First review of Tornado via request out of the TSA discord. It’s too bad the request didn’t come back in April as the stock went on an absolute rip after their 2023 annual filings and is up 86% on the year. Since that rip it’s hit some serious resistance trying to get through that $1 area resistance, and after some initial love, has pulled back about 10% in the last couple of trading sessions. What do the financials tell us?

Balance Sheet:

Very solid current ratio above 2.0 that consists of $4.2M in cash, $12M in receivables, $28.6M worth of inventory and $2M in prepaids against $22.7M of short term liabilities due within the next year.

Great current ratio, but not very liquid with less than 10% of current assets comprised of cash, and 60% in inventory. In a high inventory turnover business 60% isn’t an alarming number, but the company is trending between 4-5 turns per year. Is that a great metric in this sector? To be frank I’m not sure, but the percentage of inventory to current assets appears high to me with that kind of number. In the company’s defense, they do state higher inventory levels are due to expected increased production in the back half of the year.

When a company is showing some liquidity concerns on the balance sheet with $12M of receivables, I would like to see an aging breakdown to gauge the health of that A/R. Tornado doesn’t provide that detail in their quarterlies. Since their operating line of credit is dependent on A/R factors, I personally find this lack of disclosure unacceptable, but I will note the last aging report investors would have seen were at the end of 2023, and very little was over 60 days overdue and looked relatively healthy.

Tornado has $4.5M of debt at decent terms.

Cash Flow:

$3.4M of operational cash flow generated through their first six months in contrast to burning over $2.05M at the same time a year ago, a pretty impressive turnaround. But, their OCF after Q1 was over $5.2M so they actually burned $1.8M in this most recent quarter.

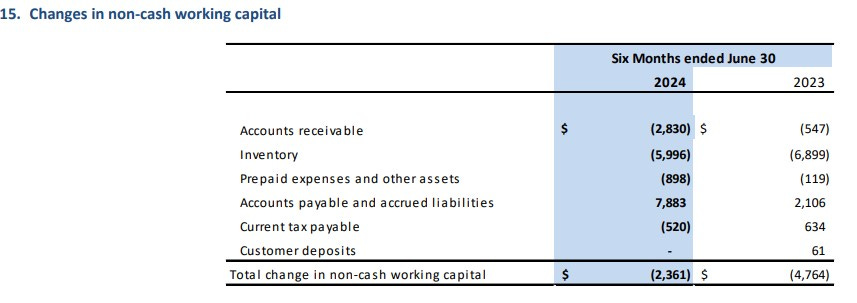

Why the variance? I think a lot of those answers can be found within their working capital adjustments.

Their overall operational cash flow is being hurt by growth in receivables and significant additional investments in inventory and assisted by significant growth within their accounts payables. There was about a $4.8M swing in working capital during Q2 which hurt the individual quarters OCF but overall the company has made some pretty good strides here in 2024.

The company also utilized $1.15M on asset purchases and paid down $3.1M of debt YTD. Overall they are in a very similar cash position they were to begin the year.

Share Capital:

137.5M shares outstanding with the only dilutionary measures occurring this year consisting of 1.7M options that were exercised

8.34M options outstanding, all well ITM but none expiring for over a year and half

Per Yahoo finance, 45% insider ownership

More insider selling than buying on the open market in the past year

Income Statement:

Outstanding top line performance of $34.4M in the quarter and $68.3M at the half way point of the year, an increase of 46% and 53% respectively. Not the sexiest gross profit rate you’ll ever see at 18.1% in the quarter, but that is up 150 basis points to last year. YTD that trend continues at 17.5%, up 100 basis points over 2023.

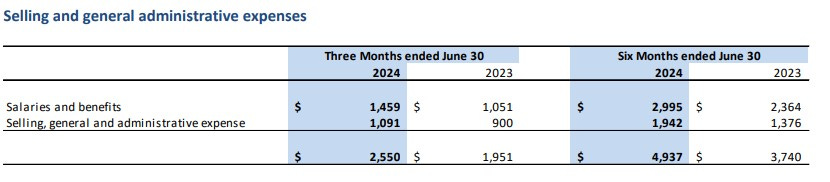

The entirety of Tornado’s cash burning expenses are under one bucket, SG&A. Those expenses rose by 32% YTD. Considering revenues grew by 53% that level of growth is pretty decent conversion.

When your gross profit rate increases and your spending grows at less of a rate than your revenue, that is going to translate to improved profitability and we have significant improvement here. Even with paying nearly $1M more in taxes this year, profitability improved by 138% in Q2, and 168% YTD. Through six months, they produced $4.9M in net income against last years $1.8M.

Overall:

Pretty solid financials, particularly the income statement. Achieving 7% net income on margins in the high teens is no easy achievement. The balance sheet while overall strong looking, does show some liquidity weakness and that will cause some cash flow fluctuations as witnessed in the gap from Q1 to Q2 in working capital adjustments.

There is more value here than there was a year ago in my opinion with these improved results when looking at EV/EBITDA dropping from the mid teens to under 9 at the time of this writing. This issue arises within the sector they find themselves in, service O&G companies. I think the softness since the financials is more related to the 16% decline in oil prices this month than anything within these numbers.

The above slide tells me they are able to withstand fluctuations within the commodity sector they reside in, and show significant growth despite it. The slide below is just fucking cool and I had to include it.

First review here and I’m pretty impressed overall. I’d like to do a little deeper dive into them and their competition, but right now I’m tempted to throw some coin at it. A solid opening 3.75 stars.

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.