This will be my first look via multiple requests. There has been a lot going on recently with financials dropping last week along with significant strategic announcements. The market has overwhelmingly approved with the stock rising by over 57% on the week.

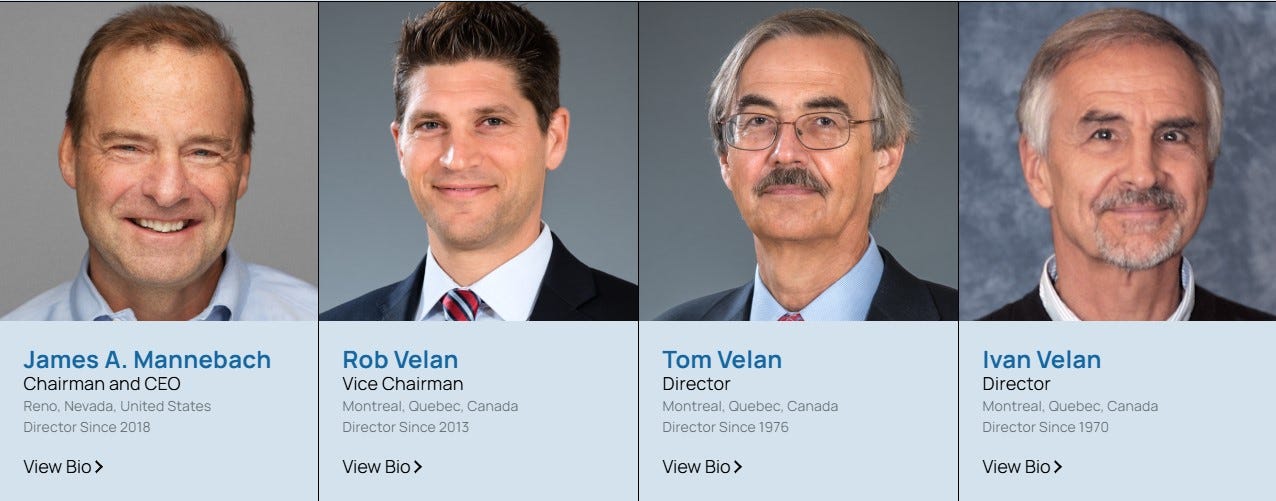

The company will celebrate its 75 anniversary this year with a long heritage in a family affair that still holds four directors on the board bearing the company name.

If you are a long term shareholder, judging by the weekly chart you have been through some things with a 160% jump in early 2023 only to lose all of that value nine months later.

After this significant run with the daily chart approaching a 91 RSI, is this something to seriously consider now? After 75 years are they finally ready for primetime or is this just a thirst trap on the TSX?

Note: Velan Inc reports in USD.

Balance Sheet:

Current ratio is in decent shape at 1.3 and that consists of $35M in cash, $65.6M in accounts receivable, a hefty $154M worth of inventory, $139.4M of assets held for sale and $10.6M of other short term assets against $302M of short term liabilities.

The big thing that stands out is the illiquidity of the balance sheet despite the acceptable current ratio with only 9% of current assets in the form of cash. Their balance sheet would change dramatically with their strategic announcement made on the same day as their earnings release, assuming these negotiations and agreements go through as planned. It would add some cash to their balance sheet but most of the proceeds from the sale would go to extinguish the provision in note 9 related to their asbestos related liabilities. Assuming these transactions are finalized by the end of February, they will have a much cleaner looking balance sheet to review when they report their annual filings in May.

Velan has significantly reduced receivables and inventory levels during their fiscal year. Their A/R aging does look like shit however, with 42% past due, although the company is not anticipating taking any significant write offs as of yet.

As of the end of their third quarter, Velan has $19.5M of debt, down from $28.8M at the start of the year.

Cash Flow:

The company has generated $19.9M in operational cash flow but there is a hell of a lot of stuff going on within the OCF part of this statement to declare them as a company producing a significant amount of cash through regular operations just yet.

They utilized nearly $9M for the addition of assets and paid down a net of $5.7M in debt.

Overall they ended Q3 with 15% more cash than they began the year with.

Share Capital:

21.6M shares outstanding with no notes supporting the cap table which is annoying AF

Two tier caste system of shares including 6M subordinate voting shares and 15.6M multiple voting shares which carry 5x the voting weight.

Appears to be minimal DSU’s outstanding or other dilutive measures and no SBC costs to date

24% insider ownership and 13% institutional (per YF)

No insider activity to find within SEDI

Income Statement:

Strong top line performance in both the quarter and on a YTD basis growing by 17.5% in the third quarter growing to $73.4M and now up 19.5% through nine months to $212M.

Margin improvement borders on unbelievable with 38.6% of gross profit compared to a miniscule 13.1% in Q3 of last year and YTD coming in at 30.7% vs 18% last year. So through three quarters increased their margin dollars by 104% on 20% more business.

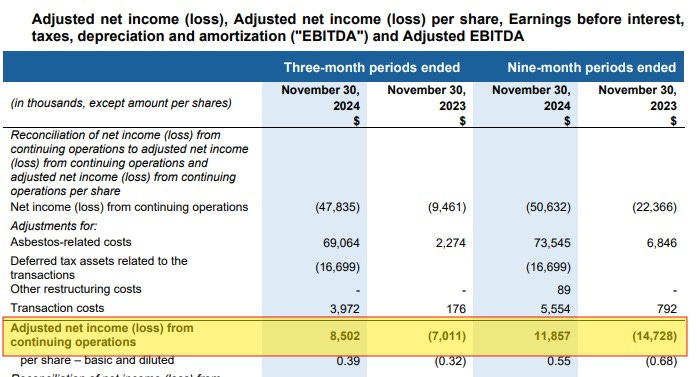

Administration costs which is their primary cash burning expense bucket only rose by 9.9% in the quarter and 4% YTD on 20% more business and more than doubling their gross profit dollars. Normally this would be what I refer to as a Wolf Trifecta, and be responsible for a dramatic improvement in profitability. Velan however experienced $81.3M in restructuring costs relating to the Asbestos related litigation. Therefore, at least for the time being these one time costs destroyed the P&L with losses of $62.1M in the quarter and $63.2M YTD.

Overall:

So, to sum it up these financials are quite messy, but if and when these strategic initiatives take place, what kind of a company will we be looking at?

Currently the company has produced a half billion dollars in revenue on a TTM basis (CAD), but that has resulted in nearly $90M of net income losses.

If we are generous and just look at their NNI (normalized net income) for the quarter and annualize it that would roughly provide $34M CAD on $500M of revenue.

That would then leave the company trading at .75x revenue and about 11x earnings. That could potentially be attractive for a company growing at a double digit clip but I had to jump through a few hoops to get there.

Eleven bucks looks like it had the ability to be a pretty good bargain. At nearly $18 today, that’s very tough to say. This company still has to execute the two transactions as part of their strategic initiatives, and this is the same company who has lost money in nine of its last twelve quarters with lumpy revenue and even lumpier profitability as they have taken significant write offs in the last few years similar to the one time losses experienced here.

I could make a case for this at $11 but I would be hard pressed to make one here near $18 with these numbers, particularly when it is so overbought. Watchlist worthy for now. Three stars.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3200+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Another great choice to write up, Wolfie. For me, the value-add is your commentary on the oddities, warts and snags--i.e., identifying some specific operational, market or financial circumstance, outlining it's accounting manifestation and then assessing the implications of those factors for valuation and price. (Or vice versa: the meta-add is getting to ride along as you pick up the scent anywhere along that linkage and chase the others down.)

Curious what your thoughts are, generally, about family-owned companies or firms with a long history of closely-held ownership. I think it's an important interpretive/predictive characteristic, but it can cut a lot of different ways: they are often better at ignoring the chirping of equity markets and so better at exercising long-term strategic discipline; OTOH, there's the risk of a very consequential and essentially private agenda behind that strong executive control that retail will be the last to find out about.

Another unique feature, nepotism, presents a similarly mixed bag. There are cases of successful young execs who were born and bred to run the company whose work runs in their blood (in some instances, maybe literally). However, fruit tree branches can be surprisingly long; I always worry about the apples that are/were in line for the throne no matter how fall far they fell from the tree.

p.s., Glad to see the 'stack seems to be working out.

Hi Wolf, thanks for the write-up! Lots of things are happening with this company, as @blinklebloop mentions a high probability of a sale. Besides that, a couple of things that came up from the article:

1) They report in USD, so those $8.5 million that you annualized would be $34 million USD, right?

2) Wouldn't you compare that to the backlog deliverable NTM (excluding French assets) that amounts to $250 million USD?

3) A couple of good things going forward: no more legal costs from the asbestos lawsuit, they had a bunch of spare capacity that they will keep reducing, procurement optimization, etc., all the elements of the turnaround.

4) Q4 usually is their stronger quarter as there is a concentration of orders, plus this Q4 some big orders from Italy also slipped into Q4. Just more color on what is to come.

Curious to know your thoughts on this.

Thanks!