another downgrade I’m afraid to 3.5 stars. To be honest, that’s probably where I should have pegged them back at the end of Q3.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email me at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I saw decks of company, i had a hard time understanding what is order intake Vs. order backlog. Order intake means "when initial PDAs are signed" OR when FINAL Project order is placed AFTER Management said yes upon reviewing their enginering ...

Same for Order backlog - it means FINAL PROJECT ORDER has been placed and now they have to ship the whole assembled unit to client site and if it goes into backlog, then it simply means. thermal energy lack resources to do multi-tasking?

-------------------------------------------

i am just confused that why 3 parameters (order intake, order backlog and # of PDAs) are reported by managment, when you can do calculations just based on 2 parameters (# of PDAs and backlog) to gauge sales. What about using (order intake an order backlog to measure sales )

it would be great if you could put only a few sentences about the company at the beginning of each review. Like in which kind of busineess/industry it operates, ownership structure(only rough percentage of insiders, institutions and if there is ay well regarded investor present) and maybe some other little detail for those who are not yet familiar with the company and maybe even hear about it for the first time ever.