Well, they released their financials finally, months late and within about a week after going full CTO. Don’t be confused. This isn’t the Undertaker rising from his back for a come back victory in WrestleMania. This is like keeping your 106 year old parent riddled with disease on life support instead of just doing the humane thing.

What a ride the last few years have been. Full disclosure as always, I actually held a position in this ditch pig once upon a time. It’s an embarrassing admission given the current state of things. It was an entry level position akin to playing “just the tip to see how it feels”, and I thankfully started to see the light around two years ago so I actually didn’t make out so badly.

I gave VSBY a zero star review ten months ago which I only reserve for companies that I think won’t be around in 12-18 months. So when the stock went full CTO after months of an MTCO for late financials, it looked like you could start etching a date on their tombstone. Well they ended up releasing their financials finally and here we are.

This will not be your typical review - more like an airing of grievances as well as stating everything that is and has gone wrong with this company. It may get violent, vicious, and vulgar. I may need to take some timeouts in the process. Grab a cold one, hug your loved ones, and put the kids to bed.

WTF:

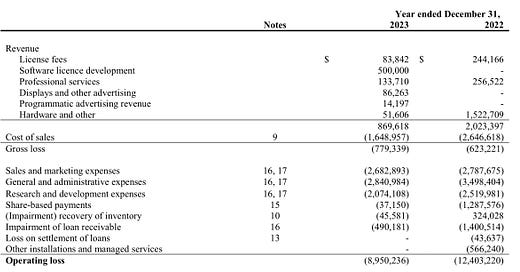

Let’s first go to the P&L because it may be the most humourous one that I have ever seen. Watching Jay and company run this business is like watching a monkey fuck a football.

Not only was revenue down in their most recent fiscal year by 57%, their gross profit was -90% compared to -30% in 2022. When you run a business with this level of ineptness that it’s a mathematical impossibility to determine a break even point, that might be your first clue that you are in the wrong line of work. They would have lost $1.6M less if their revenue was zero. Add in $8.2M of operating expenses and $2.5M in other expenses and you get to an $11.5M loss compared to a $12.4M loss last year.

Insiders:

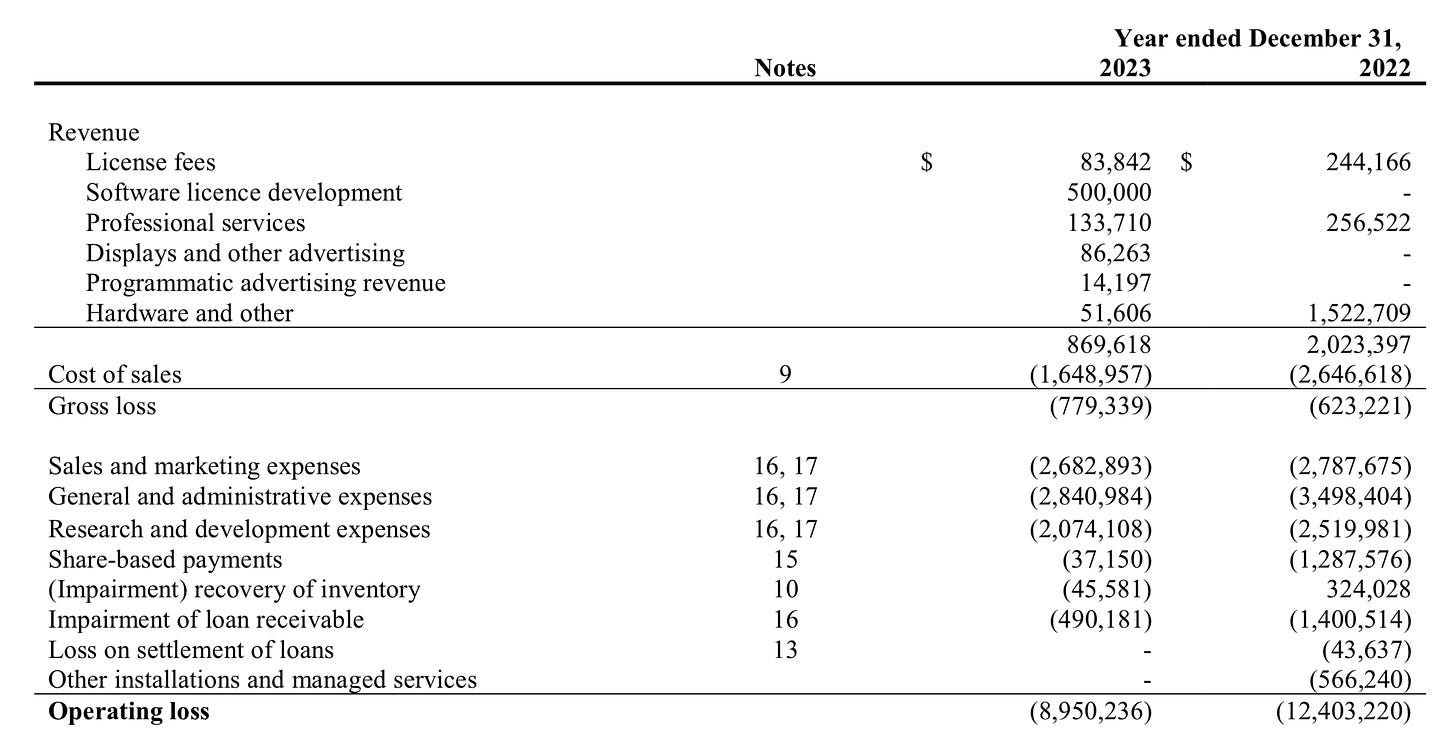

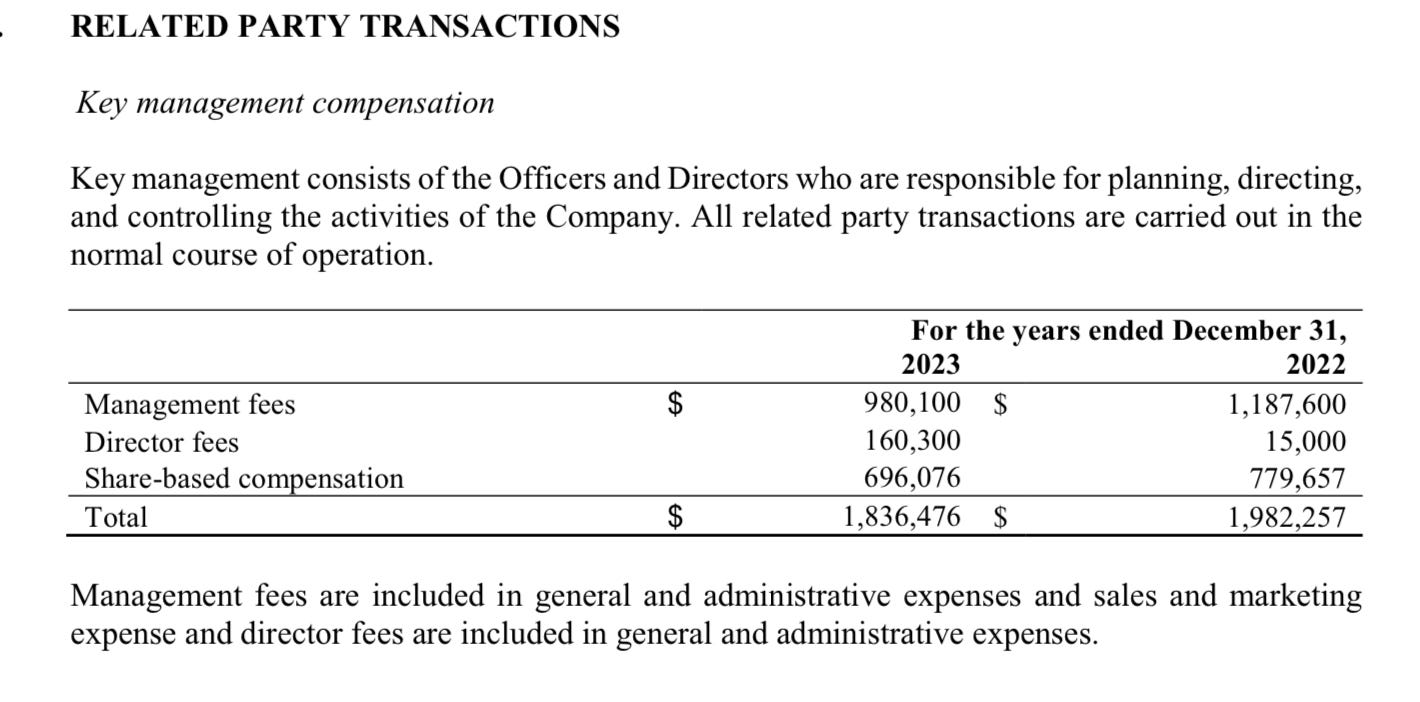

Insiders of the company have earned $3.8M during the last two years which include over $2.3M in cash based compensation through fee based expenses for their previously mentioned performance.

If that wasn’t egregious enough, $1.25M of Marketing expenses and $155k of accounting expenses were paid to related entities over two years.

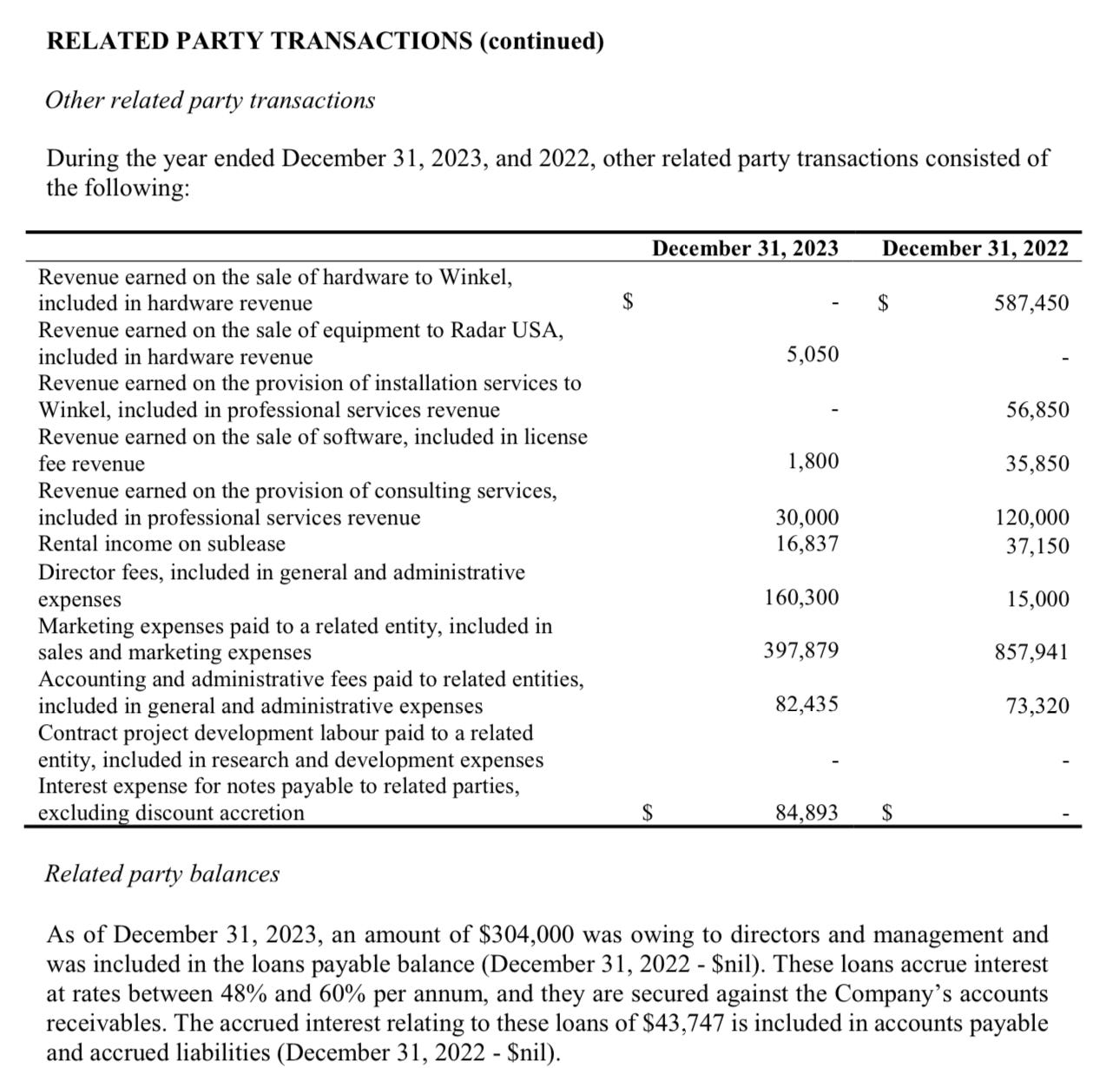

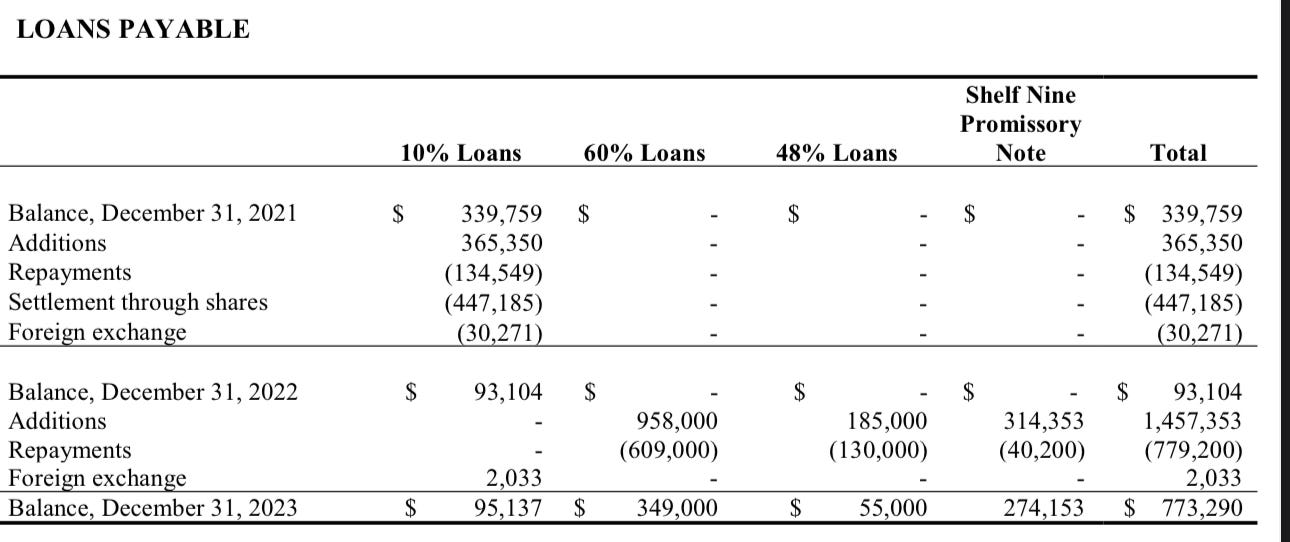

Furthering the corporate incest, about 1.15M of loans issues with interest rates between 48-60% came from insiders. Approximately $750k of this was repaid, while their accounts payables grew from $1.4M to over $4.1M. So, as payments to vendors lagged, insiders ensured they received theirs first, with sizeable interest.

Finally, in July of 2023 VSBY raised $3.36M at five cents. The CEO participated for 500k for $25k and the newly acquired execute chairman 1.29M for $64,500. As of March 31 of this year, that executive chairman has not paid for those shares per the financial notes, with that amount owing is included in the company receivables.

Joint Ventures:

The joint ventures of Winkel, AustinGIS and RadarUSA were pumped to extreme levels when they were first entered into and all three have turned into failures of epic proportions.

In 2023, Winkel lost $3.6M, RadarUSA $766k, and AustinGIS $4.25M on a combined $3.1M in revenue. Due to the negative equity of these businesses, their carrying value to VSBY is zero, therefore they did not have to recognize their portion of losses from these “partners”.

VSBY has sold services to and loaned Winkel millions of dollars since this venture was entered into and have impaired $2.66M of those amounts to date. Even in Q1 of this year they provided $300k in services but due to an unlikelihood of getting paid, could not recognize those amounts as revenue.

RadarUSA is a related entity with significant portions of their ownership owned by the CEO and other VSBY founder. VSBY provided $120k worth of consulting services to Radar (themselves essentially), and at some point determined that they would not be able to pay themselves and didn’t recognize $90k as revenue. Since they are essentially the same people it would make sense that they share office space. During last year it was determined that Radar would not longer be able to pony up any dough for their portion of the lease, so lease receivables of $65k were written off. They can’t even collect from themselves.

At the end of 2023 the final JV partner, AustinGIS had total current assets of $365k, current liabilities of $3.1M with $2.8M of long term debt. Luckily for VSBY investors, the company was able to double their ownership of this dogshit to 24% in 2023.

Shelf Nine or Shelf None?:

In October, VSBY acquired a company called Shelf Nine, paying $500k via stock, assumed all of their liabilities and 1.275M of the accounting for the transaction was allocated to goodwill.

In the original news release when the LOI was reached, Shelf Nine was to bring to the table 4500 digital screens across the US projected to generate $38M in revenue over the next three years.

By year end, a mere two months after the transaction was finalized, auditors determined the entire goodwill amount should be written off due to “not meeting targets”. Curiously, the company awarded previous owners for a partial attainment of their first milestone and issues shares. You can’t make this up.

$38M over three years works out to well over $1M in revenue per month expected from this deal. As a whole, VSBY recorded revenue of $207k in Q1 for the entire company. My best guess in parsing through their segmented revenue is Shelf Nine looks to have made up about $75k of that - for the quarter!

The Current Sitch:

At the end of March the company had $25k in cash and $200k in receivables which are about as reliable as the weather forecast in Iceland. This overtop of $6.2M in liabilities due within the next twelve months. They also burned $688k operationally in the first three months of 2024.

The cash on hand and receivables do not even cover amounts payables to management, mainly for the generous loans they provided to the company at 48 and 60 points.

The company issued two sets of convertible debentures in April and July for total proceeds of approximately $420k at 18%. $50k of convertible debentures were also given to insiders as compensation for services and listed as settlement of debt within the financials. Just another example of insiders getting theirs first.

One of the most complex news events occurred in April when VSBY created a new entity VSBY SPV1. That involves taking over Winkel’s contract in Latin America. Along with that is also an assumption of an additional $2.1 of debt. They added nearly $1M to this credit facility just a few weeks later with the current interest rate of SOFR + 12% coming in at approximately 17%. In just a couple of months this credit agreement has been amended twice to push back initial payments.

Additional promissory notes for $100k at 18-48% interest were also issued.

How this may shake out on the revenue line is anyone’s guess but an idea should be known when the company reports Q2 in about a month. The mess of the balance sheet should be more up to date as well.

Conclusion:

If you have any semblance of a brain, you’ve probably come to a similar grim conclusion.

VSBLTY has turned into the worst performing company that I have ever looked at. Period. They have produced vomit inducing financial statements for several years. Insiders have fared extremely well over that time span with outlandish compensation through managerial fees, related party relationships, and through earning interest on loans provided to the company at interest rates of up to 60%. One insider had participated in a private placement (viewed as bullish at the time) but didn’t pay for those shares as of their last financial statements. Any joint venture they have entered into has been an adjective failure, and their latest acquisition was a flop within two months.

Everything this company has touched since its inception has turned to utter shit. Anyone expecting any different in the future needs a mental wellness check. If leadership was selected to light the Olympic torch this Friday in Paris, they would find a way to first drown in the Seine.

I will not be doing another VSBY review like this. The next write up from me will be an obituary. I look forward to dancing on their grave.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2800+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.