I haven’t reviewed this NEO play since July when their 2023 annuals dropped. I think once every six months is adequate. If you have read my reviews on Verses in the past, then you’re aware that I haven’t been their largest fan. They released their Q3 Friday after hours which is usually a tell tale sign that they will look like absolute horse shit. Even the biggest VERS bulls aren’t expecting great financials here.

To be honest, financials of a largely pre revenue are not as meaningful as a more mature company that is producing dollars on the top line, but all sets of financials do open a window into what type of company they are. To date. Verses have shown themselves to be mismanaged cash burning pigs whose actions show their goals are not aligned with retail shareholders.

I will also be honest about my ability to properly opine on AI in general. I’m not an expert in the field nor do I play one on TV or on Substack, so if that is why you’re here I suggest you hit the back button or close your browser right here.

If you have been a trader of the stock, there have been a couple of fantastic opportunities to generate significant multiples - going about 10x from late 2022 into early 2023, and then again in early January rising to $2.50 shortly after hitting multiple year lows of 35 cents.

Coincidentally, at that $2.50 mark was when the following YouTube video was made about yours truly, citing what a horrible investor I am given I was bearish on this stock, among many other mistruths. Given the creator has a Jim Cramer tweet like track record on Canadian microcaps, bulls should have known this could have been the kiss of death, as the stock is now down 45% in the six weeks since it was released.

Outside of incredible IR spend and a couple of chat rooms resembling a circle jerk playing a frat house game of ookie cookie (careful with the google search), you’ll be hard pressed to find many respected investors who are really high on the company.

Let’s have some fun and dig into their Q3 and see if they can improve on back to back 1/2 star reviews.

Balance Sheet:

We start with one of the worst current ratio’s I’ve ever reviewed, at .19. While things have changed post financials, at Dec 31st the company had less than $900k in cash, $1.2M in receivables (from related parties) and $1.65M in other short term assets against a mind boggling $27.4M in liabilities due over the next twelve months.

47% of VERS total assets are from loans or outstanding amounts due from related parties with zero owned IP or significant equipment or long term assets.

In fairness, not all of the $27.4M in current liabilities will be cash burning. The $10.9M currently outstanding in convertible debentures will convert to shares at $1.20 at time of conversion and the $7M in RSU liability is merely a reflection of the company’s egregious share based compensation.

That still leaves well over $9M in liabilities including $6.2M to settle legal claims against the company, the two co-founders and their related company, Cyberlab.

Cash Flow:

Twenty four point two fucking million dollars ($24.2M) of operational cash burn through their first nine months compared to $22.7M of OCF burn at the same stage a year ago. In addition, amounts due from related parties grew by a half million dollars, and raised a net of $24.4M so far this year (up to Dec 31) via multiple measures (PP’s, debentures and special warrants). Overall they found themselves in a very similar position at quarter end, with under $900k in cash.

Of course much has occurred in the six weeks since, most notably the $20M raise at $1.57 which closed on January 9th. While the amount is relatively significant, the terms of 8% + 8% suggest it wasn’t done from a position of strength. The net amount of proceeds is still unknown due to some of the commission being discounted, but at their current burn rate, that hefty sum would only last the company between six and seven months indicating that Verses could easily be back at the trough before the end of 2024, even after raising over $45M during this fiscal year.

Share Capital:

177.4M shares outstanding in a quickly bloating float, but the dilution rate can be viewed as over inflated due to the 10M class B shares which converted into 62.5M A shares earlier this year.

Post financials issued 12.7M shares through their special prospectus offering. Assuming a 40% exchange rate, the company would have approx $120M CAD left on their BSP (base shelf prospectus) from September

Approx 47.4M warrants outstanding including the half warrants from the most recent raise and nearly 1M exercised since at $1. About 28M are currently ITM with a potential windfall of $11M to the treasury in the next 6 months assuming the stock can maintain itself over a dollar

Approx 9.1M shares in future dilution on the G42 debentures not including future accretion

21.1M stock options outstanding including 10M granted at $1.01 this year. All but 100k of these options are ITM but none expire until June 2027 or later

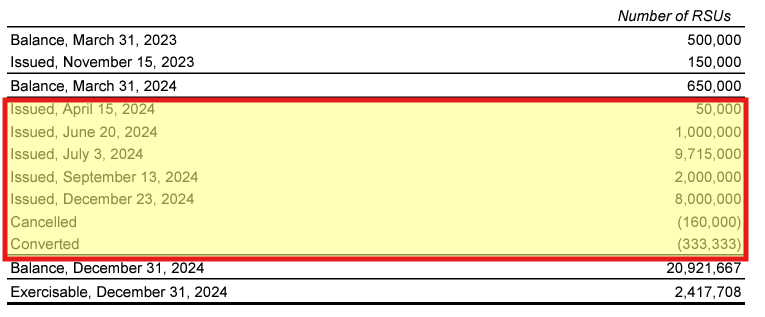

20.9M RSU’s outstanding. When I last reviewed their financials last July, they had 650k outstanding. They have granted themselves and others 20.7M free RSU shares since April of this year.

With the annual financials and annual meeting occurring over the next six months, I would watch for a voting resolution to reset the number of options and RSU’s available to award, which when combined could be an additional 40M shares or more. Bookmark this.

Yahoo Finance shows insiders own 33% but this is a highly moving target with all of the movement within the float. Insiders have been allergic to the open market, not even slapping the ask once when the share price was as low as 35 cents last fall.

Fully diluted float sits around 290M shares or 63% higher than what was reported as issued as of Dec 31.

Income Statement:

With a donut in revenue in their third quarter and only $155k at six points of margin this year compared to $1.4M in revenue at this stage a year ago along with $35.5M of expenses through nine months, there isn’t much to say about the entirety of the P&L. Nobody was anticipating these numbers to look good, but the story here isn’t the totality of their financials, it’s within the details.

Over the last seven quarters, net losses have amounted to over $82M, with over $53.7M worth of cash burn. Within that time frame, they have awarded over $16.7M worth of share based compensation, spent over $3.5M on investor relations and nearly $1.5M on travel and meals. In their short time as a publicly traded company they have already amassed a deficit of over $116.5M.

Overall:

So where does one begin? As I said previously, nobody was expecting these financials to look stellar. The big question is when do they start to improve, when can they start achieving some actual revenue, and can they continue to raise significant amounts of capital until that happens?

The stock hasn’t traded “healthy” by any definition. It is currently only worth a third of what is was a year and a half ago, and almost half of what it was just six weeks ago.

Bulls have had a lot of news to get excited about recently with the Atari challenge, and more recently beating out Deepseek in a code breaking challenge. What does all this mean? It surely gives those high on the company’s future much to crow about. My Mom as pretty good back in the day at Missile Command too - that didn’t result in much outside of family bragging rights.

I jest of course, but if this was as meaningful as the company or bullish investors want you to believe, where is the serious, smart money? Yes, G42 was in for $10M earlier this year, which is relative pocket change to them in the grand scheme of things, but they haven’t seemed willing to step up in subsequent capital raises. This most recent raise of approx $18.5M net should last a maximum of six to seven months and perhaps considerably less if those proceeds are used to cover the $6.1M owed to their former contractor as early as the end of April.

Insiders do not seem to have a lot of skin in the game with the conversion of preferred shares and free RSU share awards which has them controlling at least one third of the tradable float. These are also the same crew who arbitrators ruled against in that hearing, and the same crew wining and dining themselves on the shareholders dime in addition to their egregious share based compensation plan.

It’s now been fifteen months since the open letter to the board at OpenAI. Where’s the interest outside of some cult like chatter on a CEO message board?

The four big tech companies alone are expected to spend approximately $325B on AI investments this year alone. Deepseek was a complete unknown a month ago and garnered more media attention than anything in the AI space in recent weeks. If Verses tech can outperform all of them and do it more efficiently than you have to ask yourself why is nobody stepping up to the plate in a more significant way?

Let’s not forget about the Night Market Research short report which is still less than a year old.

There were some pretty damning accusations in that piece, and the company itself did not release much of a retort. Instead it was left to an individual investor to deliver a rather weak public response and in many ways hasn’t aged very well. At the very least, they embellished resume’s and partner relationships with organizations with Volvo and NASA, among others. Night Market also had quotes from a previous employee, but in fairness to the Verses it is hard to rely on unnamed sources. My main takeaway from the report is the company has a long history of touting relationships, partnerships and pilots with “Fortune 500” companies that have resulted in sweet fuck all, and these promising statements go back longer than half a decade. The only multi million dollar contract Verses has signed did not make it beyond year three of ten year deal and the company is now back to producing zero revenue. To top it off that contract was also with a related party, and that fact in itself is very hard to dismiss.

It’s not just the significant mentions of partnerships and pilots that are troubling, but the suggestions that they were near producing significant revenues. They have certainly given the impression of multiple annual deals in the tens of millions. Above is a link to their July 2022 pitch deck and I’ve included images of the transcript.

I think you get the idea. Listen, I recognize that startups will experience pain points, they will have hits and misses and not everything goes to plan. But Verses batting average is absolutely abysmal when it comes to backing up their statements and what has come to fruition in terms of putting any dollars on the top line. Combine that with leaders who have very little skin in the game acquiring the vast majority of their stake via a creative share structure and highly dilutive SBC, and in this writers opinion they have shown very little interest in being responsible with capital. So the fact that you have a selection of bullish investors who will barely acknowledge their short comings is truly something to witness. The group on CEO.ca sound more like the Heaven’s Gate cult of 1997 than a selection of highly educated investors. All they are missing are matching sweatsuits and black and white Nike’s.

Am I risking getting egg on my face should Verses AI amount to something in the future? I suppose so. I’ll admit I’m wrong should that time come. The only reason VERS is not getting a zero of five star review is there still seems to be people willing to throw money at this pig. I’m sticking with my third consecutive .5 star rating.

Want your stock reviewed, or have an idea for my next scholastic series? Request via Substack DM or email me at thewolf@wolfofoakville.com

Paid Subscriber Benefits:

Priority Review Requests

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat. My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

wolf thanks for the detailed analysis and your own style keep it up

This review hilariously illustrates the power of going back to the transcripts of earlier earnings calls!